This is a fascinating topic. Within the framework for our government, checks and balances were put in place to prevent concentration of power in one branch or one individual — analogous principles could be applied to our economic system. What evidence is there that laws and regulations relying on morality are ever effective?

"The Moral Dimension of Boom and Bust"

Courtesy of Mark Thoma, at Economist’s View. Excerpt from The moral dimension of boom and bust, by Robert Skidelsky, Project Syndicate, at the guardian.co.uk.

"This monstrous conceit of contemporary economics has brought the world to the edge of disaster":

The moral dimension of boom and bust, by Robert Skidelsky, Project Syndicate: After the first world war, HG Wells wrote that a race was on between morality and destruction. Humanity had to abandon its warlike ways, Wells said, or technology would decimate it.

Economic writing, however, conveyed a completely different world. Here, technology was deservedly king. … In the economists’ world, morality should not seek to control technology, but should adapt to its demands. Only by doing so could economic growth be assured and poverty eliminated.

We have clung to this faith in technological salvation as the old faiths waned and technology became ever more inventive. Our belief in the market – the midwife of technological invention – was the result. We have embraced globalisation, the widest possible extension of the market economy.

For the sake of globalisation, communities are denatured, jobs offshored, and skills continually reconfigured. We are told by its apostles that the wholesale impairment of most of what gave meaning to life is necessary to achieve an "efficient allocation of capital" and a "reduction in transaction costs". Moralities that resist this logic are branded "obstacles to progress". …

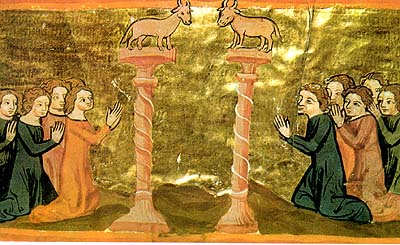

That today’s global financial meltdown is the direct consequence of the west’s worship of false gods is a proposition that cannot be discussed, much less acknowledged. One of its leading deities is the efficient market hypothesis – the belief that the market accurately prices all trades at each moment in time, ruling out booms and slumps, manias and panics. Theological language that might have decried the credit crunch as the "wages of sin", a comeuppance for prodigious profligacy, has become unusable. …

Mathematical whizzkids developed new financial instruments, which, by promising to rob debt of its sting, broke down the barriers of prudence and self-restraint. The great economist Hyman Minsky’s "merchants of debt" sold their toxic products not only to the credulous and ignorant, but also to greedy corporations and supposedly savvy individuals.

The result was a global explosion of Ponzi finance … which purported to make such paper as safe and valuable as houses. …

The key theoretical point in the transition to a debt-fuelled economy was the redefinition of uncertainty as risk. Whereas guarding against uncertainty had traditionally been a moral issue, hedging against risk is a purely technical question.

Future events could now be decomposed into calculable risks, and strategies and instruments could be developed to satisfy the full range of "risk preferences". Moreover, because competition between financial intermediaries steadily drives down the "price of risk", the future became (in theory) virtually risk-free.

This monstrous conceit of contemporary economics has brought the world to the edge of disaster. …

The prudential supervision regime initiated by the Bank of Spain in response to the Spanish banking crises of the 1980s and 1990s shows what a sensible middle way might look like. …

HG Wells was only partly right: the race between morality and destruction encompasses not just war, but economic life as well. As long as we rely on technical fixes to plug moral gaps and governments rush in with rescue packages that enable the merry-go-round to start up again, we are bound to keep lurching from frenzy to frenzy, punctuated by intervals of collapse. But, at some point, we will confront some limit to growth.

I see thing a bit different. I would advocate what he would likely call a "technical" solution.

When it comes to our present predicament, I don’t blame all economists, but some did push the non-government intervention line too way too far. There’s a big difference between interfering in markets that are functioning well, and regulation and intervention designed to ensure that the conditions markets need to perform well are in place.

Markets need a supporting institutional structure. Without such a structure, markets can fail and in some case, as we are seeing, they can crash and burn. One of the problems is that many people – economists – assumed that the institutional structure would be self-regulating. If there are agency problems, lack of transparency and informational differences, monopoly or monopsony power, property rights that are not well-defined, and so on, somehow the market would force institutional changes in the structure of the markets that would bring about an optimal outcome (meaning the markets approximate competitive ideals).  However, when it comes to self-correction, resources flow fairly well between markets to correct imbalances – that type of self-correction is evident and I do not doubt that it works. But institutional self-correction – correction of the incentives that determine where resources flow – is another matter.

However, when it comes to self-correction, resources flow fairly well between markets to correct imbalances – that type of self-correction is evident and I do not doubt that it works. But institutional self-correction – correction of the incentives that determine where resources flow – is another matter.

The assumption that the institutional structure is self-correcting was one of Greenspan’s failings, a failing he has recently acknowledged. Markets don’t always provide, on their own, the institutional structure needed to ensure their successful operation. We see this when we try to transport markets to developing countries that have little experience with this type of economic organization. If the legal structure and social customs necessary to support markets are not in place, and these can take a long time to work out in a given society, then markets will not perform as expected (and may even be counterproductive). Simply dropping the markets into those economies does not magically produce the necessary social and legal conditions that are needed for the markets to be successful.

I believe, and have for a long time, that more active engagement with markets is needed to deal with various potential for real market failures. For the most part, especially in an economy like ours where much of the institutional structure that is needed is already in place, including government oversight agencies vested with the proper authority, the test is pretty simple. Is the structure of this market consistent with competitive ideals? In asking that question, and acting on it when the answer is no, you’ve already ruled out "too big to fail," you’ve captured externalities, agency issues, adverse selection, lack of transparency and informational asymmetries, and a host of other problems. They aren’t hard to find or identify. If we had imposed a simple rule, that no firm can be so large that its failure threatens the market it operates in (let alone the entire economy), how much better off would we be right now? And that’s just a start. Why, for example, do we let a firm like Wal-Mart use its market power to impose its will on suppliers (or its workers)? Why do we think that’s a healthy market structure? Somehow we have convinced ourselves this type of market behavior is helpful.

But trying to do anything about these problems runs into a wall of opposition, at least it has in the past. There’s no need to break up a large firm, those markets are contestable, and over time the firm will eventually reach its peak and be surpassed by upstarts anyway – remember when IBM was the company to fear? (But why is replacing one monopoly with another, e.g. Microsoft, not a problem?) Government intervention will make things worse we are told, it’s almost always better to let the market fix the problem on its own even if it means tolerating departures from optimality in the short-run. Just be patient and all will be well.

But all isn’t well, and we need to be more active in regulating market structure. Firm size is a good place to start (but not the only front that needs action). If economies of scale are so important that we must tolerate firms that are large parts of financial or goods markets, large enough to threaten the broader economy if they fail, then these firms are natural monopolies and need to be treated as such. The market will not provide the proper regulation of behavior in these cases, and they certainly won’t regulate themselves. And if they aren’t natural monopolies, and I’m not convinced that, for example, investment banks fit this category, then break them up. We’ll still have to worry about systemic risk, having 1,000 small banking firms go bankrupt at the same time is no easier than if a single firm a thousand times larger goes under (and it may even be harder to intervene when there are a thousand failures rather than just one), but the chances of this happening are smaller when the industry is competitive, and more active regulation on other fronts can reduce the exposure to systemic risk factors. In any case, those risks will be present when there is one firm, or a thousand.

The other problem is forgetting how markets correct themselves when they do manage to do so. The costs of self-correction are often not considered when thinking about market adjustment. Correction of resource allocations can be costly, but it’s institutional flaws that are the most problematic. To the extent that there is an automatic institutional correction mechanism built into the system’s design, it often only happens after a large motivating event. When the problems could not have been foreseen, there isn’t much choice but to react ex-post, and we often impose new regulations after the plane crashes, not before, as we attempt to ensure it doesn’t happen again. But sometimes we can see problems developing, or we can find them if we take the time and effort to look in the right places, and in such cases we should step in and prevent the accident from occurring in the first place. Letting ideology stop us from looking, and then reacting when we find substantial problems, is not the best approach.

We have been too worried, I think, about making a mistake when we do this (What if we are wrong about a bubble and pop a real boom?). Yes, the government won’t always get it right – even the private sector undertakes activities that look foolish in hindsight and the government is no different – but we need to think in terms of whether we are doing good on balance and not be so worried about that the one case when we might get it wrong (though we do want to minimize such cases). The balance is currently off, fear of one mistake is causing us to forego lots of useful actions, and it’s time for that to change.