Time to start contemplating the other "D" word? Here’s an article by Mish examining unemployment and depression.

Prepare For Depression Level Unemployment

Deflation has already set in and it’s now realistic to start talking about another "D" word, this one being depression. Before we can use a word, we must define it. For the sake of argument, let’s define depression as unemployment of 10% or greater.

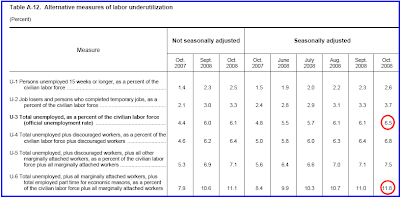

Looking at alternative measures of unemployment (counting discouraged workers, those working part time for economic reasons, etc), we are already there at depression levels of unemployment as noted in table A-12 of the October Employment Report.

Table A-12

click on chart for sharper image

The official unemployment rate is 6.5%. However, if you start counting all the people that want a job but gave up, all the people with part-time jobs that want a full-time job, all the people who dropped off the unemployment rolls because their unemployment benefits ran out, etc., you get a closer picture of what the unemployment rate is. That number is in the last row labeled U-6.

U-6 is 11.8%. It reflects how unemployment feels to the average Joe on the street. Note that it was 8.4% a year ago. Both U-6 and U-3 (the so called "official" unemployment number) are poised to rise further.

But let’s assume depression means 10% in the base rate (Line U-3). Can unemployment rise from 6.5% to 10%? Let’s take a look at the data and see.

ADP Says U.S. Companies Cut 250,000 Jobs in November

ADP, the largest payroll processor in the US says Companies Cut 250,000 Jobs in November.

Nonfarm private employment decreased 250,000 from October to November 2008 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change in employment from September to October was revised down from a decrease of 157,000 to a decrease of 179,000.

November’s ADP National Employment Report offers evidence of a labor market that continues to weaken. This month’s employment loss was again driven by the goods-producing sector which declined 158,000 during November, its twenty-fourth consecutive monthly decline.

The manufacturing sector marked its twenty-seventh consecutive monthly decline, losing 118,000 jobs. These losses were compounded by an employment decline in the service-providing sector of the economy which fell by 92,000, the second monthly loss in the service-providing sector recorded by the ADP Report since November of 2002.

In November, construction employment dropped 44,000. This was its twenty-fourth consecutive monthly decline, and brings the total decline in construction jobs since the peak in August of 2006 to 521,000.

Small Businesses Have Largest Decline In Seven Years

Today, the ADP Small Business Report found that small businesses lost 79,000 jobs in November, the largest decline in more than seven years.

The ADP Small Business Report has shown that:

- Total small business employment: -79,000

- Goods-producing sector: -47,000 small business jobs

- Service-providing sector: -32,000 small business jobs

Mass Layoffs Double From Year Ago

Challenger says U.S. Job Cuts More Than Double From Year Ago

Job cuts announced by U.S. employers in November more than doubled from a year earlier, led by a surge at financial firms as the credit crisis deepened and the global economy faltered, according to a private placement firm.

Firing announcements rose 148 percent to 181,671, the most since January 2002, from 73,140 in November 2007, Chicago-based Challenger, Gray & Christmas Inc. said today. The figures aren’t adjusted for seasonal effects, so economists prefer to focus on year-over-year changes instead of monthly numbers.

Companies are slashing jobs as access to credit remains frozen and sales weakened worldwide. A deteriorating labor market is likely to undermine consumer confidence and spending, pushing the economy further into what may become the longest recession in 70 years.

“Those hoping for a holiday reprieve in downsizing as Christmas approaches could be disappointed,” John A. Challenger, chief executive officer of the placement company, said in a statement. “December has historically been among the larger job-cut months of the year, with many employers making last-minute staffing adjustments to meet year-end earnings goals.”

Surpassed 1 Million

The Challenger report today showed companies have announced a total of 1,057,645 cuts so far this year, up 46 percent from the same period in 2007. Job cuts have surpassed 1 million for the first time since 2005.

The number of planned job cuts increased 61 percent in November from the 112,884 announced in October, Challenger said.

Financial companies led industries in announced cutbacks with 91,356 reductions last month after Citigroup Inc. said it would cut 52,000 workers from its payroll. Retail employers followed with 11,073 firings, while computer and electronics firms combined for 15,350 cuts.

Note that Challenger data is based on mass layoff announcements. Those firings typically do not show up immediately but rather will filter through to the official employment reports over a matter of months as the layoffs actually occur.

Thus we can expect to see weakness continuing for many months ahead as a result of these recent doubling of layoff announcements.

Service Industries Contract by Most on Record

The Institute for Supply Management is reporting Service Industries Contract by Most on Record.

Service industries in the U.S. contracted the most in at least 11 years, and a measure of private payrolls showed job losses accelerated, signaling the economy’s decline deepened last month.

The Institute for Supply Management’s index of non- manufacturing businesses, which make up almost 90 percent of the economy, fell to 37.3 in November, the lowest level since records began in 1997.

“What we’ve seen since mid to late September is that business activity has shut down, along with the consumer,” Stephen Gallagher, chief economist at Societe Generale in New York, said in an interview with Bloomberg Television. “There is no reason for an immediate turnaround; financial markets have not stabilized; consumers have not stabilized.”

The Labor Department’s November jobs report may show payrolls fell by 330,000, the biggest drop in 26 years, according to a Bloomberg News survey of economists.

John Silvia, chief economist at Wachovia Corp. in Charlotte, North Carolina, lowered his forecast for November payrolls by 100,000 to a decline of 450,000, following the ISM report. Ellen Zentner, of Bank of Tokyo-Mitsubishi UFJ Ltd. in New York, projected job losses reached 470,000 last month.

The ISM group’s index of new orders for non-manufacturing industries decreased to 35.4 from 44 the prior month. Its gauge of employment dropped to a record-low 31.3 from 41.5, and a measure of prices paid fell to 36.6, also the lost since at least 1997.

There are two more employment reports for 2008 coming up. The first of those, for November, will be out Friday December, 5. Both will be horrid. The unemployment rate is currently at 6.5%. It appears to be headed to 7% or higher by the end of the year.

If so, unemployment will have risen from 4.4% at the beginning of 2007 to something like 7% at the beginning of 2009. Given that job losses are accelerating and that unemployment is a lagging indicator (unemployment is expected to rise for some number of months after the economy bottoms), it is not unreasonable to be talking about 10% unemployment sometime in 2010, with 8.5% to 9% or higher extremely likely.

If so, unemployment will have risen from 4.4% at the beginning of 2007 to something like 7% at the beginning of 2009. Given that job losses are accelerating and that unemployment is a lagging indicator (unemployment is expected to rise for some number of months after the economy bottoms), it is not unreasonable to be talking about 10% unemployment sometime in 2010, with 8.5% to 9% or higher extremely likely.

8.5% or higher unemployment is enormously deflationary with the current backdrop of consumer debt and huge numbers of people underwater on their homes. Those thinking about the possibility of an economic depression are thinking clearly. Those looking at spiking monetary figures and presuming pent up inflation are likely barking up the wrong tree for quite some time.

Reminder: Please ignore the 48-hr. delay box, it should be gone soon. Phil’s Favorites are always immediately available. Blogroll and archives can be found at the Favorites’ backup site. – Ilene