Trader Mark is noticing that bad news, of which there is plenty, is not as consistently tanking the market (except for Monday,… but that was ages ago) Good sign? – Ilene

Seeds for a Rally

Courtesy of Trader Mark, at Fund My Mutual Fund

The market continues to shrug off bad economic news. That’s a positive.

- The U.S. service sector contracted dramatically in November, as employment, new orders and prices fell precipitously, hurting retailers, hotels and other industries.

- The Institute for Supply Management, a trade group of purchasing executives, said Wednesday that its services sector index fell to 37.3 in November from 44.4 in October. It was far below the reading of 42 expected by Wall Street economists surveyed by Thomson Reuters. A reading below 50 signals contraction, while a reading above 50 indicates growth.

- Of 18 industries in the survey, including warehousing, real estate, restaurants and wholesale trade, only one — health care and social assistance — reported growth.

- Its sister manufacturing report on Monday showed the worst reading since May 1982, when the country was near the end of a 16-month recession.

This Friday’s labor report is the big news of the week but everyone already assumes an epic collapse in the number. If everyone already assumes this, a case could be made we’ve already built in the bad data. If so, and the market ignores it, you could set the stage for a nice rally.

It’s a very tricky situation as the economic news is actually getting worse but the reaction to the news is all that matters; not the news itself (at least in the Wall Street world; Main Street is a different universe)

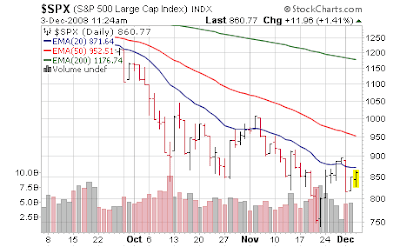

So for now, I’ve cut back the short exposure which I got back Monday on the fall below 840 and will monitor the market reactions. If we see continued strength we’ll jump back in on the long side with the ETFs we hold on the long side. S&P 870 is just about the 20 day moving average in fact which is convenient since it has been the level of resistance of late, so a break above has us (once again) leaning bullish. After acting relatively "textbook" the past month, the market has indeed been doing a good job of changing direction on a dime this week and shaking people out of positions left and right… the breaks of multiple supports Monday should have meant a further move down, but for now, the textbook technical signs seem not to be working… we got a reversal instead.

Sentiment is everything and as long as the market shakes off bad news we have to be constructive in the near term. Friday will be very telling. The 50 day moving average is way up at 970 so a 100 point S&P rally would still only take us up to a traditional bear market resistance level. The inability to break over the 20 day for months on end has been quite shocking, so jump from the 20 day (870) to 50 day (970) would be more par for the course. Between 840 and 870 as we keep saying it is sort of white noise – we are neutral. We’ll see how it goes, the action is so random it is hard to believe in what your eyes are telling you anymore. And as you can see from what I write, everything is keying off technical moves – nothing to do with fundamentals. The futures and index prices seem to move everything.

*chart below says 50 day is 952, but what I use says 970+