Another H/T to Barry, as he reports on a NY Times article by Gretchen Morgenson, Debt Watchdogs: Tamed or Caught Napping? about Moody’s. I’ve been reading Barry’s articles for a long time and have never seen him write anything quite so angry (not saying there’s nothing I’ve missed). – Ilene

Blaming Moody’s

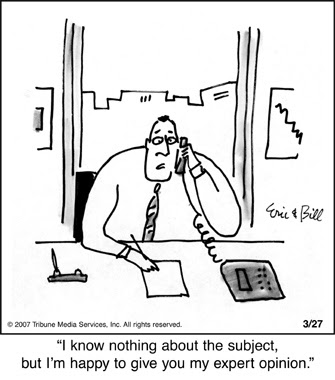

Excerpt: The Sunday NYT has a big Gretchen Morgenson column on Moody’s, one of the three incompetent and corrupt ratings agencies that helped foster the current credit crisis.

A combination of factors led the ratings agencies to their current state of criminal embarrassment. Once they went public, the usual short term focus on profits began driving what was once an objective decision making process regarding rating bonds.

Once again, we see misplaced incentives shift the focus of a publicly traded firm: From safe, low-margin business of rating bonds to the more lucrative business of covering structured financial products and derivatives.

Thomas J. McGuire, a former director of corporate development at the company who left in 1996, was quote din the Times article, saying: “Moody’s was like a good watchdog that had regarded the financial markets as its turf and barked and growled when anybody it didn’t know came near it. But in the ’90s, that watchdog got muzzled and gelded. It was told to turn into a lapdog.”...

And of course, the SEC, enraptured in their radical free-market, self-regulating, delusions, were nowhere to be found…

Since I cannot put this in the book, I might as well toss it out here: All of these motherfuckers need to be thrown in prison, where they will be sodomized on a daily basis for the rest of their lives.

Barry’s Source:

Debt Watchdogs: Tamed or Caught Napping?

"These errors make us look either incompetent at credit analysis or like we sold our soul to the devil for revenue, or a little bit of both.”

— A Moody’s managing director responding anonymously to an internal management survey, September 2007.

The housing mania was in full swing in 2005 when analysts at Moody’s Investors Service, the nation’s oldest and most prestigious credit-rating agency, were pressured to go back to the drawing board.

Moody’s, which judges the quality of debt that corporations and banks issue to raise money, had just graded a pool of securities underwritten by Countrywide Financial, the nation’s largest mortgage lender. But Countrywide complained that the assessment was too tough.

The next day, Moody’s changed its rating,…

Since the subprime mortgage troubles exploded into a full-blown financial crisis last year, the three top credit-rating agencies — Moody’s, Standard & Poor’s and Fitch Ratings — have faced a firestorm of criticism about whether their rosy ratings of mortgage securities generated billions of dollars in losses to investors who relied on them.

The agencies are supposed to help investors evaluate the risk of what they are buying. But some former employees and many investors say the agencies, which were paid far more to rate complicated mortgage-related securities than to assess more traditional debt, either underestimated the risk of mortgage debt or simply overlooked its danger so they could rake in large profits during the housing boom…

Members of Congress have grilled the agencies, asking their executives to answer accusations of incompetence and to say whether they assigned glowing ratings to keep clients happy and expand their business.

State and federal officials are also making inquiries…

When Moody’s began lowering the ratings of a wave of debt in July 2007, many investors were incredulous.

“If you can’t figure out the loss ahead of the fact, what’s the use of using your ratings?” asked an executive with Fortis Investments, a money management firm, in a July 2007 e-mail message to Moody’s. “You have legitimized these things, leading people into dangerous risk.”

Whether such risks were truly undetectable, or were ignored by Moody’s and the other agencies, is at the core of what regulators, legislators, investigators and investors are trying to determine.

Moody’s current woes, former executives say, were set in motion a decade or so ago when top management started pushing the company to be more profit-oriented and friendly to issuers of debt. Along the way, the firm, whose objectivity once derived from the fact that its revenue came from investors who bought Moody’s research and analysis, ended up working closely with the companies it rated, and being paid by them…

Consider a residential mortgage pool put together in summer 2006 by Goldman Sachs. Called GSAMP 2006-S5, it held $338 million of second mortgages to subprime, or riskier, borrowers.

The safest slice of the security held $165 million in loans. When it was issued on Aug. 17, 2006, Moody’s and S.& P. rated it triple-A. Just eight months later, Moody’s alerted investors that it might downgrade the top-rated tranche. Sure enough, it dropped the rating to Baa, the lowest investment-grade level, on Aug. 16, 2007.

Then, on Dec. 4, 2007, Moody’s downgraded the tranche to a “junk” rating. On April 15 of this year, Moody’s downgraded the tranche yet again; today, it no longer trades. The combination of downgrades and defaults hammered the securities.

Reversals like this have enraged investors. Internal e-mail messages disclosed by Congress in October, for example, recounted a July 2007 conversation Moody’s had with an irate customer at Pimco, a major money management firm.

“He feels that Moody’s has a powerful control over Wall Street but is frustrated that Moody’s doesn’t stand up to Wall Street,” the e-mail stated. “They are disappointed that in this case Moody’s has ‘toed the line. Someone up there just wasn’t on top of it,’ he said.” For decades after its founding in 1909, Moody’s was an independent and respected arbiter of credit quality. Today, the company’s 1,200 analysts rate debts of 100 nations, 12,000 corporate issuers, 29,000 public issuers like cities and 96,000 complex securities known as “structured finance.” It is a franchise that generated revenue of $1.35 billion and earnings of $370 million in the first three quarters of this year alone.

Edmund Vogelius, a Moody’s vice president, explained the company’s business model in a 1957 article in The Christian Science Monitor.

“We obviously cannot ask payment for rating a bond,” he wrote. “To do so would attach a price to the process, and we could not escape the charge, which would undoubtedly come, that our ratings are for sale.”

In the early 1970s, Moody’s and other rating agencies began charging issuers for opinions. The numbers of securities — and their complexity — had increased and the agencies could no longer finance their operations on revenue from investors who bought Moody’s publications.

In 1975, the Securities and Exchange Commission secured the rating agencies’ positions by allowing banks to base their capital requirements on the ratings of securities they held. The upside of this was that it theoretically created an elegant self-policing mechanism: any firm that ran afoul of the agencies also would run afoul of investors. The heavier hand of direct government regulation could be scaled back.

But for Mr. McGuire, the former director of corporate development at Moody’s, there were also dangers in relying on ratings as a form of regulation because the agencies would be able to sell ratings even if they failed investors…

“In my view, the focus of Moody’s shifted from protecting investors to being a marketing-driven organization,” he said in testimony before Congress last month. “Management’s focus increasingly turned to maximizing revenues. Stock options and other incentives raised the possibility of large payoffs.”…

…By the time Moody’s became a public company in 2000, structured finance had become its top source of revenue. Employees in this unit rated bundles of assets like credit card receivables, car loans and residential mortgages. Later they rated collateralized debt obligations, or C.D.O.’s, yet another combination of various bundles of debt.

Moody’s could receive between $200,000 and $250,000 to rate a $350 million mortgage pool, for example, while rating a municipal bond of a similar size might have generated just $50,000 in fees, according to people familiar with Moody’s fee structure.

A standard of profitability at many companies is its operating margin, which measures how much of its revenue is left over after it pays most expenses. While operating margins at Moody’s were always enviable — in 2000 they stood at 48 percent — they climbed even higher as revenue from structured finance rose. From 2000 to 2007, company documents show, operating margins averaged 53 percent…

“The mistaken notion that Moody’s was a company like any other, that was very fundamental,” said Sylvain Raynes, a former Moody’s analyst who is co-founder of R&R Consulting, a firm that helps investors gauge debt risks. “It is not just a profit-maximization entity like Exxon or Microsoft. Moody’s has a duty to the American public. People trusted it.”

Moody’s soaring fortunes were tied to the housing boom. When the Federal Reserve Board cut interest rates to 1 percent in 2003, Moody’s structured-finance revenue stood at $474 million, more than twice the amount generated just three years earlier.

As low interest rates fed the housing surge, Moody’s structured-finance business continued to rack up impressive gains. In 2005, structured finance generated $715 million, or 41 percent, of Moody’s total revenue…

By early 2007, it was becoming more and more obvious that the subprime mortgage boom was ending. Yet Moody’s did not start downgrading mortgage-related securities until that summer. In July and August, the firm cut the ratings on almost 1,000 securities valued at almost $25 billion.

“These loans are defaulting at a rate materially higher than original expectations,” Moody’s said. Investors sharply criticized Moody’s over the tardiness of the response, internal documents made public in Congressional hearings show.

Two e-mail messages in July 2007 recount conversations Moody’s had with executives at Vanguard, BlackRock and Fortis, three huge money management firms. While Fortis offered some of the harshest assessments, none of the firms were pleased.

The Vanguard executive, the messages show, was frustrated that Moody’s was willing to “allow issuers to get away with murder.”…

Two months later, Moody’s executives held a meeting for their managing directors to talk about the crisis. The tone of the meeting, according to a transcript released by Congress, was defiant.

Moody’s had become a “punching bag,” said one of its executives, an easy target for investors eager to deflect responsibility for escalating mortgage losses…

During the meeting, Moody’s executives predicted that the current crisis of confidence would pass, just as investor outrage over the company’s failure to detect trouble at Enron and Worldcom had several years earlier…

Full article here.