Adam Warner discusses the Buy-Write strategy (and if you search his previous articles, you’ll find more), high premiums in October, and also provides some tips. – Ilene

Even More Buy Writing

Courtesy of Adam Warner at Daily Options Report

Every time I put this Buy-Write topic to bed, they keep drawing me back in.

OK, not going to do another one of these as I voiced my opinions on it all week. But just wanted to correct something that Barron’s had in their Striking Price column this weekend.

"Buy-writing," a classic strategy that refers to buying a stock and selling ("writing") an out-of-the-money call on it, is attracting enormous interest from investors seeking to harness volatility. The "buy-write" lowers the cost of buying the stock by the amount received for selling the call, and also serves as a modest hedge. Option premiums are exceptionally high at the moment because of the record levels of volatility, so sellers are getting princely sums.

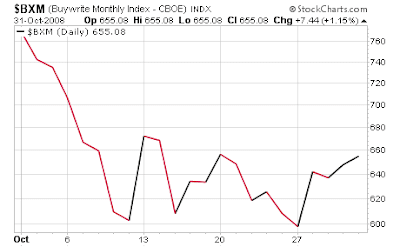

The strategy’s benchmark is the Chicago Board Options Exchange’s S&P 500 BuyWrite Index, or BXM. In October, it had its largest monthly gain in 20 years — 8.1% — well above its two-decade average of 1.7%.

Um, no. Unless "up 8.1%" is the new "down 14%". The above shows the graph for BXM in October.

What I believe he means is that BXM took a record premium in in October. This pup rolls at each expiration, shorting the near month option that is closest to ATM. And with volatility so high, it gets a higher premium each month as measured on a percentage basis.

Truthfully as you go on in the article, he quotes Michael Schwartz from Opco on some excellent Buy-Write rules. If you do them, follow most of these.

Stock selection is primary, getting a premium is secondary. Pick stocks that you want to own, not calls that you want to sell.

• Never invest more than 10% of your capital in a buy-write. Leverage cuts two ways.

• Sell slightly out-of-the-money calls to leave room for upside profit potential. (Institutional investors often pick calls that are 10% or more out-of-the-money and carry premiums of $1 or more, though many are now taking less than $1 because stock prices are so low.)

• Let time work for you. You can sell three- to six-month calls for higher premiums.

• Don’t annualize returns. Focus on the potential return for the trade’s actual duration; annualized returns are rarely earned.

• Ignore theoretical values. Expensive options stay expensive longer than expected, and vice versa. The current correction has shown that volatility, which always reverts to its mean, may not do so when expected.

• Don’t sell the call and try to buy the stock at a better price. This leaves you with a "naked call" and unlimited market risk. Enter buy-writes simultaneously. A net debit order is entered for any combination of prices to buy a stock and sell a call that equals your desired debit ($30 stock price less $3 option price equals $27 net debit).

• If stock fundamentals change, sell the stock and buy back the call.

• If you can earn a high percentage of the maximum profit before expiration, do it. Waiting for the last 10% to 15% of premium often means risking everything for no more than an incremental gain.