"This is a farewell kiss, you dog!"

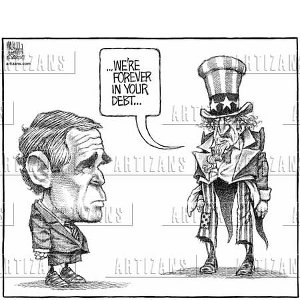

That's what a Baghdad reporter yelled at Bush as he threw not just his left, but his right shoe at the President, who showed great reflexes by dodging both attacks (better reflexes than the Secret Service, that's for sure!). Anyway, we needed an image that would define the Bush Presidency for generations to come and this may indeed be it, surpassing the "Mission Accomplished" moment of May 2003 that Bush used to mark the end of the Iraq war. "The war is not yet over," Mr. Bush said, following a meeting with Prime Minister Nouri al-Maliki, but "it is decisively on its way to being won."

With the market in crisis and 3 Million US jobs on the line and no resolution to the auto bailout, the President decided it would be a good time to make a surprise trip to Iraq, where there are still politicians willing to be photographed shaking hands with him. Unfortunately – here on the other side of the world, as of 7am on Monday morning, we have not won a consensus on the auto bailout. "The one thing that concerns us is a DISORDERLY bankruptcy," a senior administration official who was not in Iraq said Sunday. "Every other option is open."

Those options are ranging from $10Bn to $40Bn or more in aid for the Big 3 as the clock ticks down on 2008. According to the WSJ: "One possible source of funding is the Treasury Department's $700 billion fund set up to rescue the financial industry. Only about $15 billion remains uncommitted from the first tranche of $350 billion, so the Bush administration could be forced to request the second half to cover the car companies' needs." The government is also considering requiring any auto makers seeking aid to file for bankruptcy (orderly, we presume). Under such a scenario, the money would be used as so-called debtor-in-possession financing. Outside experts said such financing could require $50 billion or more for GM and Chrysler combined.

Those options are ranging from $10Bn to $40Bn or more in aid for the Big 3 as the clock ticks down on 2008. According to the WSJ: "One possible source of funding is the Treasury Department's $700 billion fund set up to rescue the financial industry. Only about $15 billion remains uncommitted from the first tranche of $350 billion, so the Bush administration could be forced to request the second half to cover the car companies' needs." The government is also considering requiring any auto makers seeking aid to file for bankruptcy (orderly, we presume). Under such a scenario, the money would be used as so-called debtor-in-possession financing. Outside experts said such financing could require $50 billion or more for GM and Chrysler combined.

Clearly this uncertaintly is holding back the US markets. The province of Ontario in Canada agreed to provide $2.8Bbn for the Canadian auto industry this weekend; French President Sarkozy stayed in his country this weekend (avoiding having baguettes thrown at him) and discussed a stimulus package for French auto makers and suppliers; Sweden approved $3Bn of support for Saab and Volvo (who are owned by GM and Ford) and Germany is discussing providing loans to Opel (GM) providing GM promises not to funnel it to the US. So many world leaders are stepping up to the plate while ours plays dodge shoe and International markets are performing quite well ahead of the US open.

Asian markets are well up on the rumor that the Auto industry will be bailed out. The Nikkei jumped 5.2% but couldn't crack the 8,700 mark, finishing at 8,664 while the Hang Seng gapped open up 4% this morning but gave up half the gains to finish at 15,046, well under the 50% line at 16,000 and more or less at last week's mid-point. The Shanghai Composite gained half a point as China moved to increase bank lending over the weekend but lower than expected industrial output figures put the brakes on the China rally. Car makers led the Nikkei with our TM shares gaining 9.8% in that session and HMC added 8.5%. Shippers continued to rally along with the Baltic Dry Index as South Korea announced accelerated capital spending programs that boosted the construction industry.

Europe is up about a point 2 hours ahead of the US open, also led by auto makers. "A bailout for the autos industry is one less thing to worry about for investors Monday, and will certainly provide relief in the short term," said Jeremy Batstone-Carr, strategist at Charles Stanley. Analysts said investors are also waiting to see the outcome of a U.S. FOMC meeting, which concludes Tuesday and could result in an interest-rate cut. So, as predicted last week, it's stimulus and the anticipation of more stimulus giving us what gains we have this morning. Holding the EU markets back today is a large list of financial institutions facing massive losses from the Madoff scandal. Santander, the EU's largest bank, said clients had exposure of $3.1Bn!

Europe is up about a point 2 hours ahead of the US open, also led by auto makers. "A bailout for the autos industry is one less thing to worry about for investors Monday, and will certainly provide relief in the short term," said Jeremy Batstone-Carr, strategist at Charles Stanley. Analysts said investors are also waiting to see the outcome of a U.S. FOMC meeting, which concludes Tuesday and could result in an interest-rate cut. So, as predicted last week, it's stimulus and the anticipation of more stimulus giving us what gains we have this morning. Holding the EU markets back today is a large list of financial institutions facing massive losses from the Madoff scandal. Santander, the EU's largest bank, said clients had exposure of $3.1Bn!

The ECB is considering various policy moves to unfreeze the credit markets including guaranteeing short-term interbank loans, lowering bank deposit rates (to encourage interbank lending rather than ECB deposits) as well as purchasing government or corporat debt. Rumors are that action could be taken before the year is out and a recent 0.75% rate cut has already taken rates down to 2.5% so again we have anticipation of massive stimulus floating the markets today.

Also working on a different sort of stimulus is OPEC, who are meeting in Algeria this week where a rate cut of 2Mb a day in output is anticipated and boosting oil prices back above $47.50 in pre-market trading. Rumors that Russia will be adding their own 300Kbd production cut is what sent oil prices flying this morning and the question we need to ask ourselves is "Will Goldman Sachs EVER make a correct call on oil?" Just last week they reversed their $100 per barrel call of late November to tell us it would now be $30 in Q1 and, no sooner do Goldman talk their sheep out of their holdings than oil ramps up 10%. Whatever reputation they had is being spent fast on these wildly fluctuation market calls.

Many forecasters now predict that global oil demand next year will be the weakest in more than two decades, another sharp turnaround from expectations earlier in the year. In January, the U.S. Energy Department's forecasting arm put global oil demand next year at just over 89 million barrels a day. It now estimates that demand in 2009 will be 3.7 million barrels a day less than that. Energy economist Philip Verleger has a much darker view, arguing in a recent report that oil demand next year could prove so weak that OPEC in the next year will need to trim at least five million barrels a day from production to avoid oversupply.

It does not matter if OPEC cuts supply 2M or 3M barrels a day as they already have 3.5Mbd of spare production capacity and raising the supply buffer over 5Mbd only serves to wash out the terror premium that speculators have been pricing into oil since 9/11/2001 and is responsible for the bulk of the price moves. Oil speculation is driven by the idea that a barrel of July 2009 oil you purchase today for $49 will be worth significantly more than $49 in July. Your bet has to be that either demand will increase or something will happen to hamper supply and make your contracts more valuable. As more and more oil is idled in the market, it's like taking stock in a company that has indicated they may be selling more shares at a later date – you face the risk of dillution to your future shares. Given OPEC's spotty compliance history along with the fact that they DO NOT control 60% of global production (and if they cut another 2Mbd, it will be closer to 65% of global production out of their control) – it's very difficult for speculators to risk holding barrels of oil, paying for storage etc when the price is as likely to go down as up.

Speculative oil dollars have to compete with speculative financial dollars and speculative copper dollars and speculative gold dollars and speculative plays on the Dow, who would have to be trading significantly higher before people are going to start paying $60 a barrel for oil again. Oil had it's great run up because it was underpriced and the energy sector was trailing a major market run after the market bottomed out in 2002. Now the energy sector is still outpacing the broader market by 80% and that's going to make bargain hunters look elsewhere – certainly the idea of concentrated energy virtual portfolios will take a while to come back in fashion…

While our government's total debt rose from $9.15Tn last November to $10.7Tn at the close of last month, the amount of interest paid on that debt fell by $10Bn due to record amounts of treasury purchases. “You still have a massive paranoia in the marketplace and you’ve got that safety-at-any-cost mentality,” said Jay Mueller, who manages about $3 billion of bonds at Wells Fargo Capital Management in Milwaukee. “People are not buying Treasury bills because they think the yields are attractive. They are buying them because they are afraid to put money anywhere else.” This may sound great but the fact is our government needs to keep borrowing over $100Bn a month to keep the lights on while holders of Treasury notes may eventually have a change of heart and dump their securities on the open market, forcing the government to compete against their older bonds by raising rates on new bonds – this is how interest rates can shoot up alarmingly in the future. Have I mentioned I like gold lately?

While our government's total debt rose from $9.15Tn last November to $10.7Tn at the close of last month, the amount of interest paid on that debt fell by $10Bn due to record amounts of treasury purchases. “You still have a massive paranoia in the marketplace and you’ve got that safety-at-any-cost mentality,” said Jay Mueller, who manages about $3 billion of bonds at Wells Fargo Capital Management in Milwaukee. “People are not buying Treasury bills because they think the yields are attractive. They are buying them because they are afraid to put money anywhere else.” This may sound great but the fact is our government needs to keep borrowing over $100Bn a month to keep the lights on while holders of Treasury notes may eventually have a change of heart and dump their securities on the open market, forcing the government to compete against their older bonds by raising rates on new bonds – this is how interest rates can shoot up alarmingly in the future. Have I mentioned I like gold lately?

Russia is still having currency trouble as Putin had to pledge to avoid a "sharp" devaluation of the ruble in order to dissuade citizens from storming the banks and demanding their funds, presumably to convert to foreign currencies and, of course, gold. It also has prompted Russia’s first credit-rating downgrade in nine years and may prolong the decline of the nation’s manufacturing industry. A one-time, 20 percent devaluation is needed even though the ruble has fallen 15 percent against the dollar since August and the central bank widened its trading band five times in a month, said Anton Struchenvsky, an economist at Moscow brokerage Troika Dialog. “It’s like using a tourniquet: The blood doesn’t flow, the arm goes numb, but if you keep it tight for long the tissue will die,” Struchenvksy said. A devaluation is “the only way to let the blood, the money, back into the economy.”

Putin and Dmitry Medvedev, the 43-year-old president he picked to replace him, are trying to avoid a rerun of the 1998 financial crisis, when the government defaulted on $40 billion of debt and devalued the ruble 70 percent. Russians hammered on the locked doors of the country’s collapsing banks as their savings were wiped out, and demonstrators carrying rubles in miniature coffins marched past the central bank headquarters. International and domestic investors have pulled about $211 billion from the country, BNP Paribas SA estimates, after the price of Urals crude oil dropped 64 percent, credit markets seized up and Russia fought a five-day war with Georgia. This is the partner OPEC is relying on to voluntarily stop selling $5.5Bn worth of oil again as their trade surplus has already turned into a deficit.

The WSJ is floating a story that Obama's stimulus plan may reach $1Tn, effectively doubling the promise of last Monday's open. All this was expected by us last week so we are not going to get excited about it this week unless we make some real progress. My target for the Fed cut is 9,100 by tomorrow afternoon with follow-through to 9,500 by the end of the week. Anything less than that will actually be a disappointment but we're not going to get ahead of ourselves, we're just going to see how things hold up today. Last Monday, the rumor of $500Bn from Obama and an auto bailout took us to just over 9,000 from 8,635 on that Friday's close. Today we start from 8,629 on the Dow so, very simply – we need to do better than this!