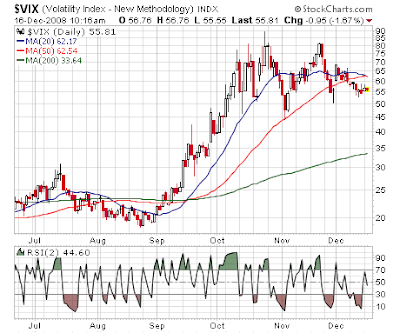

Adam Warner, at Daily Options Report, is kind of getting the feeling January volatility is primed for a slam. Here’s the chart.

VIX Chart-O-Rama

In my subjective opinion, which if I’m hot is correct 51% of the time, volatility is primed for some smackage here. Part of it is just statistical as the holiday’s rapidly approach, but part is *real* as it’s just plain slowing down. 30 day historical volatility has tapered from the mid 80’s to the mid 60’s in about a month. 10 day volatility has plunged to 40.

VIX holding relatively strong today with the Big Ben’s Big Rate Cut Extravaganza on tap, but after that and resulting (potential) directional move, look out.