Anyone know what WWSD is (what would Satan do?)? Notice a sentence from Random Roger that is not quite as bearish as everything else this weekend: "Quite a few market pros think the S&P 500 could go to 600 before this bear is over (I do not). SPX 600 is an unknown, it may happen, it may not." Okay, one person thinks the S&P is NOT going to 600. Well, Roger’s leaning in that direction anyway. – Ilene

WWSD?

Courtesy of Roger, at Random Roger’s Big Picture

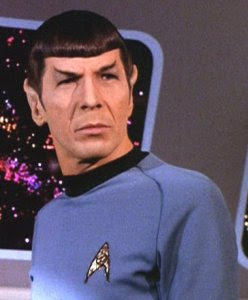

The S of course is for Mr. Spock who was known for being coldly analytical about everything, well maybe everything except the green women. Or was that James Tiberius Kirk?

The S of course is for Mr. Spock who was known for being coldly analytical about everything, well maybe everything except the green women. Or was that James Tiberius Kirk?

Anywhoo can you be coldly analytical about the stock market? Can anyone? We are in the middle of a nasty market these days. The S&P 500 is down 43% from its peak from 14 months ago. Many stocks are down 50-70% from their respective peaks.

During bear markets many stocks go down a lot more than market for no true fundamental reason. There are plenty of stocks, domestic and foreign, that are down more than their fundamentals justify and that will not go out of business in this cycle (or any cycle in the foreseeable future).

The reason people are scared to buy stocks now is the fear that the stocks they choose go down a lot more from here and it is a reasonable fear but not the best way to make investment decisions. Quite a few market pros think the S&P 500 could go to 600 before this bear is over (I do not). SPX 600 is an unknown, it may happen it may not. What is known is that many stocks are now at much lower prices than they were a year ago or at similar prices to what they were five and ten years ago. Again this is easily knowable by looking at a chart. Not only are many of these names at lower prices some of them are also much cheaper (lower prices as potentially nominal and cheaper in terms of common valuation metrics).

If you know a stock has a much lower price today, has a cheaper valuation today, is unlikely to go out of business and you have some cash it probably makes sense to buy a little now. I’m not saying a bottom is in and I’m not saying get 100% invested right now but if you raised cash, have not bought anything while the S&P 500 has had a 7, 8 or 9 handle and you have not sworn off stocks, you’ll probably get a price you’ll be happy with a few years from now.

But what about the S&P 500 going to 600? From Friday’s close 600 would be a 32% drop. Yes that could happen but the probability of a 32% drop after a 43% drop is quite low. The focus here is what is known now versus what is feared for in the future.