Selling opportunity? Trader Mark is selling into this rally. In a subsequent post, Potential Short Set Ups, Mark highlights a number of stocks he believes are setting up for low risk shorting-opportunities.

S&P Back to Top of its Multi Month Range as World Economies Plunge

Trader Mark at Fund My Mutual Fund

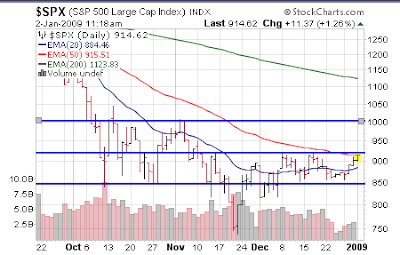

As you see in the chart below we are back to the top of a quite substantial sideways range

The S&P has been in this range for about 20 sessions in a row and we’re now at a similar spot as two weeks ago. We’ve been ignoring all bad news for about 5 weeks now and keep saying "it’s all priced in, brigher days ahead – Obama soon is here." Fair enough – if we break out of this range (S&P 850 to 920) we’ll drink this Kool Aid as well. I’d like to reiterate (a) the market is not the economy and (b) no one should be dogmatic. We had similar action multiple times in late 2007 (remember the market was at ALL TIME HIGHS in October 2007 so if the market was a forecasting tool for what is coming down the pike in "6 months", it sure was a broken tool).

The S&P has been in this range for about 20 sessions in a row and we’re now at a similar spot as two weeks ago. We’ve been ignoring all bad news for about 5 weeks now and keep saying "it’s all priced in, brigher days ahead – Obama soon is here." Fair enough – if we break out of this range (S&P 850 to 920) we’ll drink this Kool Aid as well. I’d like to reiterate (a) the market is not the economy and (b) no one should be dogmatic. We had similar action multiple times in late 2007 (remember the market was at ALL TIME HIGHS in October 2007 so if the market was a forecasting tool for what is coming down the pike in "6 months", it sure was a broken tool).

The next obvious range would be S&P 920 to 1000 which would take us to early November highs.  I’m not going to bite on the first close above S&P 920 because it would be just like mother market to draw in all these thousands of technicians waiting for that level to break to deploy capital, and then reverse. We’ve been able to capture a lot of excellent trades and log gains while only using half our capital so I’m content with how things are going. As we’ve seen, this market can take away in two weeks what takes four months to gain – the moves down are much more hectic than upward moves.

I’m not going to bite on the first close above S&P 920 because it would be just like mother market to draw in all these thousands of technicians waiting for that level to break to deploy capital, and then reverse. We’ve been able to capture a lot of excellent trades and log gains while only using half our capital so I’m content with how things are going. As we’ve seen, this market can take away in two weeks what takes four months to gain – the moves down are much more hectic than upward moves.

Just about the time we get complacent and start feeling performance anxiety ("hey maybe the bottom is in, what am I doing with all this cash??!"), is usually when you get hammered in the bear. As I was stating in October and November – that sort of action was abnormal, even in bear markets. Straight down with such a ferocity is not typical. What we are going through now is more typical – even the bear of 2000-2002 showcased action typical to this for much of the move down.

Today we had some scary awful industrial data both here and abroad, but not to worry – governments worldwide are working on saving us.

Here

- Manufacturing in the U.S. shrank in December at the fastest pace in almost three decades as the recession deepened and spread overseas.

- The Institute for Supply Management’s factory index fell to 32.4, less than forecast and the lowest level since 1980, from 36.2 the prior month, the Tempe, Arizona-based private group said today. Readings less than 50 signal contraction.

- “It’s a breathtaking plunge in manufacturing,” said Ken Mayland, president of ClearView Economics LLC in Pepper Pike, Ohio, whose estimate tied for lowest among economists surveyed. “The exports numbers are reflecting recessions abroad. The world is very much coupled.”

- The ISM’s gauge of new orders dropped to the lowest level since records began in 1948, while export demand was also the weakest since those records started in 1988.

- “The environment is still the toughest, for people of my generation, that we’ve ever seen.”

Europe

- European manufacturing contracted in December by more than initially estimated and at its fastest pace on record, signaling the recession is deepening.

- Manufacturing shrank for the seventh consecutive month as businesses feel the pain of tighter bank lending, the euro’s rise to a record against the pound and weaker demand at home and abroad.

- Industry contracted throughout the euro-area’s largest economies. An index for Germany fell to 32.7 from an initial estimate of 33.5 and the gauge for France dropped to 34.9 from 35.9. A measure for Italy rose to 35.5 from 34.9 in November.

China

- China’s manufacturing contracted for a fifth month in December as recessions in the U.S., Europe and Japan sapped demand for exports, a survey showed. Manufacturers in industries from metals to toys are reducing production or closing down.

- “Chinese manufacturing was very weak in December,” said Eric Fishwick, head of economic research at CLSA in Singapore. “With five back-to-back PMIs signaling contraction, the manufacturing sector, which accounts for 43 percent of the Chinese economy, is close to technical recession.”

- “Chinese manufacturers reduced the size of their workforces at the fastest rate recorded by the series to date,” today’s report said.

- Exports fell for the first time in seven years in November, imports plunged and industrial output grew at the slowest pace in almost a decade.

The latter (China) is most interesting to me – remember the "decoupling theory" that was so prominent in late 2007 and early 2008? If not, it’s the "thesis" that the fast growing emerging economies would flick off any slowdown in Europe and the U.S. They were nearly imprevious. This thesis was advanced by the same people who CNBC recycles for the latest predictions. But the stock market is not about reality – it’s about thesis. So while I mock the thought that China will be "just fine" thank you, because the Baltic Dry Index is up 0.0002%, I own a proxy for China stocks (in fact I doubled it late Friday since the chart was firming up). Thesis baby… thesis. Don’t worry about reality. Never mind that 43% of the Chinese economy is going backwards; the other 60% of their economy will (ahem) grow by 15% so that they can reach those 8% GDP figures everyone is clinging to. Yep. Sure why not – government stimulus is on the way and that’s all that matters.

The latter (China) is most interesting to me – remember the "decoupling theory" that was so prominent in late 2007 and early 2008? If not, it’s the "thesis" that the fast growing emerging economies would flick off any slowdown in Europe and the U.S. They were nearly imprevious. This thesis was advanced by the same people who CNBC recycles for the latest predictions. But the stock market is not about reality – it’s about thesis. So while I mock the thought that China will be "just fine" thank you, because the Baltic Dry Index is up 0.0002%, I own a proxy for China stocks (in fact I doubled it late Friday since the chart was firming up). Thesis baby… thesis. Don’t worry about reality. Never mind that 43% of the Chinese economy is going backwards; the other 60% of their economy will (ahem) grow by 15% so that they can reach those 8% GDP figures everyone is clinging to. Yep. Sure why not – government stimulus is on the way and that’s all that matters.

Again, this week is thin trading and we come into earnings season in the coming weeks along with retail data next Thursday and employment data Friday. We’ve ignored bad data for 5 weeks or so but I’ll be curious when many companies begin to pull back 2009 guidance and report their numbers if this "ignoring" can continue for week after week. But until reality returns, we are "thesis" players ourselves.