A $300Bn Tax cut!

A $300Bn Tax cut!

That’s the word in the WSJ this morning as Obama-mania sweeps the investor class. That goes a long way to explaining what the catalyst was for last week’s rally – we knew we were going to be getting a run-up into the inauguration – we just didn’t think it would come so early but it doesn’t take too many people to hear whispers of tax cuts (as part of an $800Bn stimulus plan) to kick start some into taking the plunge.

While I’m happy that the cuts are geared more to the middle class than the Bush cuts were, it’s not yet clear whether these cuts replace, or are in addition to, the existing tax cuts. We’re not even thinking about who’s going to pay for this all as I’m not sure if Obama’s team has done the math on how far down tax collections are already going to be this year with the financial sector (which booked over $2Tn in profits in 2007) declaring almost no income for 2008. Either way, the message to Wall Street is loud and clear with these tax cuts: "Meet the new boss – same as the old boss" and we will get fooled again!

Still I refuse to get disillusioned 2 weeks before Obama is sworn in – let’s give him until the end of January before we decide his policies aren’t working! Obama is up on Capitol Hill today speaking about his stimulus program and also scheduled for Congress’ back-to-work week are hearings on how the SEC could totally fail to catch Madoff before $50Bn went down the tubes as well as the usual squabbling over what the US response should be to what is now a much more serious war in the Gaza, which threatens to drag on during the next two very lame duck weeks.

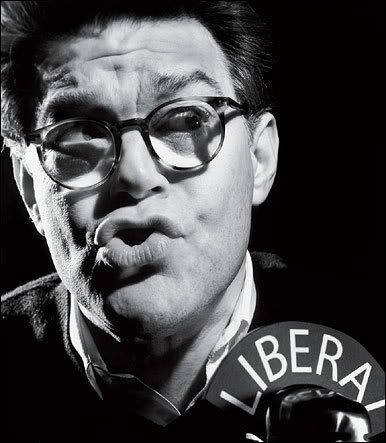

Also in politics, congrats to former SNL writer, Al Franken, who is now the newest Senator from Minnesota as they finally finihsed the recount and, after the likely court battle to stop him, will take his seat in the Senate and begin writing his next book. It would be smart for other Senators to read his other books and I imagine many will be giving Al a very wide berth lest they become fodder for his lecture tours. Governor Bill Richardson, on the other hand, will NOT be the new Commerce Secretary as there is a Federal probe of one of his political donors. "Given the gravity of the economic situation the nation is facing, I could not in good conscience ask the President-elect and his administration to delay for one day the important work that needs to be done," Richardson said in a statement.

Also in politics, congrats to former SNL writer, Al Franken, who is now the newest Senator from Minnesota as they finally finihsed the recount and, after the likely court battle to stop him, will take his seat in the Senate and begin writing his next book. It would be smart for other Senators to read his other books and I imagine many will be giving Al a very wide berth lest they become fodder for his lecture tours. Governor Bill Richardson, on the other hand, will NOT be the new Commerce Secretary as there is a Federal probe of one of his political donors. "Given the gravity of the economic situation the nation is facing, I could not in good conscience ask the President-elect and his administration to delay for one day the important work that needs to be done," Richardson said in a statement.

So it’s politics as usual in Washington in 2009 and it remains to be seen whether it’s going to be markets as usual as we find out how much of last week’s gains will stick. We added 600 Dow points off Monday’s bottom at 8,400 (7%) with Transports generally outperforming followed closely by the Auto sector as the bailout took hold but, sadly, followed next in performance by Basic Materials and Oil/Energy sectors with Finance, Construction and Medical sectors bringing up the rear. So it’s "meet the new market – same as the old market" in 2009 as well.

Last Monday I said I was bullish on oil at $40 but I also said we did not want to see it break $45 and the war has pushed it up to $46 this morning. It doesn’t matter that $46 seems cheap compared to last year – last year people had money, this year they don’t and $10 per barrel that oil gained last week is taking $200M a day out of the hands of US consumers and $860M a day out of the pockets of global consumers. That’s $300Bn of global stimulus wiped out in a week as that is money that is clearly going to be burned for fuel. We were optimistic on Monday and went bottom fishing, picking up some trades I discussed on Tuesday morning but we did not get the rotation we needed to build a longer rally on. We ended the week with the worst ISM number I’d ever seen at 33 (below 50 is contraction) and the global manufacturing situation is simply tragic:

We ran a Big Chart Review on Tuesday and please keep in perspective that we got gains last week on very low volume and that the 30% off line on the Dow is right about 9,100 and one of our indices needs to break 30% for the others to get serious about staying above 40% off the highs. The 40% line for the S&P is 946 (now 931), Nasdaq 1,717 (now 1,632), NYSE 6,232 (now 5,915) and Russell 514 (now 505) and we will continue to watch those levels very closely for real signs of investor confidence but nothing that happened last week has convinced us that investors are going to simply ignore EVERYTHING and run back to the markets. The SOX, by the way, need to gain 20% to get back to 50% off their highs, which is why I skipped them…

In Tuesday’s post I said I expected to get back to the previous Big Chart levels by the 9th and possibly around 9,500 either just before or just after the inauguration. We’re a little early and the low-volume run-up is what ruined it for me, a slow build could have given us more confidence. Keep in mind that the stimulus they are talking about in the MSM this morning is the same one we’ve been discussing for 2 weeks and we aren’t the only ones who saw it coming early so I’m not expecting much bang for the buck on today’s "revelation."

In Tuesday’s post I said I expected to get back to the previous Big Chart levels by the 9th and possibly around 9,500 either just before or just after the inauguration. We’re a little early and the low-volume run-up is what ruined it for me, a slow build could have given us more confidence. Keep in mind that the stimulus they are talking about in the MSM this morning is the same one we’ve been discussing for 2 weeks and we aren’t the only ones who saw it coming early so I’m not expecting much bang for the buck on today’s "revelation."

We’ll keep an eye on our indexes and it would not be surprising to see a 4% pullback this week but if that line holds (roughly where we were on Tuesday’s close) then we could be properly set up for a real "change" rally leading up to inauguration day.

Asian markets caught Obama fever this morning, with the Nikkei adding 2.1% higher after being closed since Tuesday (so lots of catching up to do) aand the Hang Seng kept pace with a 1.9% gain while the Shanghai shot up 3.3% after declining for the past 8 sessions. "The Obama package is probably the only positive for the markets at the moment … commodity prices in general have also been recovering over the last couple of weeks, again on Obama policy expectations," said Yoji Takeda, head of regional equities at RBC Investment. The rally was led by miners, energy companies and exporters despite the fact that Japan auto sales fell to a 34-year low, probably due to a consensus that the government will intervene to stimulate the Dollar and the Euro vs the Yen. With rates already at 0.1%, I’m not sure where they are going but it will be fun to watch.

Also boosting crude futures is a recycled story that China is filling their own SPR as fast as they can while oil is cheap – a much more sensible move actually compared to the 50M barrels bought by Bush while oil was $70 and higher. Still oil is not priced up due to overall scarcity but due to anticipation of supply disruptions and another major country adding another major reserve really doesn’t help speculators looking to profit off of wars or hurricanes, when they will be able to squeeze desperate people for the fuel they need to survive. More than anything else, it was Bush’s unwillingness to tap the SPR (when he could have sold at a nice profit) that led to a series of price spikes – if Obama reverses that policy and competes with speculators to sell barrels during a crisis, we could actually see lower lows in oil down the road.

European markets were off to a good start but turned sharply down after lunch. The German stimulus plan is still on hold over their own political season and the UK rescue plan clearly isn’t working as money is simply not flowing in England. Retail sales in the UK were very, very bad and Waterford/Wedgwood (china) filed for bankruptcy as the 200 year-old company is no longer able to secure financing so business is still pretty bad out there…

Steve Jobs is still not dead and AAPL is flying pre-market as the company announces that a hormonal imbalance, not cancer, is causing his health issues. MacWorld opens today and it will be the first time Jobs does not deliver the keynote address and NOW it’s time to cover Apple (I’ve been fanatic telling people not to cover into all the health BS).

We are market agnostic today as we went into the weekend very well covered, almost bearish on Friday’s crazy run-up and we reserve our opinions until we see how the Dow handles the 30% line and whether or not any other indices join it in the "less than 40% off club." Whichever way it goes, we should have a very exciting two weeks into expiration day on the 16th and our change of government on the 20th. Happy 2009!