Wondering? Ask Mish,

Is The Stock Market Cheap?

What does make sense is to discuss earnings estimates. Here are two charts from a recent report by John Mauldin entitled 2008: Annus Horribilis, RIP.

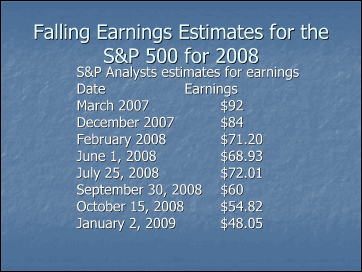

S&P Earnings Estimates For 2008

click on chart for sharper image

Notice the consistent ratcheting down of estimates. Analysts were amazingly optimistic all year long. Earnings estimates for the year plunged from $92 all the way to $48. Looking at estimates for 2009, we see the same thing.

S&P Earning Estimates For 2009

click on chart for sharper image

Think the stock market is cheap? Let’s do the math. The S&P closed at 910. If those earnings estimates hold, the effective PE is 21.53. The historical average PE is about 15. At a PE of 15 the S&P would drop to 634. That is a huge drop of 30% from today’s closing price.

What happens if the stock market over shoots as it typically does in bear markets. Assume a PE of 12. At 12, one might expect to see the S&P at 507. That would be an even bigger decline of 44% from here.

What About Those S&P Earnings Estimates?

Given that earnings estimates have been falling like a rock, why should anyone assume those estimates are about to improve any time soon?

Please consider Wal-Mart Leads Retailers in Slashing Profit Forecasts.

Wal-Mart, the world’s biggest retail chain, said today that fourth-quarter profit will miss its earlier forecasts after sales at stores open at least a year rose 1.7 percent last month, missing analysts’ estimates.

Macy’s cut its fourth-quarter profit forecast to as little as 90 cents a share from a previous minimum of $1.10. It also announced the closing of 11 of its 859 stores.

Nordstrom Inc., citing “competitive markdown pressure across the industry,” said it wouldn’t meet its fourth-quarter per-share profit forecast of 35 cents to 45 cents.

Limited Brands Inc. slashed its fourth-quarter profit projection to as little as 55 cents a share from a previous range of 85 cents to $1.

J.Crew Group Inc., which sells $200 cashmere sweaters, slashed its full-year forecast for a fourth time. In the fourth quarter, it predicts a loss of as much as 29 cents a share, down from profit of as much as 10 cents, because of “aggressive inventory actions” to clear out merchandise.

Bebe Stores Inc. reduced the low end of its forecast to 5 cents from 12 cents.

Gap cut its full-year profit forecast to as much as $1.30 a share from a previous high of $1.35 after December merchandise margins fell.

Sales are down as is forward guidance, and it’s not just department stores. Here is another data point to consider: U.S. Companies Issuing Profit Outlooks for Jan. 7.

Of 26 companies who provided earnings guidance, 17 were lower, 5 were up and 4 were the same. Here are a few names Intel (INTC) down, Family dollar (FDO) down, Network Equipment (NWK) down, Time Warner (TWX) down, Verizon (VZ) Up, Ethan Allen (ETH) down, Cyberoptics (CYBE) down.

From Mauldin’s Article:

In 2001, as-reported earnings were $24.67. Operating earnings in 2002 were $27.57. Does anyone think the current recession will be milder than the last one? Or shorter?

And it gets worse. Core earnings, which take into account pension and other under-reported liabilities, were less than $16 in 2001, and so P/E on a core earnings basis topped out at 71, and on an as-reported basis were as high as 46!

Let’s Have Some Fun With Numbers

Earnings PE Target

$25.00 12 300

$35.00 12 420

$45.00 12 540

$55.00 12 660

$25.00 15 375

$35.00 15 525

$45.00 15 675

$55.00 15 825

$25.00 18 450

$35.00 18 630

$45.00 18 810

$55.00 18 990

One can point out that stocks scorched higher from that 2002 bottom. But remember that there was a housing bubble, a derivatives bubble, a commercial real estate bubble, and dare I say it … even a commodities bubble that followed. One can summarize the last move up in two words "credit bubble".

Indeed it was a credit bubble fueled by leverage of 30-1 if not 50-1 at Bear Stearns, Lehman, and Morgan Stanley, nonexistent lending standards, and avoidance of any semblance of common sense nearly everywhere one looked. Citigroup alone hid $1 trillion in assets off its balance sheet in SIVs.

Everyone was playing the "lend and securitize" model. That model is dead, as are toggle bonds that paid back debt with more debt, covenant lite agreements that postponed the repayment of debt, SIVs, and dozens of other financial engineering models.

And it was housing that fueled jobs. Now the prayers are that Obama can create 3 million jobs, but he will need to do that just to tread water.

Bear in mind that government cannot really "create" any jobs per se. It can raise taxes and shift private sector jobs creation to government jobs creation (typically a malinvestment), and it can bring production and consumption forward for those jobs that are genuinely needed (filling potholes), but once the potholes are filled, one has to ask the question, "What will we do for an encore?"

No Driver For Earnings

Looking ahead to 2009, 2010, 2011 there is simply no driver for earnings like we saw in 2002. Enormous leverage, creative financing, and the housing bubble are all gone and are not coming back.

The brokerage houses are now under bank rules and leverage will be reduced to 10-1 or possibly 12-1. A reduction in leverage is a reduction in risk, but also potential earnings.

In the immediate future, think about what increasing layoffs are going to do to credit card defaults, foreclosures, commercial real estate, demand for PCs, etc.

Then once the markets bottom, think about how fast those earnings will rise. Here’s a hint: It will not be anything remotely like 2002.

Rushing in now on that expectation that stocks are cheap is playing the greater fool’s game all over again. Stocks are not cheap, no matter how many pretend otherwise.