Todd Harrison on 2009: False hopes and empty promises?

Ten Themes for 2009

“A year has passed since I wrote my note. I should have known this right from the start.”

–The Police

2008, with all the twists and turns and credit burns, will be remembered as the year when perception finally caught up with reality.

The writing was on the wall for all to see as the cumulative imbalances steadily built since the back of the tech bubble. As time and price are the arbiters of financial fate, it was simply a matter of time before the wheels fell off the wagon.

As we edge into a tense twelve-month stretch, pundits are furiously offering fresh predictions, prophecies and price targets. While we at Minyanville pride ourselves on adapting rather than conforming, we’re happy to toss our hat in the ring and gaze across the financial horizon.

We did so last year with some success but know all too well that you’re only as good as your last trade.

Alas, without further adieu and in no particular order, I humbly submit ten themes for this coming year.

The Not So Quiet Riot

The age of austerity has officially arrived and we’ll see a steady stream of social strife as the rejection of wealth increases in size and scope. While societal acrimony began to percolate last year, this dynamic will manifest through social unrest and geopolitical conflict as we edge ahead.

This is, without question, the single biggest socioeconomic risk as we stand at a critical crossroads. On the one side, there is orderly debt destruction that will ultimately pave the way for true globalization. On the other, there is isolationism and protectionism as sovereign nations protect their interests at any cost.

If calmer heads don’t prevail and the global community takes a turn for the worse, history books will likely point to Shock & Awe as the beginning of WW3. You don’t have to agree with this assessment; you simply have to respect it.

Hedge Fund Overhaul

Once upon a time, in the early 1970’s, the mere mention of Wall Street was taboo at cocktail parties. The more things change, the more they stay the same as Main Street casts blame, in many cases rightfully so.

Early last year, I opined that 50% of existing hedge funds would cease to exist. The perfect storm of 2008 will expedite this process, as will reactive regulation following the Bernie Madoff scandal.

Typical hedge fund terms are “one and twenty,” or 1% management fee and 20% performance fee. Expect industry standards to shift to a three-year aggregate performance structure that eliminates the annual payout and weeds out the excess capacity in this space.

Seismic Readjustment

Entering September, we offered that the disconnect between equity and credit would manifest as a car crash or a cancer.

Four months later, despite lower equities and massive government intervention, the equilibrium between equity, credit, commodities and currencies remains elusive.

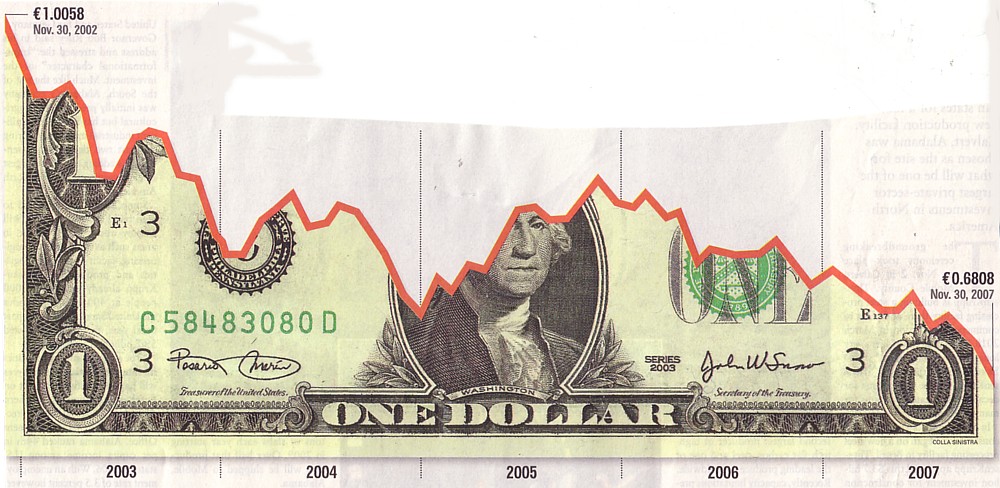

In a free-market system—such as the one we used to have—these inefficiencies would be naturally resolved by supply and demand. In the current world, a “man made” readjustment, such as a meaningful currency move that significantly devalues the U.S. dollar, becomes increasingly likely.

In a free-market system—such as the one we used to have—these inefficiencies would be naturally resolved by supply and demand. In the current world, a “man made” readjustment, such as a meaningful currency move that significantly devalues the U.S. dollar, becomes increasingly likely.

Motion and Movement

When asked about my year-end price target on the S&P, my answer is constant. Tell me what the dollar will do and I’ll offer an educated guess on stocks. Indeed, since the beginning of 2002, our financial machination has operated through the lens of “dollar devaluation vs. asset class deflation.”

My sense for 2009 is that—all else being equal—we’ll see wild movements and a wide range, perhaps with S&P 600 as a nadir and one (if not two) 20% bear market rallies filled with false hope and empty promises.

The January 20th transfer of power is an important inflection point, for if we can collectively navigate past that date without geopolitical conflict, stocks have room to run into March or April, when the bloom begins to fade on the new administration’s rose.

Pension Panic and Puny Munis

The unfortunate aspect of our current conundrum is that in many ways, the cancer is bigger than the patient. It is analogous to a financial dike springing holes faster than the government can invent fingers.

Unfunded pension plans and bankrupt municipalities should jockey for mindshare in 2009 as the financial crisis evolves. The government will fight fire with fire — perhaps allowing citizens to withdraw from their retirement accounts without tax penalties — but that solution is transient at best.

As Bennet Sedacca recently wrote on Minyanville, “Municipals have no liquidity, no natural buyers, virtually no research and awful fundamentals. Unlike mortgages and other items you can trade electronically, it would be much harder for Uncle Sam to manipulate municipals, with the notable exception of state general obligations. I would not be surprised to see massive failures in this space.”

The Employment Conundrum

Acute market watchers have long derided the Bureau of Labor Statistics for producing economic figures that aren’t representative of true market conditions. Indeed, if we calculate unemployment to include discouraged workers, as it was measured prior to the Clinton administration, current readings would be closer to 15%.

While it’s no stretch to assume a further uptick in unemployment—remember, it was 25% during The Great Depression—the ironic twist is that those with jobs will also feel the pinch.

Expect relative pay cuts, rather than salary bumps, to be a central theme this year despite folks working twice as hard to absorb the productivity chasm.

Industrial Revolution

The financial crisis of 2008 was akin to a forest fire; scary and dangerous but a necessary evil that will ultimately allow for fertile rebirthing and greener pastures.

The entire spectrum of industries—from finance to media to retail to philanthropy to academia—will be forced to reinvent themselves as the new world order emerges. This isn’t necessarily a bad thing, as a phoenix will rise from the scorched earth in each of these sectors. The leaders coming out of a crisis are never the same as the leaders that enter it.

Through that lens, I view The Great Depression as a framework for optimism. Disney (DIS), Texas Instruments (TXN), Continental Airlines (CAL), Hewlett-Packard (HPQ) and The Washington Post (WPO) are proof positive that the greatest opportunities are bred from the most profound obstacles.

A Yen for Japan

While comparisons abound between our current stateside situation and Japan in the 1980’s, there aren’t many folks talking about Japan as a relative winner in the global marketplace.

There is clearly risk to that region but we must remember that they have a 25-year head start down Deflationary Road. Japan has the highest level of savings relative to private debt. Their public debt is horrendous but what is happening over time—and why the Yen is appreciating—is that Japanese savers are bringing those savings back to Japan.

You can’t spend relative performance, we know, but I expect Japan to out-perform U.S. equities this coming year.

Alpha Bits

Now that the equity epitaph has been written for the “buy and hold” strategy, it may be time to begin looking for babies in the bathwater. There will be deep value opportunities in small and micro-cap stocks, creating an environment where real value investors step up and stand out.

This will not come easy and it will require due diligence. Debt free companies with strong balance sheets, free-cash flow and trustworthy management will trade at a premium. Integrity, as a whole, will be a commodity in the coming years as distrust in the system permeates.

As a savvy seer once told me, “I don’t invest in companies, I invest in people.” Look for the cream of corporate America to rise to the top—and the entrepreneurial spirit to awaken—as once trusted companies fall by the wayside.

You Gotta Believe!

We often say that it should never take something bad to make us realize we had it good and 2008 was a harsh reminder that profiting is a privilege rather than a right.

This is no garden-variety one-and-done recession; it will be a prolonged process as we attempt to regain respectability on a global stage after eight years of mismanaged affairs. It would be myopic to expect a V-shaped recovery despite the historic stimuli being injected into the marketplace. Keep it in perspective, no matter what comes our way.

The upside to the anger sweeping the Street is that we, the people, will band together as we find our way. Communities such as Minyanville will flourish as folks surround themselves with trusted peers that have skill-sets that compliment their own.

We will, in many ways, yearn for simpler pleasures as we appreciate the little things and each other. We’ll revisit our religious beliefs, support our local businesses and strive to provide a safer world for future generations.

There will be better days and easier trades. The onus is on us to find our way, one step at a time and together as one.

R.P.

Message In A Bottle – The Police. [Personal note: I waited on Sting about 20 years ago at Hugo’s in West Hollywood, but unfortunately didn’t recognize him till my coworkers pointed him out, or I would have flirted more.]