Last Monday we started the week with a bang as word spread of a $300Bn tax cut.

Last Monday we started the week with a bang as word spread of a $300Bn tax cut.

Since this was more of the same nonsense as we've had the last 8 years we remained slightly bearish and, after finally getting the good word that Steve Jobs still lives, we decided to cover AAPL as it broke $96. Also on Monday I railed against the ludicrous run-up in oil that I said was unsupportable in the current economy. Tuesday we had the Fed minutes and I had been warning for 2 weeks that is was highly unlikely that they would be cheery as those were the minutes of the meeting that led the Fed to cut rates to zero to stave off the collapse of the US economy! My comment on the low-volume S&P chart on Tuesday morning was: "We haven’t turned up the moving averages yet and that makes this a very dangerous time when we could still get another bottom test before we make a real move."

Also on Tuesday morning, which was opening very well, I pointed out: "Keep in mind that this is just another round of massive global stimulus keeping the markets afloat." We talk about this all the time in our "roller coaster" market model and it has served us very well in making very good market timing calls. I identified the energy sector as the Achilles heel of the markets saying: "We are, of course, not happy with an energy-led rally and we’re still looking for some real signs of rotation" but we did not get it from XHB, which I hoped would show signs of life but didn't last out the day. We basically turned negative on the Fed minutes as the fake rally did not break our watch levels.

Nonetheless we spent the balance of the week waiting for a retest of our 8,650 level on the Dow, 870 on the S&P, 1,550 on the Nasdaq, 5,600 on the NYSE and 480 on the RUT. My comment at the close of Wednesday morning's post was: "Tomorrow we get weekly jobless claims so the hits may just keep on coming this week – a wonderful environment to test our levels so let’s keep our eye on our 38 favorites and see what discounts we are offered this week." While we did not pull the trigger on Friday, we are hoping for a good reason to do so today.

Only the Dow actually broke down last week and we are willing to forgive them as they were dragged down by commodity pushers XOM, CVX and AA while getting no help at all from the financials, who fell 7.5% for the week, making the Dow down 4% look good. We need oil to die for this economy to get healthy – not just the price of crude but investors must stop throwing money down that sinkhole of a sector as the integrated majors (XOM, CVX et al) are still outperforming the Dow by 40% over 2 years and almost 90% over 5 years.

Last week effectively ended for the bulls on Wednesday morning, when the ADP report showed us 700,000 jobs lost in December. AA also guided down that morning and dove 10% at the open along with INTC and TWX, who also guided down. AA has earnings today after the bell but this week is NOT as exciting as you may think with just 35 companies reporting. Our biggies for the week are SCHW (already in-line this morning) and AA today. CBSH and INFY tomorrow morning, AMR and NITE on Wednesday morning with XLNX at night, BLK, BGG and MER Thursday morning with DNA, INTC, SHFL and ZZ at night. Friday we see FHN, JCI and SNE but that's it for the week and next Monday is a holiday and the following Tuesday is inauguration day and THEN earnings season really begins.

Last week effectively ended for the bulls on Wednesday morning, when the ADP report showed us 700,000 jobs lost in December. AA also guided down that morning and dove 10% at the open along with INTC and TWX, who also guided down. AA has earnings today after the bell but this week is NOT as exciting as you may think with just 35 companies reporting. Our biggies for the week are SCHW (already in-line this morning) and AA today. CBSH and INFY tomorrow morning, AMR and NITE on Wednesday morning with XLNX at night, BLK, BGG and MER Thursday morning with DNA, INTC, SHFL and ZZ at night. Friday we see FHN, JCI and SNE but that's it for the week and next Monday is a holiday and the following Tuesday is inauguration day and THEN earnings season really begins.

We finished out last week with my Thursday rant on the $2Tn deficit, but I said: "As long as every man, woman and child on earth can scrape together 3,333 dimes for the US collection plate – everything will be fine!" so at least we have a plan… Friday morning we revealed the Great Goldman Sachs conspiracy and we discussed the massive UNDERemployment that I feel is far worse than the headline unemployment so it was no surprise at all that retail sales were awful.

So that's how we got back to our mid-range targets, falling just about 5% back off the highs that were tested on Tuesday with the Russell acting as our underperformer of the week. We are still looking for Nasdaq leadership off the bottom with the Russell heading up to confirm the move and it is critical that investors find something to invest in besides energy stocks if we are going to build something sustainable. There are still $3Tn trapped in the Energy sector's roach motel and those people need to take their losses and move on. Even housing and banking investors got the message eventually but housing bears and financial bears are allowed on TV – true oil bears are banned from CNBC and much of the MSM, who are so deep in the pockets of the energy interests that they should be ashamed to call what they give you "news."

That being said – I did, however say a couple of weeks ago that I would be a buyer of oil back at $35 as a long-term investment. I'm not down on the energy sector because I think oil is going to zero – I simply don't think it's going back to $60 anytime soon and since oil is what XOM, CVX et al sell for a living, one might conclude that would have a negative impact on their profits, causing XOM to be worth perhaps less than the $400Bn they command now. In fact, if XOM hadn't already bought back close to $100Bn of their own stock in the past 3 years, I dread to think of where they would be right now. It's amazing to me that a company that spent over $50Bn buying their own stock in the $80s isn't seen as reckless and dangerous as the financial institutions who gambled their own capital away betting on their own bubbles. Like I said, we're still waiting for capitulation in that sector but it's going to be a doozy when it comes.

Oh yes, oil! Let's start by solving a problem. Let's say you spend $2,000 a month on fuel for you home and cars. That's $24,000 a year. PGH is an energy trust that pays a monthly dividend that works out to 20% a year and we can buy 6.000 shares of PGH for $8.10 and sell 60 July $7.50 calls for $1.20 and sell 60 July $7.50 puts for $1.25. That would be a return of $14,700 on our $48,600 investment plus another $9,720 if the dividend keeps up and, presto – your annual fuel bill is covered. In theory, as oil goes up your dividends will go up too as will the value of your stock so this is not a bad way to take a portion of your virtual portfolio and put it to work generating income for a specific purpose. The danger is that the stock falls below $7.50 and is put to you in July (of course you can roll the puts) and you end up owning 12,000 shares at an average of $6.18 (assuming you collect $0.80 in dividends along with the options sold) for $74,160 but, if the dividend keeps up, you will still be collecting $20,280 against your $74,160 plus whatever future options you sell. This works out to taking just over 3 years of your current energy expenditures and investing them in a stock to hopefully never have to tap your bank again to pay those bills.

A simpler way to invest in oil long-term is, of course, USO and that ETF can be bought for about $31 this morning and the Feb $30 puts and calls can be sold against it for $7. That gives you a net entry of $24 with a $7 profit if called away on Feb 20th or you will have another round put to you at $30 if USO finishes below and your average entry will be $27, 13% lower than today's price. Since there are options strikes to sell each month at each $1 increment, there will be many opportunities to roll the callers and putters along, making another nice way of collecting a monthly income to offest your fuel bill. We can assume oil stays above zero so this is a very good play to make and with 20% contract sales, you only need to invest 6 months worth of energy spending to hopefully cover your future energy costs. We're going to track this play every month with members as our goal will be to eliminate energy bills at PSW!

Over in Asia, the Nikkei was closed and the Shanghai held fairly flat this morning but the Hang Seng fell 2.8% and the Bombay Sensex fell another 3% but the Baltic Dry Index rose 5.5% so go figure… Commodities of all stripes led China down and we noted that they were the leaders in last week's wrong-way advance so merely a sign of things evening out in addition to the delayed reaction to our 7.2% unemployment announcement that came after their Friday close. Airlines also turned sharply lower as fuel hedging in the $90s cost China Eastern Airlines $900M. "A string of bad data has nipped the New Year optimism in the bud," said Bank of New Zealand strategist Danica Hampton. "If you look at the data last week it's pretty terrible, so people will come back this week and decide the world is a pretty gloomy place again."

Europe is down about a point, also led by Materials, ahead of the US open in "wait and see" trading despite the widely expected ECB rate cut this week. The Euro is trading down against the dollar and they yen but not the Ruble, which is down 3.7% on it's first day of trading in the new year. “There’s colossal demand for foreign currency from the corporates needing to refinance,” said Evgeny Nadorshin, chief economist at Trust Investment Bank in Moscow. “If you have such an option, it is better to buy now before the ruble devalues more.” Investors have withdrawn more than $200 billion since August because of the war in Georgia, a more than 70 percent decline in oil prices since records in July and the worst market rout since the 1998 default, according to BNP Paribas SA estimates.

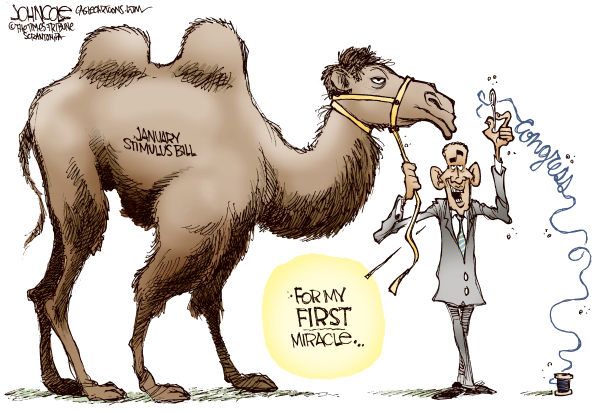

In the US, C is forming a brokerage deal with MS and may book a $10Bn gain on the transaction but ultimately, they may be giving up Smith Barney if MS exercises their option down the road. As I predicted last month, the Obama team has once again upped their job creation goals, now to 4M jobs, as the reality of the situation begins to sink in. It's one thing to say it but you have to make people believe it for it to work…

So we are saying goodbye to President Bush this week, who is giving his last press conference ahead of the market open and he says that reporters sometimes "misunderestimated" him – very fitting final words from Bush! We'll be looking for a Bush bottom this week and hopefully hold our levels but there are some things that are just too attractive to pass up like F at $2.68, where we can sell March $3 puts and calls for $1.10 for a net entry of $1.58 and an average cost of $2.29 if put to us in March. The return is almost 100% if called away and F seems to be the strongest of the Big 3 and it's very doubtful that Obama will let F fail in his first 100 days. Another fun play this week is XLV, the Health Care Spider, which may get a pop from this week's JPM Healthcare Conference. The ETF spreads your bets and 2010 $20s are just $6 while the Feb $26 calls can be sold against them for $1.20.

An exciting week is in store and we're hoping to have good reason to pull the trigger on our January bottom fishing plays. Like I said, there are already bargains out there and earnings will help us shed a little light on some more opportunities ahead.