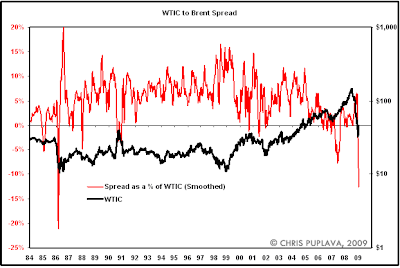

U.S. leading the world again, this time in setting lower oil prices due to "Super Contango" conditions. Contango occurs when a near-term future contract is worth less than oil for delivery further out.  Read on for Mish’s predictions on whether future demand will materialize to make current bets on higher prices profitable. – Ilene

Read on for Mish’s predictions on whether future demand will materialize to make current bets on higher prices profitable. – Ilene

Crude Situation

Courtesy of Mish

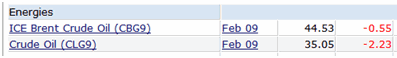

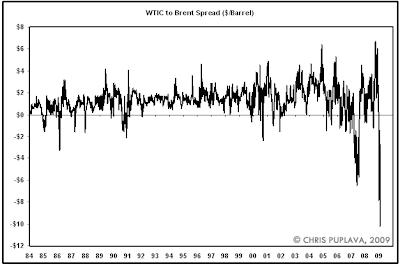

Here are a couple of charts with thanks Chris Puplava at Financial Sense

WTIC to Brent Spread in Dollars

click on chart for sharper image

Spread as % of WTIC

click on chart for sharper image

Chris writes "There is a major discrepancy between the price of WTIC and Brent crude oil. Historically, WTIC has sold at a $1.30 (or 5.4%) premium to Brent. The current discount that WTIC is selling to Brent reached a historical extreme recently on an absolute sense and a relative sense, where the spread relative to WTIC was -12.5% as of today (-$10.18)."

Inquiring minds are no doubt asking "why?"

Dave Meger at Alaron pointed me to WTI’s collapse against Brent doesn’t seem strange.

Traditionally, Brent is valued lower than WTI. That makes sense for many reasons: the US is a large net importer of crude, and prices in the US need to be high enough to attract imports.

Two years ago, a major refinery problem at a Valero plant in Texas created an enormous backlog of crude at the WTI delivery point of Cushing, Oklahoma. WTI crude coming in from Canada and the midcontinent of the US built up as a result, and WTI was pushed well below Brent. The inability to transport WTI out of Cushing to the Gulf Coast helped contribute to this buildup, and it raised — anew — questions about WTI’s role as a benchmark, given the land-locked nature of Cushing.

But this time, an argument can be made that WTI is accurately reflecting what is going on in the world of crude, and Brent is slower to react. In an oversupplied market, a commodity will tend to move toward the market of last resort, where it can always be sold. That’s evident in this week’s US import numbers: US crude imports jumped 1.236 million b/d to 10.485 million b/d — the highest level in six weeks — contributing to the 6.7-million-barrel increase in total US crude inventories.

As long as storage is available at Cushing — and given the steep rise in inventories reported by the Energy Information Administration today, storage clearly has been available — excess oil will go to where it is easiest to take advantage of the contango structure in the market. The eye-popping contango of almost $13/b between February and August WTI is a direct result of the overhang of oil on the market, and the fact that there was available storage at least through last week brought the world’s excess oil overhang.

With 32.182 million barrels now sitting in Cushing, the market appears poised to test the limits of storage capacity there. So it’s WTI that’s reflecting what is going on in the world: the collapse in demand, oversupply and a resulting enormous contango that is encouraging storage. On this one, WTI is ahead of the curve, not behind.

Oil Falls Below $34 After OPEC Reduces 2009 Demand Forecast

Bloomberg is reporting Crude Oil Falls as OPEC Cuts Demand Forecast, Supplies Rise.

Crude oil fell to the lowest price in three weeks after OPEC said demand will drop this year and U.S. supplies rose as the recession cut fuel use.

Crude-oil inventories at Cushing, Oklahoma, where West Texas Intermediate traded on the Nymex is stored, climbed 2.5 percent to 33 million barrels last week, the Energy Department said yesterday. It was the highest since at least April 2004, when the department began keeping records for the location.

“On average, we expect prices to be around $50 for WTI and Brent” this year, Francisco Blanch, head of commodities research at Merrill Lynch & Co. in London, said on Bloomberg television. “We’ve made no distinction even though the WTI market does seem oversupplied due to a number of issues around the Cushing area.”

The price of oil for delivery next December is 65 percent higher than for the front-month contract, allowing traders to profit if they can store crude. February 2009 crude ended the day at a $8.14 discount to March, from $3.88 on Jan. 5. This structure, in which the subsequent month’s price is higher than the one before it, is known as contango.

“The front end of the Nymex is weighed down by all of the oil at Cushing,” said Tom Bentz, senior energy analyst at BNP Paribas in New York. “WTI is the weakest crude grade out there right now.”

“Oil will have to drop into the high $20s before it finds its feet,” said Bill O’Grady, chief markets strategist at Confluence Investment Management in St. Louis. “We are looking at a huge drop in demand.”

U.S. fuel demand fell 6 percent last year, the biggest drop since 1980, as prices touched records and the economy contracted, the industry-funded American Petroleum Institute said today.

U.S. crude stockpiles increased 1.14 million barrels to 326.6 million barrels last week, the highest since Aug. 31, 2007, the Energy Department said yesterday. Gasoline and distillate fuel supplies also rose.

Morgan Stanley is seeking a supertanker to store crude oil, joining Citigroup Inc. and Royal Dutch Shell Plc in trying to profit from higher prices later in the year, four shipbrokers said. Frontline Ltd., the world’s biggest owner of supertankers, yesterday said about 80 million barrels of crude oil is being stored in tankers, the most in 20 years.

Oil May Fall As Inventories Rise

An analysts survey suggests Oil May Fall Because of Rising U.S. Inventories.

Oil may fall next week because inventories at Cushing, Oklahoma, where New York-traded West Texas Intermediate crude is delivered, have gained as traders try to profit from price differentials.

Seventeen of 35 analysts surveyed by Bloomberg News, or 49 percent, said futures will decline through Jan. 23. Twelve respondents, or 34 percent, forecast oil will increase and six said there will be little change. Last week, 41 percent of analysts expected a gain in prices.

Cushing supplies climbed 2.5 percent to 33 million barrels last week, the U.S. Energy Department said on Jan. 14, the highest since April 2004, when the department began keeping records for the location. The price of oil for future months is more expensive than for the front month, allowing traders to profit if they can store crude for later delivery.

“The February contract expires next Tuesday and I am expecting continued downward pressure on that contract as crude oil inventories continue to build at Cushing,” said Andy Lipow, president of Lipow Oil Associates LLC in Houston. He said March oil may also decline after it becomes the contract closest to expiration.

Oil Super Contango

Cushing stockpiles are at their highest as a record contango is pushing up oil inventories.

Oil producers, refiners and investors have put a record amount of crude oil into storage at a key delivery point as they try to profit from an unusual form of "super contango" that indicates the market expects prices to rise sharply by summer.

Such stockpiling reflects the wide gap between the price of oil for delivery in the next month and contracts to deliver oil later this spring and summer. On Monday, oil for February delivery closed at $37.59 a barrel on the Nymex, or nearly $15 lower than July’s contract price.

This situation, where the price of a near-term future contract is worth less than oil for delivery in several months, is called contango. It’s the norm in oil markets, with the price gap representing the cost of storing the oil and locking up investors’ money.

When the price spread is greater than the storage cost, "there is an opportunity to arbitrage at a profit without risk," said James Williams, an economist at energy research firm WTRG Economics.

If the expected demand in future months does not materialize, and I suspect it won’t, those locking in prices now for delivery later this year are making a mistake.