"WOW!!! How will I ever do anything else in my life that will compare to the wild ride you get trading an ultra etf in the most volatile sector in the stock market the day before option expiration?" – Matt1966

"WOW!!! How will I ever do anything else in my life that will compare to the wild ride you get trading an ultra etf in the most volatile sector in the stock market the day before option expiration?" – Matt1966

Oh no, it’s Friday already – this week flew past!

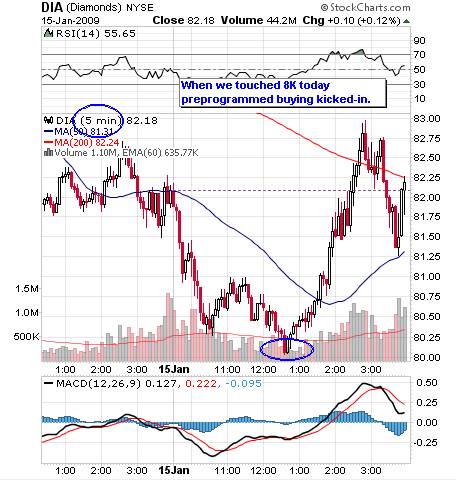

We don’t want this week to end as we are right on plan putting in our Bush bottom (David Fry’s chart left) ahead of the Obama rally we’ve been planning for since Jan 2nd. It was a little scary yesterday as we tested our low (which was lower than we originally planned our buys at) but we kept the faith and kept picking up our bargain stocks while amusing ourselves with some very profitable day trades, especially on SKF, which we played like the proverbial fiddle during the session.

In yesterday’s morning post, we discussed calls we had sold short on SKF Wednesday because we didn’t quite know where it would top out and, when in doubt, we sell premium that can be rolled but, at 10:35 we switched tactics and I said to members: "SKF now starting to get interesting as a put. Yesterday it was too likely to wipe us out so we went with naked calls that could be rolled but now the $155 puts are looking like they can be bought for $7 and they were $30 yesterday so a good gamble here with a stop if they sustain a break over $160." SKF did indeed take a quick dip that returned a quick profit and just 39 minutes later I said: "SKF – From a day trading perspective, that was a very quick $2 and if they break back over $155 (not just a spike), there’s no point in not taking the money and running. I’d buy again at $7 if they head back up but no way do you want to throw away 30% like that."

As I mentoned in the morning post, it’s like fishing – you have to know when to throw a fish back! We cast our line again at 12:46 when I said: "SKF is there again – always a little scarier to buy on the second test but often a better payoff if they fail again." We weren’t greedy of course, we got out at our $140 target with a bit more than a double just after I called it done at 2:34. This is a great way to top off a week where we focused on day trading while we waited for the market to turn. We also had an easy double on GOOG calls, which is always exciting on expiration week.

After having a fairly slow week for posting trade ideas, we’ve had more than 40 in the past two days as we finally hit our buy point and they are all heading for huge gains today. We went bullish a little early on Wednesday as we cashed in our main put plays (rolling down to cheaper covers as we expected a bounce) on the first dip below 8,200 around noon but the logic for the mattress plays remains the same, we now need to roll up our new puts to follow the market – this is no time to throw caution to the wind and, as I said to members yesterday – NOW we have nice profits to protect! Having some downside protection is what allows us to let our profits run and heading into a long weekend we’re certainly going to be shifting closer to neutral into the close.

After having a fairly slow week for posting trade ideas, we’ve had more than 40 in the past two days as we finally hit our buy point and they are all heading for huge gains today. We went bullish a little early on Wednesday as we cashed in our main put plays (rolling down to cheaper covers as we expected a bounce) on the first dip below 8,200 around noon but the logic for the mattress plays remains the same, we now need to roll up our new puts to follow the market – this is no time to throw caution to the wind and, as I said to members yesterday – NOW we have nice profits to protect! Having some downside protection is what allows us to let our profits run and heading into a long weekend we’re certainly going to be shifting closer to neutral into the close.

Yesterday’s close would have been much stronger but an airplane crashed into the Hudson River, right next to New York City around 3:30 and as soon as traders hears plane crash and NYC in the same sentence, the selling started. Broneck pointed out at the time that 8,320 would make a nice, bullish reversal pattern on the Dow and that’s going to be our target for today – I expect that is what "THEY" were shooting for yesterday before being so rudely interrupted by a catastrophe. It is very telling that poor earnings reports from both BAC and C are doing nothing to derail that move in pre-markets and we will be VERY disappointed if we can’t hit that target today.

Make no mistake about it – this is yet another stimulus rally, pushing our market roller coaster up the hill. The Senate voted to release more TARP money and Obama released the details of his additional $825Bn stimulus and this morning, the Fed allocated over $130Bn in guarantees and bailout cash to BAC so we are well over the $1Tn mark today and that usually buys the markets about 500 points before fizzing out. Hopefully this time we can get a little extra boost from the inauguration week but, like I said, hope is not a strategy so we will cover into today’s rally – just in case…

Make no mistake about it – this is yet another stimulus rally, pushing our market roller coaster up the hill. The Senate voted to release more TARP money and Obama released the details of his additional $825Bn stimulus and this morning, the Fed allocated over $130Bn in guarantees and bailout cash to BAC so we are well over the $1Tn mark today and that usually buys the markets about 500 points before fizzing out. Hopefully this time we can get a little extra boost from the inauguration week but, like I said, hope is not a strategy so we will cover into today’s rally – just in case…

Asia followed the US lead and turned up a bit this morning. The Hang Seng was flat but the Shanghai picked up 1.6% and the Nikkei finished the day up 2.5% but doing very little to reverse a 10% down week. Japan was led higher by exporters as the Yen weakened against the dollar and semiconductors did well after hearing the Obama stimulus package. Just a little bit of confidence is sneaking back into the Asian markets but games are still being played, as they are in the US: "It seems people aren’t as worried about selling from strategic holders, as most of them have already offloaded their shares…but some large investors are trying to keep the heavyweight stocks pinned down to depress the market," said Andrew To, head of sales at Taifook Securities.

Europe is off to a fine start this morning with 2.5% gains across the board as of 8:30. Banks and energy stocks are leading the party despite oil hanging around $35 this morning and despite Ireland’s takeover of Anglo Irish Bank Corp. Dublin noted recapitalization was "not appropriate" to secure the bank’s continued viability, after its reputation was damaged amid the overall drop in the financial sector and an accounting scandal involving its former chairman. Today is also the day that the short-selling ban is removed at the FTSE, perhaps giving investors a little more confidence to step into the sector now that they can once again hedge their bets.

The CPI dove 0.7% in December while wages held steady and that drove "real wage" earnings up 0.6%, which is nice. Falling energy prices (down 8.3% with gasoline down 17%) drove the savings and the "core" CPI remains unchanged. Once again, the news is not great but this is not the end of the world – which is what is pretty much priced into the markets. Like any good roller coaster ride, there is a thrilling run down to the floor but THERE IS A FLOOR and we can ride these waves up until we get to the top of the next hill.

Gold (have I mentioned I like that lately) is skyrocketing this morning as another Trillion is thrown onto the global bonfire. We grabbed gold during member chat over the past two days as it got cheap again and tested the 50 dma almost on the nose. Now we look up to a possible retest of $840 where we are likely to get rejected again but we are squeezing into a breakout on gold perhaps by the end of February and we want to be ready for that so this may be the last period we sell covers into. With today’s CPI, however, gold should not break too high as the 2008 US inflation is coming in at the lowest level since 1954.

Gold (have I mentioned I like that lately) is skyrocketing this morning as another Trillion is thrown onto the global bonfire. We grabbed gold during member chat over the past two days as it got cheap again and tested the 50 dma almost on the nose. Now we look up to a possible retest of $840 where we are likely to get rejected again but we are squeezing into a breakout on gold perhaps by the end of February and we want to be ready for that so this may be the last period we sell covers into. With today’s CPI, however, gold should not break too high as the 2008 US inflation is coming in at the lowest level since 1954.

There are 3 reasons to buy gold: As a hedge against currency devaluation, as a "safe" commodity against global unrest (we discussed the folly of using oil for this purpose last month) and as a hedge against inflation. Obviously the inflation hedge aspect seems to be thrown out the window so there will be a percentage of gold bugs giving up their positions on this news but the real story is the picture we posted yesterday – the massive flood of money being tossed at BAC, other banks and the whole economy can do nothing but devalue our currency over the long haul. Those dollars are out there, sitting dormant for now but once they get moving and start multiplying, they are simply not going to fit neatly back in the Fed’s little box.

Have a great weekend!