I'll be out tomorrow and the US markets will be closed.

I'll be out tomorrow and the US markets will be closed.

Tuesday will be a very telling day as will all of next week with earnings season kicking off in earnest and a new President being sworn in. I hate to put pressure on it but Obama's speech is make or break and he better do better than the last couple of bland statements as we are seeing some scary poll numbers out there with 62% of the people polled saying the National Economy is "very bad" and 30% saying it's "fairly bad" leaving Larry Kudlow and Company to account for the other 8%.

54% of the people thought the economy was getting worse but 75% of the people thought Obama will make the economy better and 75% think Obama will create a "significant" amount of jobs in the next 4 years. This is interesting as 93% of the same people thought that the current recession will last a year or more… Expectations are not too high as only 9% of the people think that real progress will be made in year one but 72% approve of the cabinet selections to date. What do all these numbers mean? They mean America is willing to, is longing to, give Obama a chance – that the divided electorate is getting united behind the concept of change. This will be the time to take bold initiatives and I sincerely hope Obama does not squander this unique opportunity to take this country in a bold, new direction.

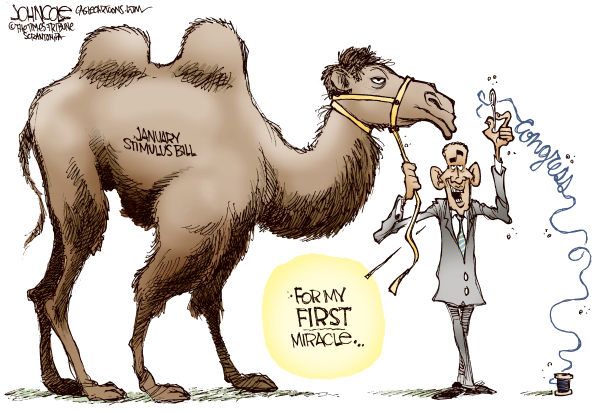

I used the above cartoon on Monday morning, when we discussed how difficult it will be to convince people a Budget with a $2Tn deficit was just what this country needs but Wall Street took care of that for us by scaring Congress into releasing the remainder of the TARP money as our Financial sector went plunging back to the Thanksgiving lows, led down by the same people that we bailed out last time (well, the ones that are left anyway). Notice GS is a little better than last time but BAC is much worse and it really can't get much worse for C but they sure are trying to disprove that theory!

Also on Monday I reminded members that our buy target on oil was $35 and we hit it again this week and got a couple of very nice entries on USO and PGH, both of whom had wild rides. I also liked and still like F and XLV on Monday but, of those 4 trades, only F got cheaper, now $2.19 and better as a naked buy at the monent but it's a very speculative play… Tuesday morning Bernanke got us off to a good start (relatively as we were way down Monday) with his speech but that sure didn't last and, as we expected, the dollar rally ground to a halt as Big Ben extolled the virtues of "Bailout Nation."

Also on Monday I reminded members that our buy target on oil was $35 and we hit it again this week and got a couple of very nice entries on USO and PGH, both of whom had wild rides. I also liked and still like F and XLV on Monday but, of those 4 trades, only F got cheaper, now $2.19 and better as a naked buy at the monent but it's a very speculative play… Tuesday morning Bernanke got us off to a good start (relatively as we were way down Monday) with his speech but that sure didn't last and, as we expected, the dollar rally ground to a halt as Big Ben extolled the virtues of "Bailout Nation."

In the morning post we looked at picking up XLF for $10.80 (now $9.68) and selling the March $10 puts and calls for $2.90 (now 2.79) for a net entry of $7.90/8.95 and my call was way early, as we're halfway there already but note you can roll the puts and calls down to the $8s, which are $3.08 to knock the net basis down to $7.72/7.86. I'm not saying to rush out and do this but I do want to point out how powerfully flexible the buy/write entries are as we're talking about adjusting your worst-case position at 27% below the entry point – and that's without accounting for any additional hedging or rolling out to longer, lower strikes like the 2010 $6s, which can be sold for $5.43 for a net $5.37/5.69. So it's cetainly not time to panic out of the financials and, in fact, we made a lot more plays as things got cheaper the next coulple of days in chat.

Wednesday morning we went from Ben to Bin Laden as Osama resurfaced to call for a Jihad and THAT is what started the market slide for the week with a 150-point gap down in the morning that took us close to 300 points lower on Wednesday. As we expected, Jihad was no help for the energy sector and that disappointment sent XLE back to the $44 mark, which has generally held up since the big drop in October. Overall, we were expecting to hold 8,200 in the morning post but by 9:31 I ammended our downside target to 8,080 with this logic:

"Open looks like it’s going to suck, we got a little complacent about terrorism and that’s dangerous. No matter how low you are, things can get lower if something blows up. Also, the Ruble is at a 6-year low and a country like Russia failing or a major bank failing are two of the ways we can still fall 20% in the markets. Right now, we are pricing back in the fear of that happening and somewhere between 8,650 and 6,920 (20% off) is the fear factor but, realistically, Bernanke just said there is NO way he is letting a bank fail and GM (the 3rd possibility) is good through March so let’s assume we stay in the top 1/3 of that range, which would be 6.6% off or 8,080 and the 50% line there is 8,365 so that would be about the range of natural fear we can expect to test." We actaully did touch 7,996 on Thursday but not a bad call for a pre-market that was showing us 8,300 and we did pop right back into that range with a finish just below 8,365 on Friday afternoon's rally…

"Open looks like it’s going to suck, we got a little complacent about terrorism and that’s dangerous. No matter how low you are, things can get lower if something blows up. Also, the Ruble is at a 6-year low and a country like Russia failing or a major bank failing are two of the ways we can still fall 20% in the markets. Right now, we are pricing back in the fear of that happening and somewhere between 8,650 and 6,920 (20% off) is the fear factor but, realistically, Bernanke just said there is NO way he is letting a bank fail and GM (the 3rd possibility) is good through March so let’s assume we stay in the top 1/3 of that range, which would be 6.6% off or 8,080 and the 50% line there is 8,365 so that would be about the range of natural fear we can expect to test." We actaully did touch 7,996 on Thursday but not a bad call for a pre-market that was showing us 8,300 and we did pop right back into that range with a finish just below 8,365 on Friday afternoon's rally…

Should we be upset if the market tests our levels and holds them or should we be excited that it does look like a real floor is being put in? There was a lot of bad news last week and we didn't fail – certainly not an A or even a B performace but at least not failing so think of our markets as a really dumb kid in need of A LOT of extra help! I mentioned Wednesday that Retail sales, without gasoline, were actually not all that bad. The poll shows how awful people think the economy is so this is one of those instances where all of the people agree "some of the time" but you won't get all the people to be bearish all of the time – PT Barnum taugt us that and Obama is as good a reason as any to shift from 92% bearish to something just a little less so.

I put up a buy list on Wednesday, mainly selling naked puts as entries off our Buy List, but by Thursday we were in serious bottom fishing mode and I talked about the idea of bull AND bear traps in the morning post. Sure enough, the bear trap sprung on Thursday afternoon – right on schedule from our perspective as we decided to short the SKF as a day trade and at 1:06 (with the Dow at 8,039) I reiterated that I still liked our buy list from the previous day and at 1:16 I picked 6 more bullish positions on V, DIS, GS, HOV, USO and IYT but still all conservative plays, selling puts for low entries or covering. As we rallied, I looked at more aggressive ideas like the Qs, YRCW, IBM and CSCO but, as I said at 2:30: "See, this is why we have to buy at the bottom, we had 2 days to pick up bargains but the whole thing goes away in less than an hour of trading. We may not hold this, but at least now we have something worth protecting if we want to sell covers!"

And, of course, there was gold. Gold's dip below $800 again this week was a gift horse we did not look in the mouth and this week's introduction of Zimbabwe's $100,000,000,000,000 Bill (eqals about $80 US) says it all! It was just a couple of months ago that I warned members we would have to practice saying the word "Quadrillion" smoothly and I've got $800 burning a hole in my pocket that's going to make me a Zimbabwe Quadrillionaire as soon as I can find a case big enough to hold the "small" bills (you can't just walk around with Trillions – some place don't give change of more than $500Bn…).

And, of course, there was gold. Gold's dip below $800 again this week was a gift horse we did not look in the mouth and this week's introduction of Zimbabwe's $100,000,000,000,000 Bill (eqals about $80 US) says it all! It was just a couple of months ago that I warned members we would have to practice saying the word "Quadrillion" smoothly and I've got $800 burning a hole in my pocket that's going to make me a Zimbabwe Quadrillionaire as soon as I can find a case big enough to hold the "small" bills (you can't just walk around with Trillions – some place don't give change of more than $500Bn…).

That was my Chart of the Day on Thursday, the S&P priced in barrels of oil, because it's all relative and it doesn't matter if you believe in the markets or not: The question is where are you going to get better realtive performance? Stocks are, themselves, a type of commodity – a limited share of ownership in a company and, this weekend, John Mihaljevic contributed an excellent article to PSW that follows up on that idea. I strongly advise that everyone reads it and thinks about the "value" of their investments, including the cash you have left in the bank.

Our Thursday afternoon rally to our then 8,320 target was rudely interrupted by a plane crash in NYC but we did get right back on that market horse on Friday morning, hitting the lower end of our trading range on the nose! As I said on Friday and I will continue to say all the way to a test of 9,100 next week (if we should be so lucky): "Make no mistake about it – this is yet another stimulus rally, pushing our market roller coaster up the hill."

Our Thursday afternoon rally to our then 8,320 target was rudely interrupted by a plane crash in NYC but we did get right back on that market horse on Friday morning, hitting the lower end of our trading range on the nose! As I said on Friday and I will continue to say all the way to a test of 9,100 next week (if we should be so lucky): "Make no mistake about it – this is yet another stimulus rally, pushing our market roller coaster up the hill."

What is it I'd like Obama to say on Tuesday? Well pretty much something like this:

I am certain that my fellow Americans expect that on my induction into the Presidency I will address them with a candor and a decision which the present situation of our people impel. This is preeminently the time to speak the truth, the whole truth, frankly and boldly. Nor need we shrink from honestly facing conditions in our country today. This great Nation will endure as it has endured, will revive and will prosper. So, first of all, let me assert my firm belief that the only thing we have to fear is fear itself—nameless, unreasoning, unjustified terror which paralyzes needed efforts to convert retreat into advance. In every dark hour of our national life a leadership of frankness and vigor has met with that understanding and support of the people themselves which is essential to victory. I am convinced that you will again give that support to leadership in these critical days.

In such a spirit on my part and on yours we face our common difficulties. They concern, thank God, only material things. Values have shrunken to fantastic levels; taxes have risen; our ability to pay has fallen; government of all kinds is faced by serious curtailment of income; the means of exchange are frozen in the currents of trade; the withered leaves of industrial enterprise lie on every side; farmers find no markets for their produce; the savings of many years in thousands of families are gone.

In such a spirit on my part and on yours we face our common difficulties. They concern, thank God, only material things. Values have shrunken to fantastic levels; taxes have risen; our ability to pay has fallen; government of all kinds is faced by serious curtailment of income; the means of exchange are frozen in the currents of trade; the withered leaves of industrial enterprise lie on every side; farmers find no markets for their produce; the savings of many years in thousands of families are gone.

More important, a host of unemployed citizens face the grim problem of existence, and an equally great number toil with little return. Only a foolish optimist can deny the dark realities of the moment.

Yet our distress comes from no failure of substance. We are stricken by no plague of locusts. Compared with the perils which our forefathers conquered because they believed and were not afraid, we have still much to be thankful for. Nature still offers her bounty and human efforts have multiplied it. Plenty is at our doorstep, but a generous use of it languishes in the very sight of the supply. Primarily this is because the rulers of the exchange of mankind’s goods have failed, through their own stubbornness and their own incompetence, have admitted their failure, and abdicated. Practices of the unscrupulous money changers stand indicted in the court of public opinion, rejected by the hearts and minds of men.

True they have tried, but their efforts have been cast in the pattern of an outworn tradition. Faced by failure of credit they have proposed only the lending of more money. Stripped of the lure of profit by which to induce our people to follow their false leadership, they have resorted to exhortations, pleading tearfully for restored confidence. They know only the rules of a generation of self-seekers. They have no vision, and when there is no vision the people perish.

True they have tried, but their efforts have been cast in the pattern of an outworn tradition. Faced by failure of credit they have proposed only the lending of more money. Stripped of the lure of profit by which to induce our people to follow their false leadership, they have resorted to exhortations, pleading tearfully for restored confidence. They know only the rules of a generation of self-seekers. They have no vision, and when there is no vision the people perish.

The money changers have fled from their high seats in the temple of our civilization. We may now restore that temple to the ancient truths. The measure of the restoration lies in the extent to which we apply social values more noble than mere monetary profit.

Happiness lies not in the mere possession of money; it lies in the joy of achievement, in the thrill of creative effort. The joy and moral stimulation of work no longer must be forgotten in the mad chase of evanescent profits. These dark days will be worth all they cost us if they teach us that our true destiny is not to be ministered unto but to minister to ourselves and to our fellow men.

Recognition of the falsity of material wealth as the standard of success goes hand in hand with the abandonment of the false belief that public office and high political position are to be valued only by the standards of pride of place and personal profit; and there must be an end to a conduct in banking and in business which too often has given to a sacred trust the likeness of callous and selfish wrongdoing. Small wonder that confidence languishes, for it thrives only on honesty, on honor, on the sacredness of obligations, on faithful protection, on unselfish performance; without them it cannot live.

Restoration calls, however, not for changes in ethics alone. This Nation asks for action, and action now.

Our greatest primary task is to put people to work. This is no unsolvable problem if we face it wisely and courageously. It can be accomplished in part by direct recruiting by the Government itself, treating the task as we would treat the emergency of a war, but at the same time, through this employment, accomplishing greatly needed projects to stimulate and reorganize the use of our natural resources.

Hand in hand with this we must frankly recognize the overbalance of population in our industrial centers and, by engaging on a national scale in a redistribution, endeavor to provide a better use of the land for those best fitted for the land. The task can be helped by definite efforts to raise the values of agricultural products and with this the power to purchase the output of our cities. It can be helped by preventing realistically the tragedy of the growing loss through foreclosure of our small homes and our farms. It can be helped by insistence that the Federal, State, and local governments act forthwith on the demand that their cost be drastically reduced. It can be helped by the unifying of relief activities which today are often scattered, uneconomical, and unequal. It can be helped by national planning for and supervision of all forms of transportation and of communications and other utilities which have a definitely public character. There are many ways in which it can be helped, but it can never be helped merely by talking about it. We must act and act quickly.

Hand in hand with this we must frankly recognize the overbalance of population in our industrial centers and, by engaging on a national scale in a redistribution, endeavor to provide a better use of the land for those best fitted for the land. The task can be helped by definite efforts to raise the values of agricultural products and with this the power to purchase the output of our cities. It can be helped by preventing realistically the tragedy of the growing loss through foreclosure of our small homes and our farms. It can be helped by insistence that the Federal, State, and local governments act forthwith on the demand that their cost be drastically reduced. It can be helped by the unifying of relief activities which today are often scattered, uneconomical, and unequal. It can be helped by national planning for and supervision of all forms of transportation and of communications and other utilities which have a definitely public character. There are many ways in which it can be helped, but it can never be helped merely by talking about it. We must act and act quickly.

Finally, in our progress toward a resumption of work we require two safeguards against a return of the evils of the old order; there must be a strict supervision of all banking and credits and investments; there must be an end to speculation with other people’s money, and there must be provision for an adequate but sound currency.

There are the lines of attack. I shall presently urge upon a new Congress in special session detailed measures for their fulfillment, and I shall seek the immediate assistance of the several States.

Through this program of action we address ourselves to putting our own national house in order and making income balance outgo. Our international trade relations, though vastly important, are in point of time and necessity secondary to the establishment of a sound national economy. I favor as a practical policy the putting of first things first. I shall spare no effort to restore world trade by international economic readjustment, but the emergency at home cannot wait on that accomplishment.

The basic thought that guides these specific means of national recovery is not narrowly nationalistic. It is the insistence, as a first consideration, upon the interdependence of the various elements in all parts of the United States—a recognition of the old and permanently important manifestation of the American spirit of the pioneer. It is the way to recovery. It is the immediate way. It is the strongest assurance that the recovery will endure.

In the field of world policy I would dedicate this Nation to the policy of the good neighbor—the neighbor who resolutely respects himself and, because he does so, respects the rights of others—the neighbor who respects his obligations and respects the sanctity of his agreements in and with a world of neighbors.

If I read the temper of our people correctly, we now realize as we have never realized before our interdependence on each other; that we can not merely take but we must give as well; that if we are to go forward, we must move as a trained and loyal army willing to sacrifice for the good of a common discipline, because without such discipline no progress is made, no leadership becomes effective. We are, I know, ready and willing to submit our lives and property to such discipline, because it makes possible a leadership which aims at a larger good. This I propose to offer, pledging that the larger purposes will bind upon us all as a sacred obligation with a unity of duty hitherto evoked only in time of armed strife.

If I read the temper of our people correctly, we now realize as we have never realized before our interdependence on each other; that we can not merely take but we must give as well; that if we are to go forward, we must move as a trained and loyal army willing to sacrifice for the good of a common discipline, because without such discipline no progress is made, no leadership becomes effective. We are, I know, ready and willing to submit our lives and property to such discipline, because it makes possible a leadership which aims at a larger good. This I propose to offer, pledging that the larger purposes will bind upon us all as a sacred obligation with a unity of duty hitherto evoked only in time of armed strife.

With this pledge taken, I assume unhesitatingly the leadership of this great army of our people dedicated to a disciplined attack upon our common problems.

Action in this image and to this end is feasible under the form of government which we have inherited from our ancestors. Our Constitution is so simple and practical that it is possible always to meet extraordinary needs by changes in emphasis and arrangement without loss of essential form. That is why our constitutional system has proved itself the most superbly enduring political mechanism the modern world has produced. It has met every stress of vast expansion of territory, of foreign wars, of bitter internal strife, of world relations.

It is to be hoped that the normal balance of executive and legislative authority may be wholly adequate to meet the unprecedented task before us. But it may be that an unprecedented demand and need for undelayed action may call for temporary departure from that normal balance of public procedure.

I am prepared under my constitutional duty to recommend the measures that a stricken nation in the midst of a stricken world may require. These measures, or such other measures as the Congress may build out of its experience and wisdom, I shall seek, within my constitutional authority, to bring to speedy adoption.

I am prepared under my constitutional duty to recommend the measures that a stricken nation in the midst of a stricken world may require. These measures, or such other measures as the Congress may build out of its experience and wisdom, I shall seek, within my constitutional authority, to bring to speedy adoption.

But in the event that the Congress shall fail to take one of these two courses, and in the event that the national emergency is still critical, I shall not evade the clear course of duty that will then confront me. I shall ask the Congress for the one remaining instrument to meet the crisis—broad Executive power to wage a war against the emergency, as great as the power that would be given to me if we were in fact invaded by a foreign foe.

For the trust reposed in me I will return the courage and the devotion that befit the time. I can do no less.

We face the arduous days that lie before us in the warm courage of the national unity; with the clear consciousness of seeking old and precious moral values; with the clean satisfaction that comes from the stern performance of duty by old and young alike. We aim at the assurance of a rounded and permanent national life.

We do not distrust the future of essential democracy. The people of the United States have not failed. In their need they have registered a mandate that they want direct, vigorous action. They have asked for discipline and direction under leadership. They have made me the present instrument of their wishes. In the spirit of the gift I take it.

We do not distrust the future of essential democracy. The people of the United States have not failed. In their need they have registered a mandate that they want direct, vigorous action. They have asked for discipline and direction under leadership. They have made me the present instrument of their wishes. In the spirit of the gift I take it.

In this dedication of a Nation we humbly ask the blessing of God. May He protect each and every one of us. May He guide me in the days to come.

Something along those lines would be nice!