Here’s a collection of news articles on the events of the day.

Cardholders Bill Of Rights And Other Potpourri

Lost in Obama’s inaugural celebration there was plenty of news worth discussing. Here are a few headline items from the past few days, but mostly today.

Obama to Sign Cardholders’ Bill of Rights

Higher interest rates on a current balance will be permitted only under specific conditions such as the expiration of a promotional rate, late payment or a variable rate. Interest rates on new transactions can be increased only after 45 days’ advance notice.

There will be no more universal default, nor raising interest rates based on a customer’s payment history with utility companies or other credit issuers not affiliated with the bank issuing the credit card.

Payments will be due at least 21 days after the bill is mailed or delivered. Credit card issuers will no longer be able to set early morning deadlines for payments.

When a different interest rate is applied to various balances, payments will be applied first to the balance with the higher rate or divided proportionally.

Customers exceeding their credit limit will no longer be hit with a fee if a hold has been placed on their account. This routinely happens to customers who reserve a hotel or rental car when merchants place a hold on the account for the entire amount to be billed several weeks or months in the future.

Finance charges on a balance due will be computed on charges in the current cycle rather than going back to the previous billing cycle. Double-cycle billing hits customers who pay their balance in full one month, but not the next.

Terms will be disclosed in plain English.

Those are very significant changes. Banks got everything they wanted under Bush, but are now about to see it all reversed. I never understood the legality of a self modifying contract (one that allows one party to change the terms at will on a notice in fine print that the other party would likely never read). Thus I consider this a good change.

Discover Card, being one of the biggest offenders of the 2-cycle billing ripoff will have that activity curtailed. See Read the Fine Print On Credit Cards for details. It will be interesting to see what that fine print looks like once this bill passes.

Banks may raise card annual fees hoping to make up for smaller growth in loans. If so, we will see if it sticks. Short term, expect to see fewer credit cards issued because banks will not be able to raise rates willy nilly.

French Banks to Get EU10.5 Billion Aid, Scrap Executive Bonuses

French President Nicolas Sarkozy agreed to provide a further 10.5 billion euros ($13.6 billion) in aid to the country’s biggest lenders in exchange for their top executives giving up their bonuses.

Sarkozy has been pressuring banks in recent days, saying repeatedly that they shouldn’t pay bonuses to management or dividends to shareholders. Credit Agricole SA and smaller rival Societe Generale SA said yesterday they wouldn’t pay bonuses to their chairmen and chief executives. BNP Paribas SA, France’s biggest bank, made a similar announcement last week.

“We ask banks that make a profit to finance the economy” and not reward shareholders, Finance Minister Christine Lagarde told reporters after the bankers met Sarkozy and top officials in Paris. The state wants banks to use the extra funds to boost shareholder equity, she said. The more profitable banks may still pay a dividend, she said.

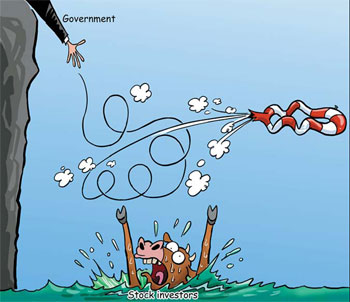

![[celtic-tiger-copy-1.jpg]](http://4.bp.blogspot.com/_ssT_7KGjZkg/SGjGWUjwgxI/AAAAAAAAAEo/QdVyAkuCmh0/s1600/celtic-tiger-copy-1.jpg)

Ireland’s Beleaguered Banks Sink With Decline of ‘Celtic Tiger’

The bloodletting may be far from over for Ireland’s battered banks as the wheels come off what was once Europe’s fastest-moving economy.The government in Dublin said Jan. 16 it would seize control of Anglo Irish Bank Corp. following a scandal that forced the resignations of its chief executive officer and chairman.

“Nobody can stop what’s happening,” said Ken Murray, CEO of Blue Planet Investment Management in Edinburgh. “It’s going to carry on, and governments are going to have to come up with the capital because the market doesn’t have it.”

Ireland’s financial industry fed the so-called “Celtic Tiger” as the economy more than doubled and banking shares increased at least fivefold in the decade ending in 2006. Now the property market is collapsing, Irish financial shares are down more than 90 percent from a year ago, and some analysts say it’s just a matter of time before Bank of Ireland and Allied Irish, the two biggest lenders, combine or end up in state control.

BHP May Take $1.6 Billion Charge After Suspending Nickel Mine

BHP Billiton Ltd., the world’s largest mining company, may take a $1.6 billion one-time charge on the value of its Australian nickel business after shuttering the Ravensthorpe mine because of declining profits and prices.

The company will book a pre-tax charge of $1.2 billion for the six months ended Dec. 31, Melbourne-based BHP said today in a statement to the Australian stock exchange. A $400 million charge will likely be recorded this half, it said.

BHP joins Rio Tinto Group and Anglo American Plc in reducing production and cutting workers as prices of metals, demand from factories and funding for projects collapse.

Tribune’s Los Angeles Times to Cut More Jobs by March

Bankrupt Tribune Co.’s Los Angeles Times, the fourth-largest U.S. newspaper by circulation, plans to cut more jobs by March to help reduce costs, according to a letter sent to the press operators’ union.

“Time is of the essence and the company intends to implement the cutbacks no later than March 15,” Russ Newton, senior vice president of operations, said in the letter. “The pressroom will be impacted by this decision.”

In the letter, dated Jan. 19, the newspaper said it wants to meet with union representatives as soon as Jan. 26 to discuss the job cuts. Sullivan said she didn’t know how many employees were represented by the union.

IBM shares rise after earnings beat expectations

International Business Machines shares climbed more than 4% Tuesday evening after the technology heavyweight’s quarterly profit and yearly forecast came in above Wall Street’s outlook.

State Street shares lose more than half their value

State Street (STT) shares were under pressure Tuesday after the Boston-based company said its quarterly net income fell 71% from the year-ago period to $65 million, or 15 cents a share. Analysts surveyed by Thomson Reuters had forecast profit of $1.14 a share, on average.

Reflecting "ongoing illiquidity in the markets," the company said after-tax, unrealized mark-to-market losses in the investment portfolio rose to $6.3 billion at the end of the fourth quarter, up $3 billion from the end of the third quarter. Losses in State Street-administered asset-backed commercial paper conduits rose $1.4 billion to $3.6 billion.

The conduits, which issue short-term debt, have been hit by the credit turmoil and there are fears State Street will have to consolidate the vehicles on its balance sheet. "We continue to believe that the asset quality of both our investment portfolio and the conduit program remains strong," said State Street Chief Executive Ronald Logue in the earnings release.

I am waving a red flag on that statement. It simply is not credible and is setting State Street up for yet another surprise.

State Street’s results surprise the market, but not everyone

State Street (STT) on Tuesday reported a 71% drop in net income to $65 million. The results were wildly below analyst estimates, but what really hurt was the bank’s outlook: a gloomy forecast of flat earnings and possible losses.

The negative view sent shares into a tailspin and cut the bank’s market value by $8 billion. Here’s why: State Street and its chief executive, Ronald Logue, have stubbornly stuck by the bank and asset manager’s portfolio and growth forecasts. Up until Tuesday’s dismal earnings most investors thought 2009 was going to be another year of 10% to 15% growth.

But a minority of skeptics have argued that State Street’s balance sheet was not as healthy as stated. They said the bank was holding back — both on its current condition and the risks it faced down the road.

Google to halt Print Ads program for newspapers

Google Inc will kill a program to sell newspaper advertising because it is not making enough money, a blow to its efforts to expand its ad expertise beyond the Internet.

Google will shut the Print Ads program on February 28, the company said on its blog on Tuesday afternoon. The two-year-old service was designed to help newspapers make money by enticing Google advertisers to expand into print newspaper sales.

"We weren’t providing a meaningful revenue impact to our newspaper partners so we are focusing our efforts on how we can do that quickly and effectively using online tools," Google spokesman Brandon McCormick said.

Google and newspapers struggle with a poor advertising market exacerbated by the world financial crisis. Google, an ad powerhouse that has expanded its empire as U.S. publishers are losing theirs, said last week it would lay off 100 full-time recruiters and close three engineering offices.

Gulf states agree on monetary union

Gulf Arab states will maintain their 2010 deadline for a single currency, the secretary-general of the Gulf Cooperation Council (GCC) has said.

Leaders of GCC countries (Saudi Arabia, the United Arab Emirates, Kuwait, Qatar, Oman and Bahrain) approved a final draft of an accord on a monetary union agreement in their annual summit in Muscat, the capital of Oman, on Tuesday.

The agreement would pave the way for a single currency, which all GCC states but Oman are working towards launching.

Inability to decide on the location of the regional central bank, which will be independent from the governments of member countries, has been an obstacle to the plan for years. The United Arab Emirates, Qatar, Bahrain and Saudi Arabia have all expressed interest to host the bank.

Remember when this was supposed to be the death of the US dollar? News was greeted by a big yawn which is what I said all along. Of course infighting still might kill the deal. They all want to host the bank. Lack of trust? You bet.

Australian Consumer Sentiment Falls on Recession Fear

Australian consumer confidence fell in January for the first time in three months, increasing pressure on the central bank to extend the biggest round of interest-rate cuts since a recession in 1991.

The sentiment index declined 2.2 percent to 89.9 points, according to a Westpac Banking Corp. and Melbourne Institute survey of 1,200 consumers conducted between Jan. 12 and Jan. 18 and released today in Sydney. Since February 2008, the index has held below 100, indicating pessimists outnumber optimists.

“Consumers are entering 2009 with great trepidation,” said Matthew Hassan, a senior economist at Westpac in Sydney. Today’s survey also suggests “the initial boost from aggressive rate cuts and fiscal bonus payments may be starting to wane.”

Australia’s PM warns 2009 ‘toughest in decades’

Australian Prime Minister Kevin Rudd said Wednesday that 2009 will be one of the toughest years for the economy in decades. "The truth is, 2009 will be one of the toughest years Australia has faced in decades as the global financial crisis wreaks havoc on Australian jobs," wire reports cited Rudd as saying in Sydney Wednesday.

Rudd indicated in a speech late Tuesday the government may roll out additional measures to bolster the country’s banking sector, which could face a funding crisis if offshore banks choose not to roll over existing credit.

A report by Merrill Lynch estimated $49 billion in lending by overseas banks to Australian business is to fall due over the next two years.

Rudd added the withdrawal of foreign credit and the tightening of domestic credit conditions is beginning to be felt in real economy.

Deutsche Bank analysts were cited in reports as saying Australia was likely to unveil an insurance scheme along the lines of that unveiled in the U.K. earlier in the week that would provide government-backing to guarantee loans.

Australia to Take ‘Whatever Action Necessary’ to Stabilize Markets

Australian Prime Minister Kevin Rudd will take “whatever action is necessary” to stabilize financial markets as a A$75 billion ($49 billion) gap looms in money available to businesses.

Rudd said foreign banks were scaling back lending to Australia and that A$75 billion of existing loans will be due in the next two years.

“If foreign banks do not roll over their share of these loans, it will be difficult for Australia’s four major banks to fill the gap on their own,” Rudd said in a speech in the South Australian capital of Adelaide last night, according to notes. “The government stands ready to take whatever further action is necessary to stabilize financial markets and help reopen the private lines of government to business to get blood flowing through the arteries of the economy.”

Japan’s ‘Severe’ Recession May Last Three Years, Yoshikawa Says

Japan’s recession may become the longest in the postwar era, according to Hiroshi Yoshikawa, head of the government committee that charts the economic cycle.

“We’d better get ready for a three-year recession,” the Tokyo University professor said in an interview in Tokyo this week. The decline “will be very severe, not only in terms of duration but also depth,” he said.

The downturn probably began in the fourth quarter of 2007 and may exceed the 36-month slump that ended in 1983 because demand from abroad will remain weak, Yoshikawa said. Japan has yet to shake off its dependence on exports, which collapsed last quarter as the global financial crisis intensified.

The economy is “worsening rapidly,” the government said yesterday after exports and factory output dropped the most on record in November. Overseas shipments accounted for 61 percent of growth in the most recent expansion, the longest in more than 60 years, according to Dai-Ichi Life Research Institute in Tokyo.

Angang Steel Shares Decline After Reporting 55% Profit Drop

Angang Steel Co., China’s second- largest steelmaker, dropped to the lowest in more than a month in Hong Kong trading after saying 2008 profit plunged 55 percent as demand and prices slumped in the global recession.

The global recession has curbed demand by builders and carmakers, damped prices and turned mills unprofitable in October, the China Iron & Steel Association has said. Baosteel Group Corp., China’s biggest mill, has said it is facing its “most difficult” period since its founding 30 years ago.

Eaton to Cut 5,200 Jobs Worldwide to Reduce Costs

Eaton Corp., the Cleveland-based maker of car engine valves and aircraft fuel pumps, plans to slash 5,200 jobs worldwide amid weak demand, reductions that follow 3,400 cuts announced last year.

The two rounds of cuts represent 10 percent of the workforce, spokeswoman Kelly Jasko said in a phone interview. The company began notifying employees today, she said.

Chief Executive Alexander Cutler said in December that Eaton’s automotive, truck and hydraulics operations have experienced a “dramatic deceleration” in demand and that the company had begun seeing weakness in some markets in its electrical and aerospace businesses. Eaton at the time said it cut 3,400 jobs in 2008 and planned to take further cost-cutting actions in early 2009.

Time Warner Inc.’s Warner Bros. Entertainment is eliminating roughly 800 positions, or 10% of its work force, across all divisions and all levels the movie studio said, citing "the global economic situation and current business forecasts."

The downsizing will eliminate about 600 employees, 300 of whom will be laid off in the coming weeks. Another 300 are to be laid off gradually over the next two years; those jobs are to be outsourced to Cap Gemini SA, a Paris-based consulting and outsourcing company that will contract the work to people in India and Poland. An additional 200 positions currently open … REST BY SUBSCRIPTION

I seldom reference WSJ material because it is subscriber based. When I do reference it, I put in that big notice effectively insuring no one clicks on it. They were supposed to be offering more free content and they did for a while. The fact that they have reversed course on free content could be telling.

U.S. Stocks Slide in Dow Average’s Worst Inauguration Day Drop

U.S. stocks sank, sending the Dow Jones Industrial Average to its worst Inauguration Day decline, as speculation banks must raise more capital sent financial shares to an almost 14-year low.

State Street Corp., the largest money manager for institutions, tumbled 59 percent after unrealized bond losses almost doubled. Wells Fargo & Co. and Bank of America Corp. slumped more than 23 percent on an analyst’s prediction that they’ll need to take steps to shore up their balance sheets. The Dow’s 4 percent slide was the most on an Inauguration Day in the measure’s 112-year history, according to data compiled by Bloomberg and the Stock Trader’s Almanac.

“All the banks are going to have to recapitalize,” said Greg Woodard, portfolio strategist at Manning & Napier Advisors Inc., which manages $16 billion in Fairport, New York. “That’s not done. That’s in front of them, and we don’t want to try to get in front of that trade.”

The S&P 500 plunged 5.3 percent to 805.22. The S&P 500 Financials Index fell 17 percent to below its lowest closing level since March 1995 as concern European banks need more capital also weighed on the group. The Dow average slid 332.13 points to 7,949.09. Both the Dow and S&P 500 retreated to two- month lows.

U.S. financial losses from the credit crisis may reach $3.6 trillion, according to New York University Professor Nouriel Roubini, who predicted last year’s economic and stock-market meltdowns.

“If that’s true, it means the U.S. banking system is effectively insolvent because it starts with a capital of $1.4 trillion,” Roubini said at a conference in Dubai today. “This is a systemic banking crisis.”

Note that $3.6 trillion number. The Fed can print that amount without jump starting inflation. Fears of inflation should be nonexistent at this point. I am not calling for that printing, I think the Fed should let the banks go under. Recapitalization plans are likely going to zombify them, just as happened in Japan.

Mike "Mish" Shedlock