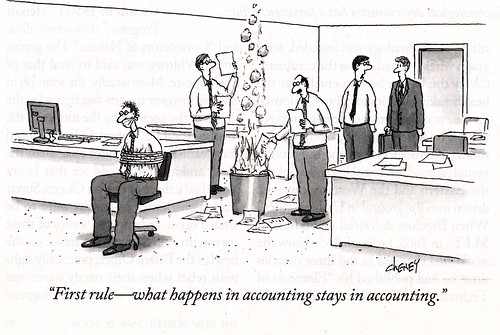

Greg Newton comments on the evolving Mark-to-Madoff accounting procedure contemplated for the Bad Bank Plan.

Great days in securities fraud

Courtesy of Greg Newton at NakedShorts

Mark-to-market. Mark-to-mystery. Now, Mark-to-Madoff.

The Obama administration is close to deciding on a plan to purchase bad — or non-performing and illiquid — assets from banks, according to industy (sic) sources. The plan could be announced early next week.

The so-called “bad bank” plan, would address the key problem of how to price the assets by using a model-pricing mechanism. The model would take account of the government’s ability to hold onto assets, even to maturity, and pay for the (sic) them with cheap funding.

than current market prices for the securities.

Another triumph for The Price Discovery Suppression Society. And, no matter what, the crookes will be paid. Again.

And The crookes will be paid: AIG Said to Pay $450 Million to Retain Swaps Staff

by Hugh Son, Bloomberg Jan. 27 2009

American International Group Inc., the insurer saved from collapse by government money after losses on credit-default swaps, offered about $450 million in retention pay to employees of the unit that sold the derivatives, according to two people familiar with the situation.

About 400 workers at the financial products unit may get the money in two installments, said the people, who declined to be named because details of the payments were confidential. The business was responsible for about $34 billion in writedowns since 2007 as the market value of swaps AIG sold to banks plunged amid the subprime mortgage market collapse.

The payments bring to more than $1 billion the amount AIG has committed to keep its employees from leaving. The New York- based insurer in September took a federal bailout to avoid bankruptcy and is selling subsidiaries to repay the government.  AIG said the program was disclosed before the government rescue, which is now valued at $150 billion. “I was extremely disappointed — but not surprised — to learn that AIG will be awarding bonuses to the very division that drove the company into the ground,” said Representative Elijah Cummings, a member of the House Committee on Oversight and Government Reform, in an e-mail. AIG shouldn’t be awarding “millions of unmerited dollars to employees while at the same time begging the U.S. government for financial life support.”

AIG said the program was disclosed before the government rescue, which is now valued at $150 billion. “I was extremely disappointed — but not surprised — to learn that AIG will be awarding bonuses to the very division that drove the company into the ground,” said Representative Elijah Cummings, a member of the House Committee on Oversight and Government Reform, in an e-mail. AIG shouldn’t be awarding “millions of unmerited dollars to employees while at the same time begging the U.S. government for financial life support.”

More here.