Corey Rosenbloom at Afraid to Trade.com comments on today’s unusual divergence of the indexes.

Conflicting Intraday Performance

Courtesy of Corey at Afraid to Trade

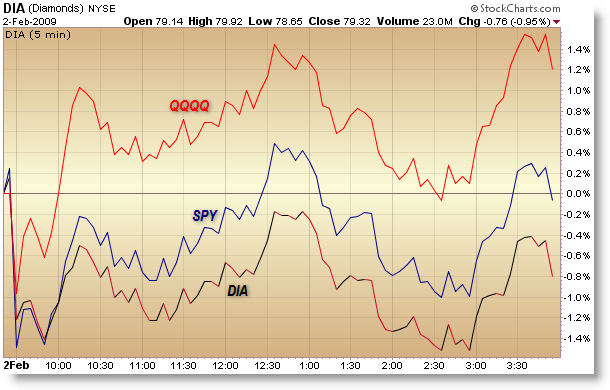

Today marked a very rare and interesting outcome in the major US Equity Market ETFs: QQQQ rose 1%, SPY was unchanged, and the DIA fell 1%. Let’s look at this and try to see what happened.

Intraday Percentage Performance SPY, DIA, and QQQQ:

The chart is a little off to account for the gap. The day started with an overnight gap down in all indexes which was filled quickest in the QQQQ (NASDAQ ETF) and then by the SPY (S&P 500 ETF). The DIA (Dow Jones ETF) never actually filled the gap – it fell about 15 cents shy.

In the Dow, the worst price performer was MMM which fell $3.00 or 5.70%. The worst percentage loss came from Bank of America which lost 8.97% today ($0.59). Remember that the Dow is a price-weighted index, so dollar values carry more weight than percentage factors. See my previous post-link “Distortion in the Dow Jones.”

Technology stocks outperformed today which helped boost the NASDAQ, with Microsoft (MSFT) gaining $0.72 or 4.21%. The best NASDAQ 100 dollar performer was the Apollo Group (APOL) which increased $4.65 or 5.71%. Intel posted a 5.43% gain as well.

The S&P 500 tends to balance the Tech-heavy NASDAQ and the Blue-Chip heavy Dow Jones, which is exactly what we saw today.

I’ve actually never seen a day where the NAS was up 1%, S&P balanced with a zero gain, and Dow losing 1%. That’s quite a wide spread between key indexes that are expected to perform roughly in line. It shows that things are a little more difficult than they used to be and that we should be using more caution and selectivity in our trading.

Corey Rosenbloom

Afraid to Trade.com