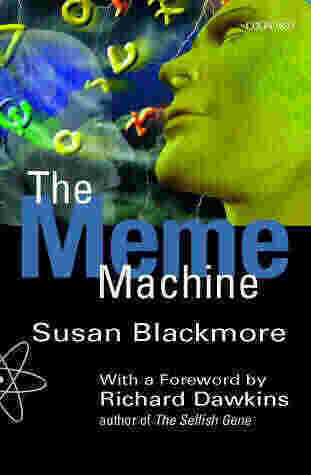

A fascinating subject, Condor Options sets out the problem, but the solution is far from simple.  I’d start by considering the concept of the "meme." From Wikipedia, a meme comprises a unit or element of cultural ideas, symbols or practices; such units or elements transmit from one mind to another through speech, gestures, rituals, or other imitable phenomena… [M]emes act as cultural analogues to genes in that they self-replicate and respond to selective pressures." Like DNA, memes contain bits of transmissible information, with varying degrees of contagiousness and virulence (virus analogy). – Ilene

I’d start by considering the concept of the "meme." From Wikipedia, a meme comprises a unit or element of cultural ideas, symbols or practices; such units or elements transmit from one mind to another through speech, gestures, rituals, or other imitable phenomena… [M]emes act as cultural analogues to genes in that they self-replicate and respond to selective pressures." Like DNA, memes contain bits of transmissible information, with varying degrees of contagiousness and virulence (virus analogy). – Ilene

Zombie Ideas

#1 The efficient markets hypothesis

#2 The case for privatisation

#3 The Great Moderation

#4 Individual retirement accounts

#5 Trickle down

For those with ears to hear and eyes to see, some of those ideas have been dead for a long time: the notion of wealth naturally spreading from the highest to other income distributions, whether in its trickle-down (Reagan) or rising-tide (Kennedy) metaphoric garb, has been disconfirmed for ages.

What’s frustrating to us is that so little of this kind of research ever penetrates the public consciousness in any permanent way. There are obvious places to lay blame, but CNBC, the WSJ editorial page, and political demagogues couldn’t accomplish this on their own; a mix of poor education and unrealistic individual aspiration is probably just as much at fault. But whatever the psychological, ideological, or external causes, some of these ideas just don’t seem willing to die. Tulip buyers in 1637 don’t look much different now from option-ARM homebuyers in Las Vegas in 2006.  The idea of privatizing Social Security may not be popular now, but given a few decades of recovery and bubbletastic inflation, those partisans will inevitably reemerge in force. Greenspan’s mea culpa regarding the illusory self-correcting power of free markets shouldn’t have been news, but it was, and some future Fed chair will no doubt make headlines again for stating the obvious.

The idea of privatizing Social Security may not be popular now, but given a few decades of recovery and bubbletastic inflation, those partisans will inevitably reemerge in force. Greenspan’s mea culpa regarding the illusory self-correcting power of free markets shouldn’t have been news, but it was, and some future Fed chair will no doubt make headlines again for stating the obvious.

It would be interesting to see a study of the psycho-social causes of the resilience of discredited ideas. Is there some short term selective advantage to being able to believe six impossible things before breakfast?