Tyler Durden analyses the mortgage subsidy program being considered by the administration and concludes it does not go far enough to significantly impact foreclosure rates. A more effective, but more costly, program would be aimed at principle reductions rather than interest rate reductions.

Mortgage Subsidies – Arguably Useless But Definitely Expensive

When Reuters yesterday [Thursday, 2-12] released the rumor of the mortgage subsidy program, the market shot up to close unchanged after being down over 3%. But was the market, as usual, ahead of itself in its optimism? While the news of subsidies may result in some marginal benefits to the most at risk homeowners, it is at best a temporary solution as it does nothing to impact the real toxic asset overhang – the staggering notional size of unserviceable mortgage debt. Additionally, subsidies will obviously not come free. A full estimate of the program’s cost can only be made once there is full disclosure on this effort (which aside from Reuters’ piece, there has not been any additional confirmation from the administration), but this post attempts to give some rough preliminary indications of how much will need to be invested and whether or not the most recent plan by the administration will even be effective.

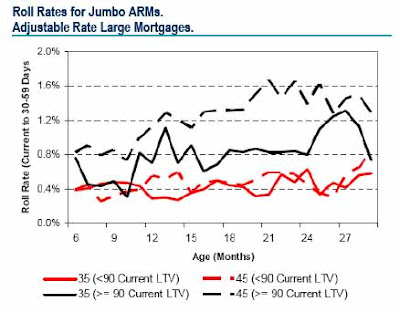

First, we present some interesting data from BAC’s mortgage group, which tracks the most at-risk groups, and what current roll rates are for assorted cohorts (roll rate is the percentage of current mortgages of specific age in months that defaults within a month), emphasizing the mortgage types mostly associated with higher than usual foreclosure rates: Jumbo ARMs and Options ARMs. The conclusion is that while principal reductions have a favorable impact on reducing delinquency rates and foreclosures, the impact of interest rate reductions is much less certain and likely will have a very muted effect at best.

In the figure below, the dashed black line shows that 1.4% of 24-month Jumbo ARMs in which the borrower has little equity (>= 90% of the Loan To Value (LTV) and where monthly debt payments consumed a large proportion of income (Debt To Income, or DTI, of 45%) become delinquent within a month. The solid black curve shows that for comparable loans, but where the borrower can better afford mortgage payments (DTI of 35%) roll rates decline to 0.8%. The red lines represent borrowers with equity in the home (LTV <90%) – delinquency rates here are lower and much more insensitive to changes in monthly mortgage payments. This demonstrates a mortgage subsidy program would mostly benefit homeowners with Jumbo ARMs and little home equity. Comparing the data for borrowers who spend a large portion of monthly incomes on debt payments (dashed lines) indicates that the biggest benefit would come from principal writedown, as delinquency rates drop significantly for those homeowners who have equity in the home. The brief conclusion is that yesterday’s news, even if ultimately confirmed, will be yet another step in the wrong direction by the government, which should be instead focusing on reducing the overall debt burden.

What will it cost? Market estimates of first-lien mortgages expected to be liquidated in this economic cycle approach $2 trillion (out of $9.3 trillion in outstanding total first-lien mortgages). Assuming the new loan modification program can reach these borrowers, and the cost of lowering mortgage rates by 100 bps is 2-4 points, the total cost of the program would be $40-80 billion per 100 bps reduction. As the targeted group of homeowners currently likely has very high mortgage rates due to high DTV and LTV ratios, the program will likely need to lower mortgage rates by anywhere from 2-4%, suggesting the cost of the program could reach $300 billion (or higher), and there is no conclusive evidence it would even lower foreclosure rates. Alternatively, to effectively achieve the desired effect of lowering delinquencies, thereby lowering LTVs, the government would have to impair the $2 billion first-lien tranche, with a 50% reduction here costing $1 trillion.