Adam Warner, at Daily Options Report, discusses Contango which is causing strange behavior in the USO.

Crude Talk

Pretty well documented that the USO is a mess as a tracking device for oil. The fund owns a mix of near month crude futures, and as such must roll them each month. Clearly Contango, when the next month trades at a premium to the nearer month, causes problems. If you have to keep taking the net dollar amount you get for the near month and using those proceeds to buy more expensive outer month, you will own fewer and fewer contracts.

USO has tried to solve the problem by first bumping up their roll date, and now apparently spreading it out over 4 days.

Of course they announce those dates. I mean if you are a market participant, would it not behoove you to bid up the next month ahead of the very large buyer you know is coming?

It appears it happened last expiration, and is in progress this go around. Here are some numbers from via FT Alphavile from Stephen Schork of the Shork Report (hat tip Abnormal Returns).

As we outlined at the time, this volatility was largely attributable to “the roll” by long-only commodity index funds, particularly the United States Oil Fund ETF (USO). Open interest in the March contract was 363,757 on February 05th. Per the fund’s website, the USO rolled 85,057 contracts the next day. In other words, the USO held sway over the market, i.e. these funds (USO, S&P GSCI et al) are artificially skewing the front of the NYMEX curve; putting downward pressure as they sell a massive percentage of open interest in the spot over the course of a few sessions.

The USO has since announced it will roll over the course of four sessions instead of one; the April/May roll will take place in between March 06th and 09th. The fund is holding length of 61,940 NYMEX futures, 4,000 NYMEX WTI financials and 30,583 ICE futures, 96,523 contracts in total with a market capitalization (as of last night’s close) of $3.86 billion.

All this length will have to get rolled in a couple of weeks’ time. What’s to prevent front running the roll? Nothing, that’s what. Over the last three sessions the April/May contango has moved from $2.14 (-5.1%) to $2.80 (- 6.6%).

Lovely.

Now the fund is not trapped, they are entited to invest in "other oil interests" according to the article. But thus far they have apparently shied away. Why? Well they have the stated goal of tracking West Texas Intermediate. Texas Tea. Oil That Is.

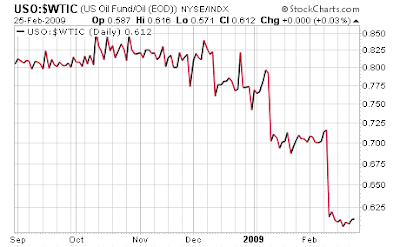

Check out the above graph, that’s how well they have tracked WTIC. So I would then question, why? I mean how much worse can they do? Proshares uses 3rd party swaps to track financials for all their family of Leveraged Monsters. Why in the world wouldn’t USO simply find a similar arrangement? I mean someone somewhere can probably create a product that actually tracks spot crude, no?