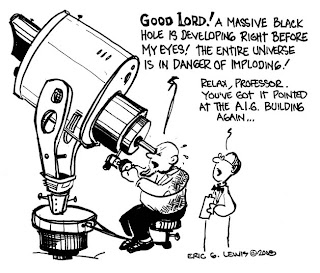

Ken Houghton explores questions arising from the AIG debacle: Who benefits from the AIG bailout? And what might justice look like in this situation?

The Two Sides of AIG

Courtesy of Ken Houghton at Angry Bear

In this corner, as previously mentioned, Yves Smith goes for the slam dunk:

Let’s see, the credit default swaps market, due to some netting, is now somewhere north of $30 trillion (as opposed to its earlier "north of $60 trillion" level). Investment banks were believed to have hedged most of their exposure via offsetting contracts, but AIG wrote naked protection. And as jAIG itself is at risk of getting downgraded again, the collateral posting requirements keep rising.

Some analysts (including Chris Whalen of Institutional Risk Analytics) have offered theories as to how the government could void a lot of CDS (some have argued for getting rid of them altogether, others argue for eliminating them in cases where the protection buyer does not hold the underlying bond/exposure). Before you say, "they can’t do that", recall the effective confiscation of gold in the Great Depression. rationing, wage and price controls, the suspension of habeus corpus. There is a good deal that the Feds could do if they chose to, trust me.

But it’s easier to bill the poor chump taxpayer than take on the financiers, even after they [have] done so much damage.

And in the other corner, I am joined by Felix Salmon, who rejects the slam:

The scandal here is not the size of the losses from the global financial meltdown — those are losses which sooner or later, in one form or another, would have had to be borne by the government anyway.

The problem, as obliquely noted by me ("So there is a viable, separable business that is making pennies [US$0.01] while the rest of the firm loses Benjamins [US$100.00]") and explicitly declared by Yves, is summarized well by Felix, in a statement to which I suspect all three of us would agree:

Rather, the scandal is that AIG could have earned billions of dollars by selling insurance against a meltdown, even as it was wholly incapable of paying out on those policies. I wouldn’t be surprised to learn that Hank Greenberg was still a billionaire, even as the policies his company wrote have cost the average American household some $1,600. It’s time for his wealth to be confiscated: it might be only a drop in the bucket compared to AIG’s total losses, but it would feel very right.

As I suggested yesterday of the successor-AIG, "So long as that board doesn’t include Hank Greenberg, I’ll be cautiously optimistic."

The problem is that’s probably not the way to bet. More on that later; for now, keep watching Joe Nocera deliver the goods and summarize the issue:

Yet the government feels it has no choice: because of A.I.G.’s dubious business practices…it pretty much has the world’s financial system by the throat….

A bailout of A.I.G. is really a bailout of its trading partners — which essentially constitutes the entire Western banking system. [edits mine*]

By the way, Joe, Yves, citing an early Bloomberg report, named some names:

Goldman Sachs Group Inc., Societe Generale SA, Deutsche Bank AG and Merrill Lynch & Co. are among the largest banks that bought swaps from AIG, according to a person familiar with the situation. The insurer handed over about $18.7 billion to financial firms in the three weeks after the September bailout, said the person, who declined to be named because the information hasn’t been made public.

*Which improves the NYT editing, since the fact of the "housing bubble" has nothing to do with AIG’s mis- and malfeasances.

*****

Click on The Free Market Clapper picture on the left for a video demonstration of how to make capitalism work for you. – Ilene