Simon Johnson explains how the Administration’s "mix and match" financial stratgey leads to confusion and a take-the money-and-run attitude among business insiders.

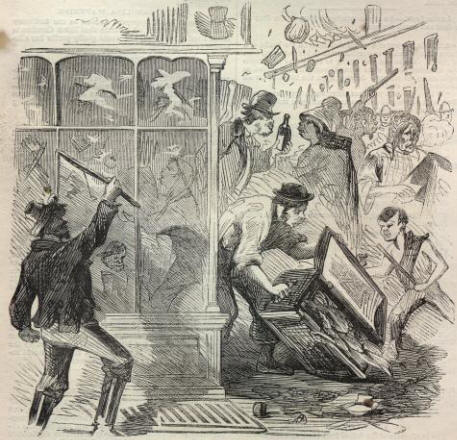

Confusion, Tunneling, And Looting

Courtesy of Simon Johnson at The Baseline Scenario

Emerging market crises are marked by an increase in tunneling – i.e., borderline legal/illegal smuggling of value out of businesses. As time horizons become shorter, employees have less incentive to protect shareholder value and are more inclined to help out friends or prepare a soft exit for themselves.

Boris Fyodorov, the late Russian Minister of Finance who struggled for many years against corruption and the abuse of authority, could be blunt. Confusion helps the powerful, he argued. When there are complicated government bailout schemes, multiple exchange rates, or high inflation, it is very hard to keep track of market prices and to protect the value of firms. The result, if taken to an extreme, is looting: the collapse of banks, industrial firms, and other entities because the insiders take the money (or other valuables) and run.

This is the prospect now faced by the United States.

Treasury has made it clear that they will proceed with a “mix-and-match” strategy, as advertized. And people close to the Administration tell me things along the lines of ”it will be messy” and “there is no alternative.” The people involved are convinced – and hold this almost as an unshakeable ideology – that this is the only way to bring private capital into banks.

This attempt to protect shareholders and insiders in large banks is misguided. Not only have these shareholders already been almost completely wiped out by the actions and inactions of the executives and boards in these banks (why haven’t these boards resigned?), but the government’s policy is creating toxic financial institutions that no one wants to touch either with equity investments or – increasingly – further credit.

Policy confusion is rampant. Did the government effectively sort-of nationalize Citigroup last Thursday when it said Vikram Pandit will stay on as CEO? If that wasn’t a nationalization moment (i.e., an assertion that the government is now the dominant shareholder), what legal authority does the Treasury have to decide who is and is not running a private company?

Will debtholders be forced to take losses and, if so, how much and for whom? As part of last week’s Citigroup deal, preferred shareholders – whose claims had debt-like characteristics – were pressed into converting to common stock. You may or may not like forced debt-for-equity swaps, but be aware of what the prospect of these will do to the credit market. Junior subordinated Citigroup debt (securities underlying enhanced trust preferred shares) were yesterday yielding 26%.

Who can explain exactly how AIG has lost so much money? Drip-drip injections of government money are not a proper clean-up; there has been no complete recognition of losses and, almost six months later, that company still cannot move on. Time horizons presumably remain short or are getting shorter for all involved. This points to a bleak future more generally.

What do rapidly widening credit default spreads for nonbank financial entities (such as GE Capital and many insurance companies) signify? Is it something about expected behavior by the insiders or by government, or by some combination of both?

Confusion in policy breeds disorder in companies, and disorder leads to the loss of value. This is the reality of severe crises wherever they unfold; we have not yet reached the worst moment. And, of course, there are many more shocks heading our way – mostly from Europe, but also potentially from Asia.

The course of policy is set. For at least the next 18 months, we know what to expect on the banking front. Now Treasury is committed, the leadership in this area will not deviate from a pro-insider policy for large banks; they are not interested in alternative approaches (I’ve asked). The result will be further destruction of the private credit system and more recourse to relatively nontransparent actions by the Federal Reserve, with all the risks that entails.

The road to economic hell is paved with good intentions and bad banks.