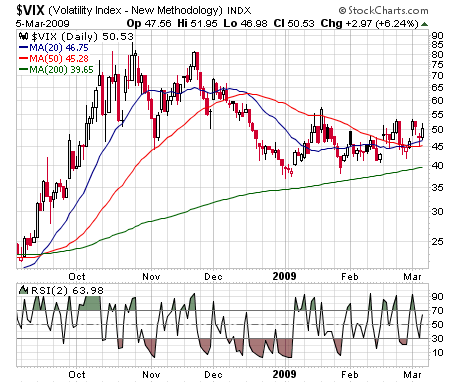

Adam Warner at Daily Options Report reports on an uninspiring VIX.

More On The Not-Lifting VIX

So what’s with the sluggish VIX? FT Alphaville takes a look.

Investors are finding that the Vix volatility index, widely followed last year as Wall Street’s gauge of fear, is no longer the accurate barometer that it was.

When the S&P 500 fell sharply last October and November, the Chicago Board Options Exchange’s Vix, which measures the implied volatility of options based on the broad US equity market benchmark, surged to record highs.

This week, the Vix has been relatively subdued even as the S&P on Tuesday fell below 700, a level not seen since 1996, following another series of sharp sell-offs.

The breakdown in the relationship between the S&P and the Vix, which have historically moved in inverse proportion to each other, is a product of a number of factors and could suggest that stocks may have seen the worst of the current bear market, say traders.

According to Randy Frederick, director of trading and derivatives at Charles Schwab, it may be a case of battle fatigue. "The Vix is not really indicating where the broader market is going at the moment and it can’t really stay at relatively elevated levels close to 50 indefinitely. No bad news is really shocking anyone any more and an elevated Vix is essentially an indication of surprise."

Well, hopefully if you read here, you’ve seen about 38 posts on this subject.

There is some thought that the lower-high VIX is actually a bullish divergence. And as they say later in the article, it’s been a pretty orderly selloff.

That is of course until yesterday. So perhaps we have entered a capitulatory phase, at least in the intermediate term?

We’ll see. But even if so, still not convinced the VIX takes out the Fall highs. Nor is that something that really will matter that much. Basically, you just don’t have the carnage in many sectors that you had last Fall (tech anyone?) and ergo you have reduced realized stock index volatility.

And mind you, 50 VIX is nothing to sneeze at.

Just one quibble with the piece though. The VIX hasn’t "failed". It’s measure of volatility, and in that respect, it’s in a fairly accurate stretch. If anything, the VIX has overstated realized volatility in 2009. It correlates about -.67 to the SPX, but as with any two measures, you will see times the relationship breaks down a smidge. We had an increasing stock/increasing volatility era in the late 90’s, perhaps we have a decreasing stock/not increasing volatility era now. Although even there, volatility is not actually decreasing, it’s just not rallying.