Was that a great week or what?

Was that a great week or what?

No really, I'm asking as I'm not sure yet… We had a great rally once we got Monday out of the way but, all in all, it was a hell of a lot of work to get back to where we were last options expiration day (Feb 20th). We nailed the market turn to a tee, beginning with my calls to go long on QLD, HOV and FAS while shorting the SKF at $250 (now $138) in last Friday's appearance on LiveStock. In fact, my closing comment in Friday morning's post was: "We EXPECT a 400-point BOUNCE along this downtrend so we’re not even impressed with anything less than 7,000 next week."

We did a little further investigation in member chat yesterday and decided that we need to break 7,450 on the Dow to actually be impressed next week. Our main concern is we get a quick spike up to that level and then a rejection that sends us racing down to the bottom so we will be positioning to guard against that next week. At the moment, we ended the day slightly bullish but would not be surprised by a drop back to the 7,000 line and we're positioned for that, as we sold the 3/31 $72 puts against our longer puts. The $2.25 we collected from those pays for us to roll up our long protection 400 Dow points but, to the downside, put a break on our insurance at the 7,000 line (the point at which they go in the money).

By contrast, last Friday, my advice to members was to cover the long DIA puts with $70 puts at $4.32. Those are now .61 and the profits from that already paid for more than half the cost of our long June puts. This is very important to understand as we often talk about being 50/50 or 60/40 bearish but when you can offset 1/2 the cost of your 60% bearish side like this, it makes it very easy to go with the flow on a market rally. The only other stock I picked on Friday was AMZN as $62.50 for reasons I elaborated in the live show, they finished up near the highs at $68.63 but the FAS as $2.85 was a real winner, finishing up at $5.15 yesterday – not bad for a week's work.

Of course nothing says lovin' like a $110 dive in an ETF you are short on and we had a series of 200-1,000% gainers on our put options as our patience finally paid off. Even as SKF was spiking to $260 last Friday, I was saying live on TV that the puts meant we didn't worry about it and, in fact, gave us a chance to roll up our positions cheaply as we had until Wednesday before we had to truly worry. For the same reasons we were short on SKF last week, we went long on FAZ yesterday – if you allocate just 5% of your virtual portfolio to volatile speculative positions like this – when they have a run that returns 500%, rare though they may be, then you gain 25% of your virtual portfolio. If you are generally well balanced otherwise, this is a great way to make "surprise" profits in either direction as the market swings.

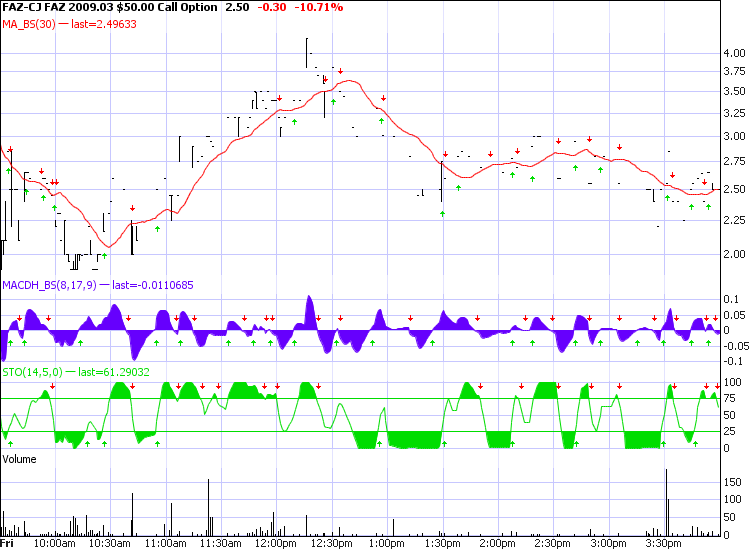

We surprised ourselves yesterday when the FAZ $50s we picked up as our first play of the morning at $2 (with a round at $2.25 and $1.75, exactly as planned) rocketed to $3.50 by lunch. That allowed us to take the cash back off the table and let the profits run into next week. A lot of people wonder if my trade ideas are clear enough for the average person to follow so here's ALL the comments I made on FAZ in yesterday's member chat:

- 9:34 ($50 calls at $2.25): The fun FAZ play of the moment is the $50s at $2.25, a fun play to scale into for the weekend.

- 9:50 ($50 calls at $2.50): FAZ – Buying calls. A GAMBLE for sure but you can pick some up at $2.25, $1.75 and $1.25 for a $1.75 avg into the weekend on an ETF that was $60 yesterday morning. I love 5:1 risk/rewards on things that are better than 30% to pay off – not to mention it was $105 on Monday so that would be a nice win, right?

- 10:18 ($50 calls at $1.75): Yes the $50s are my favorites at the moment, huge gamble though…

- 11:23 ($50 calls at $3): I do think we can do much better, it’s more the kind of trade I’d stop half out and set a stop on the rest with a traiing 10% but a quick 30% is fantastic. If XLF fails $8, then FAZ is good for $45, then watch each .20 on XLF for $2.50 on FAZ. Don’t forget S&P 750 voids bearish plays. (The S&P crossed back over 750 at 1:12 and FAZ topped out at $44.90 at 12:17).

- 11:46 ($50 calls at $3.50): FAZ/RMM – As I said before, I think there is a 30% chance you can make 500% on that call, which is why I like the play. If you made 30%, you can re-invest that into some FAZ calls you leave and you have no risk on a 500% gain potential – that’s how you make fun trades, play with the profits…

- 12:10 ($50 calls at $3.40): FAZ/Wes – I am very anti-chasing but if you can get the $60s for $1.60 and then put in for a $1 roll down to the $50s on a pullback, then I think it’s a fair gamble but GAMBLE is the operative word on this play. (That roll did not execute and the $60 calls fell to $1.20 but, as expected, far less loss than taking the $50s for $3.40 and losing .90).

- 2:56 ($50 calls at $2.50): FAZ/SW (answering a question to a member who did not get out at 1:12) – If we’re closing way up here I’d either get out or leave 1/3 on for an almost freee trade. My weekend thought is that Wen’s comments will be a huge topic but Bernanke could erase that sentiment on Sunday night and put everyone in a good mood. Cramer’s on TV now pushing the "everything’s going to be all right" platform, WHICH I AGREE WITH, but I just think there should be a healthy correction after we examine our monetary policy and then we can move up from there but ignoring what China and Europe are saying to us in very plain language going into the G20 is a recipe for disaster.

So that's how we run a play during chat. We don't do a lot of day trades but, as we close in on expiration week and the premiums drop on short-term options, we like to take some fun plays like this one while we wait for the premiums on options we sold to other people to expire.

While this is a bearish play, it's only a cover to our already bullish positions – something that lets them run by taking a contrary position that will pay off quite well if we get a reversal. The ultra-short and ultra-long ETFs can make great hedges like that and using option plays to further leverage them make powerful tools to balance your virtual portfolio on the fly. Our FAS position, for example, is up 80% in a week. If you had devoted 10% of your virtual portfolio to it, it now is making up 18% of your old balance.

Let's say it was $2,000, now $3,600. Rather than kill the play if you think it has further to run, you can take $400 of the profits and buy 2 of the FAS $50s at $2.50. When FAS was at $4 on Wednesday, those FAZ calls were $12 so a 20% drop in your $3,600 position to $2,880 (still up 40%) would bring the FAZ position up to $2,400 while a 20% gain in FAS would run that position up to $4,320 and cost you perhaps 1/2 of the $500 you invested in the the weekend insurance – that's hedging!

We begain the week talking about "The Law of Unintended Consequences" and how mark to market rules were being used to push the banks lower than logic would dictate. In the "Weekly Wrap-Up" we talked about how it wasn't so much that 6,500 was a bottom but that the recent batch of buy-outs suggest that stoks are finally well and truly oversold. I made the value case for C, then $1 and it was indeed C that sparked the rally this week when they said they were, indeed making some money.

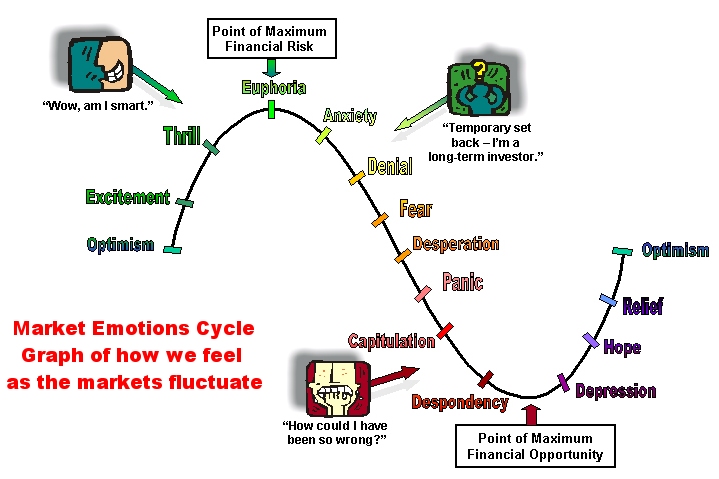

I put up 6 simple plays that could make 500% or more if the market turns. One was buying C 2011 $2.50s for .42 and selling the 2011 $7.50s .21, a .21 speread that could return $5 if C hits $7.50. As of Friday the spread already hit .52 (up 148%). The AA spread is up just 20%, the UYG spread is up 81%, the XHB spread us up 40%, the LVS spread is up 75% and the CBS spread is up 40%. As I said in the post: "You have to do SOMETHING on the bullish side. Not all plays have to be short-term as there are many long-term hedges like these that can pay off one time better than being right on 10 20% gainers, you just need a little patience." Well, in this particular case it didn't require much patience but there are still plenty of deals out there and the most important thing to take away from this is that it's GOOD to buy when other people are panicking.

Other picks we discussed in that post were FAS at $2.50 (yes, I was like a broken record on that one) and the SKF July $175 puts at $37.50 (see the post for full logic on that selection), which are already at $64.60, even if you didn't take advantage of the way-better entries we got Monday morning. On Sunday I reviewed my logic in a special post that the media, especially Cramer and CNBC, were creating an air of panic that was pushing us below reasonable levels. John Stewart picked up the torch this week, culminating in this great encounter directly with Cramer which says so many of the things I wanted to say myself.

Monday we got our level tests as we expected and, right out of the gate, I was still bargain hunting with pre-market calls on COF at $9 (now $12.56), V at $50 (now $52.05) and MA at $145 (now $158.31). IYT Sept $35s jumped from $7.75 to $10.65 and the IWM Aug $38s went from $3 to $5.08. Other featured trade ideas from Monday's member chat were CCJ at $14.35 (now $15.39), SKF $120 puts yet again at $2, which finished at $4.05 as well as the SKF Apr $145 puts at $13.30, now in the money at $29.10. GOOG Apr $310s ran from $17.35 to $29.70 and QLD Apr $14s at $6.10 were my last trade idea for members on Monday, now $10.30. Overall, not a bad start to the week!

The rest of the week is boring as I called it Turnaround Tuesday – The Citi Never Sleeps and, of course, every pick worked as we blew through our 7,200 target for the week. If anything, I was too skeptical of the rally and will remain so until we hold 7,450 for a few days and made fewer plays as I hate to chase and we have a long, long way to go if this is a real rally so we won't be missing much at these levels. Even on the way up, I couldn't resist the FAS hedged entry at $1.97 (FAS at $3.60) as it seemed like easy money, as did selling the SKF March $210 calls for $11.40 (now .60) but, other than that, after such a busy Monday, Tuesday was a fun day to just watch happen!

I mentioned how easy Tuesday was on Wednesday morning, what Cap called a "Free Money Day" but Wednesday we expected to have to fight for our gains and we sure did but it was a nice consolidation day overall. We actually skated right between the levels I set in member chat at 9:36, which was exactly what we wanted after such a nice Tuesday move. We day traded FAZ (and, of course we always trade our DIA covers around so not worth mentioning) and added SKF Apr $100 puts for $4.20 (now $6.95) ahead of Jaime Dimon's speech at 1:15, which we expected would ring a positive note for the financials. AA was added hedged to $4.35 (same play is still good) and DPO was a nice pick at $6.62, now $7.25 but it's the .167 monthly dividend we're really after! DRYS hedged to $3.39 is still the same play but that was it for trade ideas Wednesday as we watched and waited.

I mentioned how easy Tuesday was on Wednesday morning, what Cap called a "Free Money Day" but Wednesday we expected to have to fight for our gains and we sure did but it was a nice consolidation day overall. We actually skated right between the levels I set in member chat at 9:36, which was exactly what we wanted after such a nice Tuesday move. We day traded FAZ (and, of course we always trade our DIA covers around so not worth mentioning) and added SKF Apr $100 puts for $4.20 (now $6.95) ahead of Jaime Dimon's speech at 1:15, which we expected would ring a positive note for the financials. AA was added hedged to $4.35 (same play is still good) and DPO was a nice pick at $6.62, now $7.25 but it's the .167 monthly dividend we're really after! DRYS hedged to $3.39 is still the same play but that was it for trade ideas Wednesday as we watched and waited.

Thursday morning I predicted we would test the 5% levels and we held up very nicely at the open and broke through our highs. Watching levels kept emotions out of it as I said in the morning post: "There’s enough positives on the table to hope for another green day but we’ll have our technical hat on and let our levels be our guide. We’re still not going to be making many bullish plays into the weekend but we’ll be happy to flip a little more bullish as we hold the 5% levels and take another run at the 7.5% lines." I was as surprised as anyone that we tested 5% in the morning and hit 7.5% in the afternoon.

My 9:53 comment to members was: "Transports with a big pullback this morning, SOX too but I like this for a bottom call so I’m going with the DIA 3/31 $69 puts as covers here, stop at $4 or if we break 6,800, whichever comes first." Those DIA puts fell from $2.20 to $1.08, another great set of gains to lower the basis of our longer protective puts… Once again hedging with FAZ did not work but it's one of those plays that only has to be right once. TM 2011 $50s were a good deal at $17.60 (now $18.60) but I was still too bearish to make many new plays but we did stay a little bullish into the close and that was pretty much it for the week's gains so nothing to be ashamed of.

I set new levels on Friday morning and we hit them across the board but I didn't "feel" it and, in fact, reloaded on FAZ for the weekend – just in case, although it made so much money during the day that we were able to let just the profits ride, as detailed above. Should I have been more bullish? We'll know next week but I laid out a sceneario at the end of Friday's member section that explains my logic of why we must break 7,450 next week or we are very likely to retest the lows once again.

Tune in next week for more fun!