Bill Cara at Cara’s Community introduces an article by Elliot Spitzer about the brazen transfer of enormous sums of money to the usual large financial institutions unjustly made whole in their counterparty dealings with AIG. On what legal authority this plundering of public (future) funds is based is a mystery to me. – Ilene

Cara’s Commentary & Community Chat, Wed., Mar. 18, 2009

Courtesy of Bill Cara

Courtesy of Bill Cara

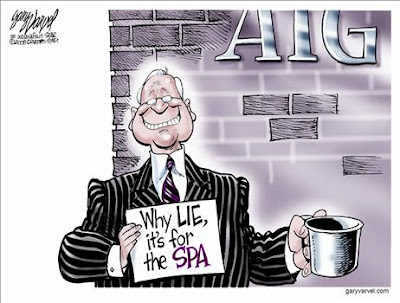

The word “outrage” has been used in record setting numbers by politicians. Humungous Bank & Broker (HB&B) has trained these monkeys well. Just when the taxpayer was about to discover the real issue here, which as Eliot Spitzer has pointed out is that TARP funds flowed right through AIG into the coffers of “Goldman, Bank of America, Merrill Lynch, UBS, JPMorgan Chase, Morgan Stanley, Deutsche Bank, Barclays, and on…”.

http://www.slate.com/id/2213942/

As it turned out, HB&B did humungous deals for massive fees, not caring if the Credit Swaps of AIG were worth anything because they parachuted their leader Henry Paulson into the Administration to take control of Treasury with a plan, if AIG were to fail, to coerce Congress into using the taxpayer’s money to make those deals work.

As Spitzer says, “The Real AIG Scandal is not the bonuses. It’s that AIG’s counterparties are getting paid back in full.”

The only outrage going on in DC these days is that Congress is not demanding testimony from Paulson, Geithner and Dimon that would set the groundwork for a comprehensive audit of Treasury and the Fed.

Interesting tidbit from the Paulson bio at Wiki: “ Time magazine named Paulson as a runner-up for its Person of the Year 2008, saying, with reference to the Global Financial Crisis of 2008: "if there is a face to this financial debacle, it is now his".

I told you that a couple years ago. Now I am saying he needs to be ordered to give testimony under oath, so that DC and the American public can get to the bottom of this mess.

Here’s an excerpt from Elliot Spitzer’s article:

Here’s an excerpt from Elliot Spitzer’s article:

The Real AIG Scandal.

It’s not the bonuses. It’s that AIG’s counterparties are getting paid back in full.

Everybody is rushing to condemn AIG’s bonuses, but this simple scandal is obscuring the real disgrace at the insurance giant: Why are AIG’s counterparties getting paid back in full, to the tune of tens of billions of taxpayer dollars?

For the answer to this question, we need to go back to the very first decision to bail out AIG, made, we are told, by then-Treasury Secretary Henry Paulson, then-New York Fed official Timothy Geithner, Goldman Sachs CEO Lloyd Blankfein, and Fed Chairman Ben Bernanke last fall. Post-Lehman’s collapse, they feared a systemic failure could be triggered by AIG’s inability to pay the counterparties to all the sophisticated instruments AIG had sold. And who were AIG’s trading partners? No shock here: Goldman, Bank of America, Merrill Lynch, UBS, JPMorgan Chase, Morgan Stanley, Deutsche Bank, Barclays, and on it goes. So now we know for sure what we already surmised: The AIG bailout has been a way to hide an enormous second round of cash to the same group that had received TARP money already.

It all appears, once again, to be the same insiders protecting themselves against sharing the pain and risk of their own bad adventure. The payments to AIG’s counterparties are justified with an appeal to the sanctity of contract. If AIG’s contracts turned out to be shaky, the theory goes, then the whole edifice of the financial system would collapse.

But wait a moment, aren’t we in the midst of reopening contracts all over the place to share the burden of this crisis? From raising taxes—income taxes to sales taxes—to properly reopening labor contracts, we are all being asked to pitch in and carry our share of the burden. Workers around the country are being asked to take pay cuts and accept shorter work weeks so that colleagues won’t be laid off. Why can’t Wall Street royalty shoulder some of the burden? Why did Goldman have to get back 100 cents on the dollar? Didn’t we already give Goldman a $25 billion capital infusion, and aren’t they sitting on more than $100 billion in cash? Haven’t we been told recently that they are beginning to come back to fiscal stability? If that is so, couldn’t they have accepted a discount, and couldn’t they have agreed to certain conditions before the AIG dollars—that is, our dollars—flowed?

The appearance that this was all an inside job is overwhelming. AIG was nothing more than a conduit for huge capital flows to the same old suspects, with no reason or explanation…

Continue here.