Tyler Durden examines whether the recent rally is a bear market bounce or a sustainable rally.

Bank Rally: A Temporary Bear Market Bounce

Courtesy of Tyler Durden at Zero Hedge

Rally in context

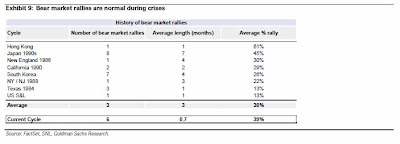

Bank stocks have staged a big rally and investors are now asking is this a bear market bounce or have we seen the bottom. In our view, this is a bear market bounce as:

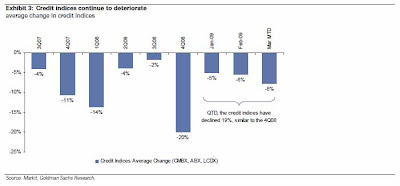

(1) Non-performing assets are still accelerating: The fundamental data is not getting any better on consumer credit. Master trust data on credit cards points to a significant deterioration in consumer credit quality – losses increased 90 bps month on month which is the highest increase since the cycle started. Moreover, we are likely to see a resumption of writedowns in March given the “X” indices have fallen by 8% so far this month. [click on images for larger views]

(2) Reason for rally: Part of the rally has been driven by comments from several banks that they have been profitable in the first 2 months of the year. However, we expect that some of this performance is driven by one-off factors such as write up on debt, mortgage origination fees, strong capital markets activity in Jan and Feb, which may fade in coming months and limited reserve builds despite our expectation that NPAs [nonperforming assets] will continue to grow.

(3) Next catalyst: The next major catalyst in the banks sector will be stress test results, which will most probably come out in the middle of April. We cannot rule out banks unexpectedly failing this test and being forced to either raise capital from investors or take government capital. We expect that some banks that pass the test will look to issue equity to pay back government TARP. Either way, we expect significant equity issuance.

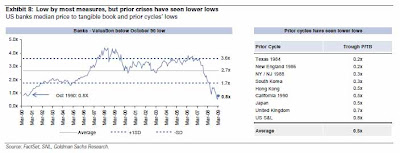

(4) Valuation may not provide a floor. We are now back to 0.8X tangible book, up from 0.5X two weeks ago. Both are low relative to long term averages. That said, when we look at prior severe regional home price depressions both in the US and globally, we find "trough" valuations within the range of 0.2X – 0.7X tangible book.