Wheee – that was fun!

Wheee – that was fun!

We had the dip we played for at the open but never came near our danger levels. We took bearish positions into the energy report, which had the big build we expected but we held our levels and our 11:18 Member Alert set bullish upside targets saying: "Nice bounce to retest our levels yet again. Effectively we fell from 7,400 to 7,285 so 115 and a 20% bounce is 23 so 7,308 is the line in the sand on the Dow. S&P fell from 778 to 767 so call 770 the big difference between a weak bounce and a serious attempt at a retrace. Russell is our bounciest index, back at 402 so let’s keep a close eye on them to see what’s real."

We had a weak bounce right back to my target 7,308 and, at 11:40, we were back to 7,286 but I said to Members: "Now next time they break up over the watch levels I’ll be a little more impressed if we survive this…" We took a stab at a couple of bearish covers, which quickly stopped out so at 1:41 I sent out an alert looking to take advantage of the dip, calling for the DIA $75s at .43 with a plan to flip bearish if the $72 puts hit .60 after the Fed minutes as we were expecting a huge move one way or the other. We never did need the put side and hit our $1.50 target (up 252%) just over an hour later. When we hit our stop out (.25 trailing stop).

I sent out an alert at 3:02, calling a top at 7,520 and flipping 70% bearish (the most we’ve been in a very long time) saying: "Wow, this is nuts! The Fed will buy Treasury paper – hooray! Scary that they have to, indicates last, desperate move if you think about it. Very important note to all. Last Fed day was Jan 28th, we gained 200 points on the day and it completely reversed the next day so cover, balance etc…. I personally and going 70/30 bearish here – let them keep going tomorrow and I’ll flip for the duration." So that’s our game plan for today, back to watching our levels and hoping for a reason to believe in the rally monkey once again.

Now for the bad news:

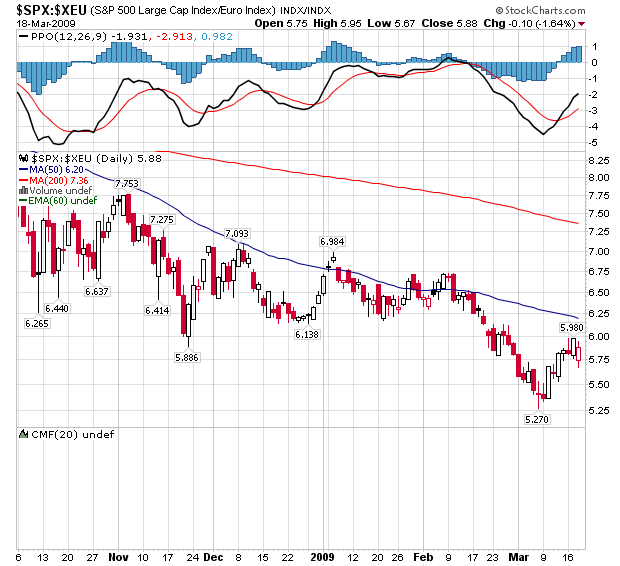

Does this chart look "wrong" to you? It’s the S&P priced in Euros, one of my three major concerns about this "rally." From a global perspective, the S&P, in fact, LOST 1.6% yesterday – it only seemed like a good day because the international buying power of the dollars your stocks are priced in fell nearly 5% on the Fed announcement and you can see that we barely held resistance that led to a huge dip at the beginning of the month. The other reasons we are concerned there may be a huge sell-off is that we have predicted the action of this market perfectly for over a week. How? Well we have our 5% rule and we also noticed that we are mirroring the "recovery" off the October 27th low -something I outlined in Friday’s Member Chat.

What happened in October? What I said Friday (and bears repeating because we’re right here NOW):

What I’m seeing, from a bear perspective, is the same pattern we made coming off the big drop into Halloween where the market ran down and down and down from 9/26 (11,143) to 10/27 (8,175) 26.6% and then rallied up 14% in the last week of October and then had a couple of more up days and went back off a cliff.

The reason I’m looking there is that they also did not have a blow-off bottom. Our last move has been down from 2/9 at 8,280 to 6,550 on 3/9 (20%) and then a run to 7,223 (10%). The failure of the October bounce was at 9,625, almost exactly 20% over the low and still 13.6% off the top, almost exactly a 50% retrace of the drop.

That means we need to be very cautious around 7,415 if we get a run like that, as that’s a 50% retrace off the top and would be up 13.2% from 6,550. If we look at it from a 5% rule perspective – We have a major drop from 11,000 to 6,500 (40%) which lines up with a Fib line at 38% and a 20% retrace of that drop is 900 points to, TADA 7,450!

This is how we arrive at magic numbers, when there is a confluence of events that all point to the same spot. The blow-off top on Nov 4th was about 300 points over the previous week but we started from 8,200, 26% more than 6,500 and 74% of 300 is 228 and we closed this week’s run at 7,223 and 7,223 + 228 is, TADA, 7,451!

We finished the day yesterday at 7,486 and we expect at least a retest of 7,450 but, as I said, the dollar changes everything and we’ll have to see how low our currency can go this week. The Euro is up nearly another 5% this morning (6:15) and even the Pound, where they are thowing money around as much as we are, is up 2% against the dollar this morning yet our pre-markets are trading down a bit. Our other major concern is historical – the last Fed meeting was Jan 28th, when the Fed first dropped the bomb on quantitative easing. That was an up 200 day on the Wednesday of a strong week and we fully retraced the next day and hit new lows the next two days.

So lots of reasons to be concerned, certainly people were concerned enough to buy gold yesterday. After a massive flush (as noted by David Fry in this chart), gold flew up to $950, making our futures traders very, very, very, happy as a single mini contract pays $5 per 0.1 move in gold and we got 750 of them from bottom to top as gold (not GLD) went from $880 to $955!

So lots of reasons to be concerned, certainly people were concerned enough to buy gold yesterday. After a massive flush (as noted by David Fry in this chart), gold flew up to $950, making our futures traders very, very, very, happy as a single mini contract pays $5 per 0.1 move in gold and we got 750 of them from bottom to top as gold (not GLD) went from $880 to $955!

This is what happens when your Central Bank goes on a shopping spree. The Fed will be purchasing $300 Bn in Treasury notes and inflation-protected Treasury securities with maturities of two years to ten years and will begin the program by late next week. The Fed also increased its ceiling on purchases of mortgage-backed securities guaranteed by mortgage giants Fannie Mae and Freddie Mac to $1.25 trillion from the previously set $500 billion.

While this sounds like a lot, don’t forget the US needs to sell $150Bn worth of notes PER MONTH to fund our $1.7Tn debt and China has already said they’re not so sure they want to keep playing the sucker in this game. Ignoring the fact that it’s patently ridiculous for our government to become the biggest buyer of our government’s debt (when we default, who gets screwed?), what are we really buying here other than time. Last year, we sold an average of $60Bn a month in notes, this year we need to increase that number by 150% so $300Bn can mask difficulties we have selling $150Bn a month for perhaps 3 months before we have a real auction and find out if there are real buyers out there for 10-year notes on the dollar at 3%. Certainly the Fed statement kept up the fantasy view that inflation is contained, despite both CPI and PPI coming in 100% over their forecasts IN THE SAME MORNING!

Mortgage rates dropped after the Fed first said it would buy mortgage-backed securities in December. But the decline in those yields stalled in recent weeks as Treasury yields had begun creeping higher and dragging other rates with them. The sour economic outlook convinced officials that they needed to move aggressively on new fronts. "The simplest explanation for the change in thinking is that the committee was increasingly losing hope in the prospect of a medium-term recovery in the economy," said Michael Feroli, a J.P. Morgan economist.

Mortgage rates dropped after the Fed first said it would buy mortgage-backed securities in December. But the decline in those yields stalled in recent weeks as Treasury yields had begun creeping higher and dragging other rates with them. The sour economic outlook convinced officials that they needed to move aggressively on new fronts. "The simplest explanation for the change in thinking is that the committee was increasingly losing hope in the prospect of a medium-term recovery in the economy," said Michael Feroli, a J.P. Morgan economist.

Japan took the bad news (95 Yen to the dollar) surprisingly well and only dropped 100 points from their open, finishing the day disappointingly under 8,000 at 7,945. The Hang Seng has a wild session, up and down 250 points but closed flat at 13,130 while the Shanghai Composite added half a point to 256. The BOJ did their best to keep the Yen down and held their own rates at 0.1% and announced they will spend $21Tn Yen to purchase bonds. Unfortunately, $21Tn Yen is "only" $247Bn but who knows, the way things are going it could be $500Bn very soon! 21 Trillion Yen – remember when I predicted we’d all better practice saying "Quadrillion" as we will have to start using it more often in the future? Zimbabwe is there already there as you need almost a Trillion dollars just to buy milk!

Europe is trading up about a point in early trading but we need to get back over the week’s high points around the US open for the move to have any legs. For the FTSE, that is 3,860, on the CAC it’s 2,840 and for the DAX, we need to break 4,060 to get the momentum we need to break out of this depressing-looking trend. In the U.K., Lord Adair Turner, chairman of the country’s financial watchdog, laid out recommendations for what he called a "profound" overhaul of banking supervision that, if adopted, will mark the end of more than a decade of light regulation in one of the world’s financial centers. At the same time, Germany’s finance ministry said it had drafted a bill that would give the country’s financial supervisor, Bafin, much greater power to control banks in Europe’s largest economy. Europe Cracks Down The changes in the U.K., said Lord Turner, will "inevitably impose some costs," but "the economy will be served better as a result."

![[U.K. and Germany Call for Tougher Regulation of Banks]](http://s.wsj.net/public/resources/images/NA-AW550B_REGUL_NS_20090318212143.gif)

If the new rules go into effect, banks in both countries will need to set aside more capital during boom times to help them survive busts, while dealing with a more interventionist regulator probing everything from their books to the capability of their staffs. In the U.K., the Financial Services Authority also wants to extend supervision to all institutions that act like banks, including large hedge funds. For investors, the changes will mean less profitable but safer banks, the FSA said. So, right now, US financials are celebrating that they are less regulated than their global counterparts but that is going to change hard and fast as Europe’s goal of next week’s G20 meeting is to bring US banking under international control.

Today we have C proposing a reverse stock split (great for shorts as they will have further to fall) and FDX reporting a 75% drop in profit and missing by a mile (.31 vs .46 expected) and guiding down to .45-.75 from expected .72 average. FDX also announced job cuts. If this doesn’t kill the markets, we REALLY are in a rally! GE has an investor conference in NY today and we’ll see if they can justify the almost 100% run in share price off the March 4th low.

Today we have C proposing a reverse stock split (great for shorts as they will have further to fall) and FDX reporting a 75% drop in profit and missing by a mile (.31 vs .46 expected) and guiding down to .45-.75 from expected .72 average. FDX also announced job cuts. If this doesn’t kill the markets, we REALLY are in a rally! GE has an investor conference in NY today and we’ll see if they can justify the almost 100% run in share price off the March 4th low.

We’re on the same levels as yesterday but we hope that the 10% levels become a bottom test if we’re really going to keep going. Stance is bearish at the moment but quick sale of DIA covers like the 3/31 $74 puts ($1.50) or the March $76 puts at $1.60 if you are good at day-trading with stops or the Apr $74 puts ($2.55) as a partial cover if you are not so sure.

I’d stay away from shorting the financials unless your longs are financial heavy. Weak dollar will support Dow exporters, especially the energy and tech sectors, who bring in half their revenues from overseas. Overall, the S&P gets 1/3 of their revenues from overseas so they should start outpacing the RUT if we keep going. So weak dollar will hurt the RUT first and they are near resistance at 425 but haven’t made it so that can be an upside stop on the RUT June $310 puts at $7, which should just about double on a $40 drop in the Russell (Tuesday’s open) and shouldn’t lose more than $2 on a $10-15 rise but $425 should be the stop line (or a great entry on the way down). This, of course, also terminates our upside plays on the May RUTs, which are better than triples already across the board unless they break through and hold 425, in which case we can go with a 20% (of the profits) trailing stop.

Here’s a sobering chart of the global markets, year to date. The flatline on the FTSE at -10% is very disturbing and, as we played for, we had our Nasdaq leadership on the way up but still 5% more to go to get back to 0, even on our leader. Our Jobless Claims came in at 645,000 for last week, just about in-line. We have Leading Economic Indicators at 10 and the Fed already told us those won’t be good along with the Philly Fed and if that hits the -40 estimate I’ll be very surprised as Richmond and NY missed by a mile.

Let’s have fun but keep a close eye on those levels, it’s going to be a wild ride!