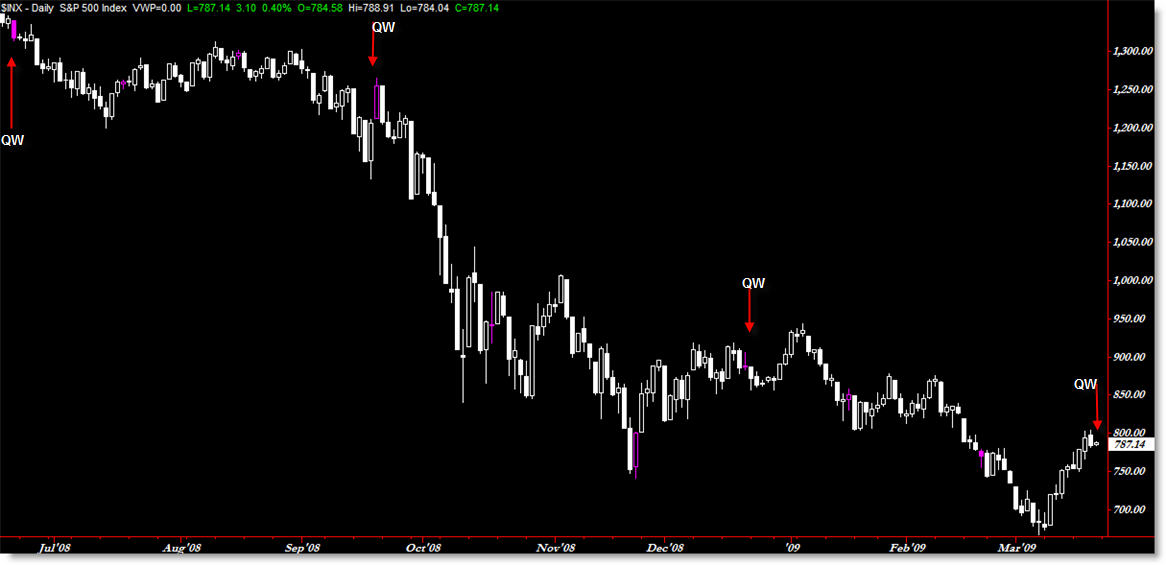

Courtesy of Corey Rosenbloom at Afraid to Trade.com

A Look Back on Prior Quadruple Witching Days

Friday brings us the infamous “Quadruple Witching” event which might be a big deal in the market, and it might not. Let’s define the concept and then look back in the past at some recent Quadruple Witching Days.

Options traders know that the third Friday of every month is “Options Expiration Days” which can lead to frenzied activity, volume, and volatility as large funds (and traders) ’square up’ any remaining open options positions before they expire and settle on Saturday. Perhaps they would prefer not to take posession of a large amount of stock, and so they may unwind hedges and/or sell/buy positions in the options (and stock) market.

Quadruple Witching occurs not only when equity options (like Google, Exxon-Mobile) and index options (like DIA, SPY), but also when futures contracts “roll over” and options on equity index futures (like @YM, @ES, @NQ) expire along with single stock futures options.

The following four components comprise a “Quadruple Witching” Day:

Equity Options

Equity Index Options

Index Futures Options

Single-Stock Futures Options

Often, the result is a rather erratic, volatile trading day that can confuse many intraday traders who aren’t aware of this occurrence. Quadruple Witching occurs on Expiration Friday in March, June, September, and December.

Let’s look back at regular Expiration Fridays and also Quadruple Witching Days in the S&P 500:

(You’ll need to click the chart for a larger image)

The last Quadruple Witching occurred on December 19th which resulted in a small-range day with volume running only slightly above the average at the time. It was a ‘dud’ in terms of normal Quadruple Witchings.

Prior to that, we had a decent range day on September 19th, with volume surging during the run-up to that Friday as price began its downslide into the October lows. That Friday took many traders by surprise as it was a sudden up-move in a down-swing that only served to delay the inevitable decline.

The first example shown on the chart comes from June 2008, where price formed a Trend Day Down on higher than average volume in the context of a down-swing.

So, not all Quadruple Witching days result in big moves, but the intraday squiggles (price swings) can occur seemingly randomly and not follow the typical expectations of technical analysis. Funds are balancing positions and they typically are looking at their books and not their charts to do so, which can cause seemingly perfect intraday trade set-ups to fail.

So, do trade with caution today but perhaps not with extreme caution. Some retail traders take these days off and start their weekend early. In the end, it’s up to you.

Corey Rosenbloom

Afraid to Trade.com