Mark Thoma presents a collection of thoughts on the administration’s soon-to-be announced Geithner plan.

"Despair over Financial Policy"

Courtesy of Mark Thoma, at Economist’s View

Reactions to the leaked details of the administration’s bank bailout plan. If I find any posts in support of the plan, I will add those in an update.

First, Paul Krugman:

Despair over financial policy, by Paul Krugman: The Geithner plan has now been leaked in detail. It’s exactly the plan that was widely analyzed — and found wanting — a couple of weeks ago. The zombie ideas have won.

The Obama administration is now completely wedded to the idea that there’s nothing fundamentally wrong with the financial system — that what we’re facing is the equivalent of a run on an essentially sound bank. As Tim Duy put it, there are no bad assets, only misunderstood assets. And if we get investors to understand that toxic waste is really, truly worth much more than anyone is willing to pay for it, all our problems will be solved.

To this end the plan proposes to create funds in which private investors put in a small amount of their own money, and in return get large, non-recourse loans from the taxpayer, with which to buy bad — I mean misunderstood — assets. This is supposed to lead to fair prices because the funds will engage in competitive bidding.

But it’s immediately obvious, if you think about it, that these funds will have skewed incentives. In effect, Treasury will be creating — deliberately! — the functional equivalent of Texas S&Ls in the 1980s: financial operations with very little capital but lots of government-guaranteed liabilities. For the private investors, this is an open invitation to play heads I win, tails the taxpayers lose. So sure, these investors will be ready to pay high prices for toxic waste. After all, the stuff might be worth something; and if it isn’t, that’s someone else’s problem. …

This plan will produce big gains for banks that didn’t actually need any help; it will, however, do little to reassure the public about banks that are seriously undercapitalized. And I fear that when the plan fails, as it almost surely will, the administration will have shot its bolt: it won’t be able to come back to Congress for a plan that might actually work.

What an awful mess.

Calculated Risk:

Calculated Risk:

Geithner’s Toxic Asset Plan, Calculated Risk: The NY Times has some details …

Toxic Asset Plan Foresees Big Subsidies for Investors: The plan to be announced next week involves three separate approaches. In one, the Federal Deposit Insurance Corporation will set up special-purpose investment partnerships and lend about 85 percent of the money that those partnerships will need to buy up troubled assets that banks want to sell.

In the second, the Treasury will hire four or five investment management firms, matching the private money that each of the firms puts up on a dollar-for-dollar basis with government money.

In the third piece, the Treasury plans to expand lending through the Term Asset-Backed Secure Lending Facility, a joint venture with the Federal Reserve.

More approaches doesn’t make a better plan.

The FDIC plan involves almost no money down. The FDIC will provide a low interest non-recourse loan up to 85% of the value of the assets. …

With almost no skin in the game, these investors can pay a higher than market price for the toxic assets (since there is little downside risk). This amounts to a direct subsidy from the taxpayers to the banks.

Oh well, I’m sure Geithner will provide details this time…

Yves Smith:

Private Public Partnership Details Emerging, Yves Smith: The New York Times seems to have the inside skinny on the emerging private public partnership … program. And it appears to be consistent with (low) expectations: a lot of bells and whistles to finesse the fact that the government will wind up paying well above market for crappy paper. …

If the money committed to this program is less than the book value of the assets the banks want to unload (or the banks are worried about that possibility), the banks have an incentive to try to ditch their worst dreck first.

In addition, it has been said in comments more than once that the banks own some paper that is truly worthless. This program won’t solve that problem….

And notice the hint of skepticism from the Times regarding the Administration’s supposition that the bidding will result in fair prices. Huh? First, the banks, as in normal auctions, will presumably set a reserve price equal to the value of the assets on their books. If the price does not meet the reserve (and the level of the reserve is not disclosed to the bidders), there is no sale; in this case, the bank would keep the toxic instruments.

Having the banks realize a price at least equal to the value they hold it at on their books is a boundary condition. If the banks sell the assets at a lower level, it will result in a loss, which is a direct hit to equity. The whole point of this exercise is to get rid of the bad paper without further impairing the banks.

So presumably, the point of a competitive process (assuming enough parties show up to produce that result at any particular auction) is to elicit a high enough price that it might reach the bank’s reserve, which would be the value on the bank’s books now.

And notice the utter dishonesty: a competitive bidding process will protect taxpayers. Huh? A competitive bidding process will elicit a higher price which is BAD for taxpayers! …

Paul Krugman again:

More on the bank plan, Paul Krugman: Why was I so quick to condemn the Geithner plan? Because it’s not new; it’s just another version of an idea that keeps coming up and keeps being refuted. It’s basically a thinly disguised version of the same plan Henry Paulson announced way back in September. …

[W]e have a bank crisis. Is it the result of fundamentally bad investment, or is it because of a self-fulfilling panic?

If you think it’s just a panic, then the government can pull a magic trick: by stepping in to buy the assets banks are selling, it can make banks look solvent again, and end the run. Yippee! And sometimes that really does work.

But if you think that the banks really, really have made lousy investments, this won’t work at all; it will simply be a waste of taxpayer money. To keep the banks operating, you need to provide a real backstop — you need to guarantee their debts, and seize ownership of those banks that don’t have enough assets to cover their debts; that’s the Swedish solution, it’s what we eventually did with our own S&Ls.

Now, early on in this crisis, it was possible to argue that it was mainly a panic. But at this point, that’s an indefensible position. Banks and other highly leveraged institutions collectively made a huge bet that the normal rules for house prices and sustainable levels of consumer debt no longer applied; they were wrong. Time for a Swedish solution.

But Treasury is still clinging to the idea that this is just a panic attack, and that all it needs to do is calm the markets by buying up a bunch of troubled assets. Actually, that’s not quite it: the Obama administration has apparently made the judgment that there would be a public outcry if it announced a straightforward plan along these lines, so it has produced what Yves Smith calls “a lot of bells and whistles to finesse the fact that the government will wind up paying well above market…”

Why am I so vehement about this? Because I’m afraid that this will be the administration’s only shot — that if the first bank plan is an abject failure, it won’t have the political capital for a second. So it’s just horrifying that Obama — and yes, the buck stops there — has decided to base his financial plan on the fantasy that a bit of financial hocus-pocus will turn the clock back to 2006.

Here is a Defense of Private Funds for Jump-Starting the Market for Troubled Assets by Lucian Bebchuk.

The main objection is that the government will (in essence) overpay for these assets, and that will cost the taxpayers money. In the meantime, the banks – which get a windfall from the overpayment for the assets – could recover and do just fine. If the administration insists on moving in this direction rather than adopting a version of the Swedish plan, why not require some insurance against future taxpayer losses, e.g. require firms participating in the bailout to sacrifice future equity shares equal to the value of any losses that fall on taxpayers? There are probably better ways to structure this, but having such insurance in place could help with the politics of the bailout which the administration does not seem to get. Taxpayers are in no mood to be giving away money to failed banks without assurances that it is justified, that there is no other plan that will well enough to provide a substitute and that they have been protected as much as possible in the process. This plan, at least what we know about it so far, does not meet those conditions. In particular, there are alternative plans such as the proposed derivatives of the Swedish plan that can be expected to work just as well, yet do not involve giveaways to failed banks.

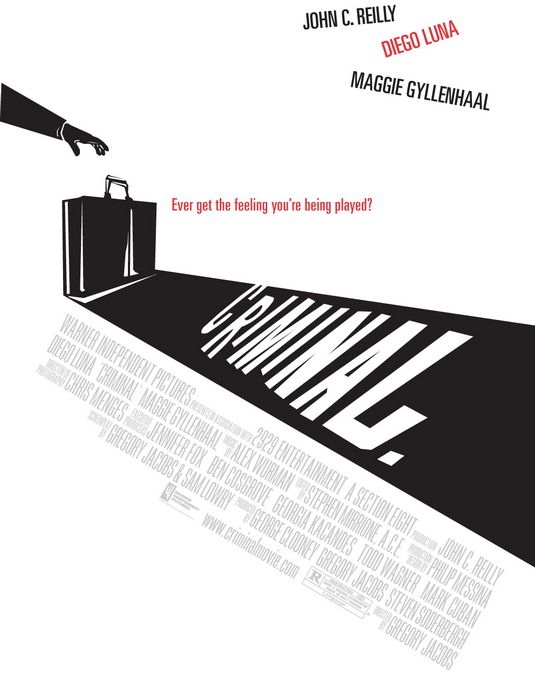

Update: More from Yves Smith, Investor on Private Public Partnership: "One would have to be a criminal to participate in this":

Hoisted from comments:

I am SAC Capital. I get to be one of the bidders on bank assets covered by the program

Citi holds $100mm of face-value securities, carried at $80mm.

The market bid on these securities is $30mm. Say with perfect foresight the value of all cash flows is $50mm.

I bid Citi $75mm. I put up $2.25mm or 3%, Treasury funds the rest.

I then buy $10mm in CDS directly from Citi [or another participant (BOA, GS, etc)] on the bonds for a premium of $1mm.

In the fullness of time, we get the final outcome, the bonds are worth $50mm

SAC loses $2.25mm of principal, but gets $9mm net in CDS proceeds, so recovers $6.75mm on a $2.25mm investment. Profit is $4.5mm

Citi writes down $5mm from the initial sale of the securities, and a $9mm CDS loss. Total loss, $14mm (against a potential $30mm loss without the program)

U.S. Treasury loses $22.75mm

Great program.

It’s just a scheme to transfer losses from the bank to the taxpayer with an egregious payout to a middleman (SAC) to effectively money launder the transaction.

You’ve also transmuted a $30mm economic loss into a $36.75mm economic loss because of the laundering. So its incredibly inefficient.

How did fraud and money laundering become the national economic policy of the US?

One would have to be a criminal to participate in this.

Folks, this IS even worse than I thought, and you know I have a constitutional predisposition to take a dim view of things…

Update: Jamie Galbgraith responds to the plan.

I’ve just been reading the NYT report. The central Treasury assumption, at least for public consumption, seems to be that the underlying mortgage loans will largely pay off, so that if the PPIP buys and holds, at an above-present-market price governed by auction, the government’s loan to finance the purchase will not go bad.

Recovery rates on sub-prime residential mortgage-backed securities (RMBS) so far appear to belie this assumption. …

The way to find out who is right is … examination of the underlying loan tapes — and comparison to the IndyMac portfolio — would help determine whether these loans or derivatives based on them have any right to be marketed in an open securities market, and any serious prospect of being paid over time at rates approaching 60 cents on the dollar, rather than 30 cents or less.

Note that even a small loss of capital, relative to the purchase price, completely wipes out the interest earnings on the Treasury’s loans, putting the government in a loss position and giving the banks a windfall.

If I’m right and the mortgages are largely trash, then the Geithner plan is a Rube Goldberg device for shifting inevitable losses from the banks to the Treasury, preserving the big banks and their incumbent management in all their dysfunctional glory. The cost will be continued vast over-capacity in banking, and a consequent weakening of the remaining, smaller, better- managed banks who didn’t participate in the garbage-loan frenzy. …

If I were a member of Congress, I would offer a resolution blocking Treasury from making the low-cost loans it expects to offer the PPIPs, until GAO or the FDIC has conducted an INDEPENDENT EXAMINATION OF THE LOAN TAPES underlying each class of securitized assets, and reported on the prevalence of missing documentation, misrepresentation, and signs of fraud. In the absence of a credible rating, this is the minimum due diligence that any private investor would require.

I hope what I’m driving at, here, is clear…

Update: From James Kwak, This Time I’m Not the One Calling It a Subsidy.:

Instead of coming up with one plan to buy troubled assets, it looks like the government has come up with three. … For now, I think the concerns I expressed last month still hold. If we take as given that the government will only negotiate at arm’s length with the banks (meaning the banks can decide at what price they are willing to sell the assets), then the most important thing is for the plan to work. But it’s not clear if the degree of subsidy offered will be enough to close the gap between what investors are willing to pay and what banks are willing to sell at. Having multiple buyers and using cheap Fed financing will increase the willingness-to-pay for these assets, but we won’t know a priori if it will exceed the reserve price of the sellers.

In the best-case scenario: (a) the government’s willingness to bear most of the risk encourages private investors to bid enough to get the banks to sell; (b) the economy recovers and the assets increase in price from the prices paid; (c) the investment funds pay back the Fed (which makes a small spread between the interest rate and the Fed’s low cost of money); and (d) the government gets some of the upside through its capital investments. (I think the main purpose of that government capital is to deflect the criticism that all of the upside belongs to the private sector.) In the worst-case scenario, the market stays stuck because the banks have unrealistic reserve prices. Perhaps the idea is that, in that case, the TALF will allow the government to (over)pay whatever it takes to bail out the banks.

Most encouragingly, the headline in the Times was “Toxic Asset Plan Foresees Big Subsidies for Investors,” indicating that the mainstream media have figured out the game. …

Update: Brad DeLong in The Geithner Plan FAQ notes that having a large share of the downside also means having a large share of the upside, so if the downtrodden assets appreciate after the government gains control of them, the Geithener plan could make money:

Update: Brad DeLong in The Geithner Plan FAQ notes that having a large share of the downside also means having a large share of the upside, so if the downtrodden assets appreciate after the government gains control of them, the Geithener plan could make money:

Q: What is the Geithner Plan?

A: The Geithner Plan is a trillion-dollar operation by which the U.S. acts as the world’s largest hedge fund investor, committing its money to funds to buy up risky and distressed but probably fundamentally undervalued assets and, as patient capital, holding them either until maturity or until markets recover so that risk discounts are normal and it can sell them off–in either case at an immense profit.

Q: What if markets never recover, the assets are not fundamentally undervalued, and even when held to maturity the government doesn’t make back its money?

A: Then we have worse things to worry about than government losses on TARP-program money–for we are then in a world in which the only things that have value are bottled water, sewing needles, and ammunition.

Q: Where does the trillion dollars come from?

A: $150 billion comes from the TARP in the form of equity, $820 billion from the FDIC in the form of debt, and $30 billion from the hedge fund and pension fund managers who will be hired to make the investments and run the program’s operations.

Q: Why is the government making hedge and pension fund managers kick in $30 billion?

A: So that they have skin in the game, and so do not take excessive risks with the taxpayers’ money because their own money is on the line as well.

Q: Why then should hedge and pension fund managers agree to run this?

A: Because they stand to make a fortune when markets recover or when the acquired toxic assets are held to maturity: they make the full equity returns on their $30 billion invested–which is leveraged up to $1 trillion with government money.

Q: Why isn’t this just a massive giveaway to yet another set of financiers?

A: The private managers put in $30 billion, but the Treasury puts in $150 billion–and so has 5/6 of the equity. When the private managers make $1, the Treasury makes $5. If we were investing in a normal hedge fund, we would have to pay the managers 2% of the capital and 20% of the profits every year; the Treasury is only paying 0% of the capital value and 17% of the profits every year.

Q: Why do we think that the government will get value from its hiring these hedge and pension fund managers to operate this program?

A: They do get 17% of the equity return. 17% of the return on equity on a $1 trillion portfolio that is leveraged 5-1 is incentive.

Q: So the Treasury is doing this to make money?

A: No: making money is a sidelight. The Treasury is doing this to reduce unemployment.

Q: How does having the U.S. government invest $1 trillion in the world’s largest hedge fund operations reduce unemployment?

A: At the moment, those businesses that ought to be expanding and hiring cannot profitably expand and hire because the terms on which they can finance expansion are so lousy. The terms on which they can finance expansion are so lousy because existing financial asset prices are so low. Existing financial asset prices are so low because risk and information discounts have soared. Risk and information discounts have collapsed because the supply of assets is high and the tolerance of financial intermediaries for holding assets that are risky or that might have information-revelation problems are low.

Q: So?

A: So if we are going to boost asset prices to levels at which those firms that ought to be expanding can get finance, we are going to have to shrink the supply of risky assets that our private-sector financial intermediaries have to hold. The government buys up $1 trillion of financial assets, and lo and behold the private sector has to hold $1 trillion less of risky and information-impacted assets. Their price goes up. Supply and demand.

Q: And firms that ought to be expanding can then get financing on good terms again, and so they hire, and unemployment drops?

A: No. Our guess is that we would need to take $4 trillion out of the market and off the supply that private financial intermediaries must hold in order to move financial asset prices to where they need to be in order to unfreeze credit markets, and make it profitable for those businesses that should be hiring and expanding to actually hire and expand.

Q: Oh.

A: But all is not lost. This is not all the administration is doing. This plan consumes $150 billion of second-tranche TARP money and leverages it to take $1 trillion in risky assets off the private sector’s books. And the Federal Reserve is taking an additional $1 trillion of risky debt off the private sector’s books and replacing it with cash through its program of quantitative easing. And there is the fiscal boost program. And there is a potential second-round stimulus in September. And there is still $200 billion more left in the TARP to be used in other ways.

Think of it this way: the Fed’s and the Treasury’s announcements in the past week are what we think will be half of what we need to do the job. And if it turns out that we are right, more programs and plans will be on the way.

Q: This sounds very different from the headline of the Andrews, Dash, and Bowley article in the New York Times this morning: "Toxic Asset Plan Foresees Big Subsidies for Investors."

A: You are surprised, after the past decade, to see a New York Times story with a misleading headline?

Q: No.

A: The plan I have just described to you is the plan that was described to Andrews, Dash, and Bowley. They write of "coax[ing] investors to form partnerships with the government" and "taxpayers… would pay for the bulk of the purchases…"–that’s the $30 billion from the private managers and the $150 billion from the TARP that makes up the equity tranche of the program. They write of "the Federal Deposit Insurance Corporation will set up special-purpose investment partnerships and lend about 85 percent of the money…"–that’s the debt slice of the program. They write that "the government will provide the overwhelming bulk of the money — possibly more than 95 percent…"–that is true, but they don’t say that the government gets 80% of the equity profits and what it is owed the FDIC on the debt tranche. That what Andrews, Dash, and Bowley say sounds different is a big problem: they did not explain the plan very well. Deborah Solomon in the Wall Street Journal does, I think, much better. David Cho in tomorrow morning’s Washington Post is in the middle.

One more update: Response to Brad DeLong by Paul Krugman

Brad DeLong’s defense of Geithner

Brad gives it the old college try. But he shies away, I think, from the central issue: the non-recourse loans financing 85 percent of the purchases.

Brad treats the prospect that assets purchased by public-private partnership will fall enough in value to wipe out the equity as unlikely. But it isn’t: the whole point about toxic waste is that nobody knows what it’s worth, so it’s highly likely that it will turn out to be worth 15 percent less than the purchase price. You might say that we know that the stuff is undervalued; actually, I don’t think we know that. And anyway, the whole point of the program is to push prices up to the point where we don’t know that it’s undervalued… more here.