Bill Cara at Cara’s Community discusses the manipulation of gold prices.

Cara’s Commentary & Community Chat

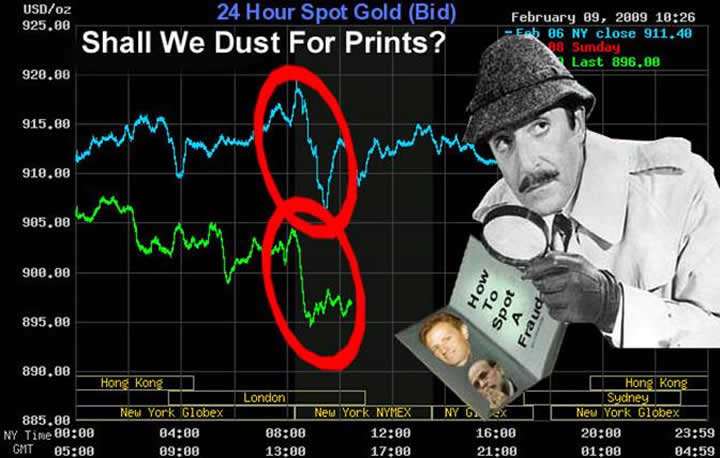

The discussion of the gold market inevitably comes down to whether or not the gold price is manipulated and by whom. GATA’s Bill Murphy has been an effective spokesperson for many people who are outraged that central bankers and the money center banks are motivated to suppress the price of gold, and they do it in a highly organized fashion. In the context of our need for free capital markets, I lend my voice to that argument as well. http://news.goldseek.com/GATA/1237997471.php

I believe that the money center banks and broker-dealers (Humungous Bank & Broker) work in combination with central banks and government in whatever way they can to ensure the risk-free trade. If it were in HB&B’s best interest to reverse the trade, ie, to inflate the price of gold via depressing the $USD, and that’s what central banks and govt wanted, that’s what HB&B would do. Their interest is to make a profit, and partnering with the US government and the Fed is a guaranteed winning move.

Yes, depending on the intentions of government, the price of gold has gone both ways in the past 100 years. In fact, during a severe deflation such as the 1930’s Great Depression, I believe that finance ministers, central bankers and HB&B did use gold as a policy instrument to end the economic woes of the time. The US government devalued the US Dollar and repriced gold from $20 to $35, but also seized people’s control over gold for about 35 years. After the people were allowed to trade gold freely in the late 1960’s, due to reflation needed to pay for Vietnam, the price of gold soared then too. During the high inflation 1970’s, the opposite was the case; the monetary authorities took actions intended to suppress the price.

So, there has always been a direct link between the $USD and gold. The common factor is the price rises when government needs it to rise, and it falls when it needs it to fall. HB&B is merely along for the ride.

http://en.wikipedia.org/wiki/History_of_the United_States_dollar

Because the US is in a severe financial crisis today, where the monetary authorities have now decided to reflate as they did in the early 1930’s and late 1960’s, I would not be surprised to see the gold price soon rally to $2500, along with the tacit approval of the international authorities, and I note that these people of the group of 20 most economically powerful nations will be meeting in London on April 2 to discuss issues like currencies and gold.

But whether the gold price is being supported or suppressed, it is my strong belief that both are wrong. What we the people need to argue is that these interventionists have no right to use capital markets as an economic policy tool. The independent owners of capital use the market as a legitimate price discovery mechanism, which ought to be our fundamental right since it is our capital. Government and central bankers should not have the right to use our capital against us.

Here is a reason why. The FOMC has decided to “stabilize” prices by buying bonds and pushing liquidity into the banks. They give their trading orders to the banks that immediately profit from them. Why not be fair about this and announce to the world that the policy decision was made and that following the six-week interval between that FOMC meeting and the next one, should the free market not adjust accordingly, the FOMC would start to trade in a fashion that would achieve the Fed’s objectives.

That is not being done because insiders would not profit from it. So, the bottom line is that I do believe intervention, at times is necessary, but policy announcements ought to be sufficient. What is happening today is a fraud against the public. These risk-free trades being handed to HB&B have got to stop.

Bloomberg TV’s interview with GATA Chairman Bill Murphy

Bill Murphy is the chairman of the Gold Anti-Trust Action Committee. In the video above, Bill speaks with Bloomberg’s Bernard Lo about global central banks’ intervention in the gold market. The video may also be found at Bloomberg, here.