Stock Jockey refers to 2008’s oil price manipulation swindle as the "other crime of the century," but it was also business as usual on Wall Street. The information in this article and those linked within might make you sick. – Ilene

The Other Crime of the Century: 2008’s Short Squeeze in Oil

Courtesy of StockJockey at 1440 Wall Street

There have been some remarkable swindles over the past year – Madoff, AIG etc etc. But the one that ravaged everyone’s pocketbook directly hit last summer.

The spike in oil to nearly $150 last July was breathtaking. And it was a killer blow to consumers around the world – the straw that broke the camel’s back as we moved deeper into a recession, and teetered on the brink disaster. At the time I was going apeshit over the price of crude, smelling a rat while peak oil types wore smug looks on their faces and shadowy industry analysts called for even higher crude prices:

May 21st

An analyst at Goldman Sachs, Mr. Murti has become the talk of the oil market by issuing one sensational forecast after another….Mr. Murti, 39, argues that the world’s seemingly unquenchable thirst for oil means prices will keep rising from here and stay above $100 into 2011. NYT

Yes, last summer Arjun Murti of Goldman Sachs was the Belle of the Ball, a regular Nostradamus living in New Jersey with two hybrid automobiles and an aversion to the media. As Barron’s said in early June of 2008, just as we headed into perhaps the biggest short squeeze in modern Wall Street history:

The 39-year-old analyst doesn’t give many interviews and keeps a low profile, preferring not to be photographed. But his strong views on energy have resonated across the financial markets.

Curious timing (he gave two high profile media interviews in three weeks) given what was going on at the time with SemGroup Holdings:

Curious timing (he gave two high profile media interviews in three weeks) given what was going on at the time with SemGroup Holdings:

When oil prices spiked last summer to $147 a barrel, the biggest corporate casualty was oil pipeline giant Semgroup Holdings, a $14 billion (sales) private firm in Tulsa, Okla. It had racked up $2.4 billion in trading losses betting that oil prices would go down, including $290 million in accounts personally managed by then chief executive Thomas Kivisto. Its short positions amounted to the equivalent of 20% of the nation’s crude oil inventories. With the credit crunch eliminating any hope of meeting a $500 million margin call, Semgroup filed for bankruptcy on July 22.

But now some of the people involved in cleaning up the financial mess are suggesting that Semgroup’s collapse was more than just bad judgment and worse timing. There is evidence of a malevolent hand at work: oil price manipulation by traders orchestrating a short squeeze to push up the price of West Texas Intermediate crude to the point that it would generate fatal losses in Semgroup’s accounts.

“What transpired at Semgroup was no less than a $500 billion fraud on the people of the world,” says John Catsimatidis, the billionaire grocer turned oil refiner who is attempting to reorganize Semgroup in bankruptcy court. The $500 billion is how much the world would have overpaid for crude had a successful scam pushed up oil prices by $50 a barrel for 100 days. Forbes

Of course the energy markets were full of intrigue at the time, but it appears in retrospect that it was business as usual on Wall Street – boys playing a game of high stakes poker, and one side had marked the cards:

What’s the evidence of this? Much is circumstantial. Proving oil-trading manipulation is difficult. But numerous people familiar with the events insist that Citibank, Merrill Lynch and especially Goldman Sachs had knowledge about Semgroup’s trading positions from their vetting of an ill-fated $1.5 billion private placement deal last spring. “Nothing’s been proven, but if somebody has your book and knows every trade, it would not be difficult to bet against that book and put the company into a tremendous liquidity squeeze,” says John Tucker, who is representing Kivisto.

What’s known for sure is that Goldman Sachs, through J. Aron & Co., its commodities trading arm, was in prime position to use such data–and profited handsomely from Semgroup’s fall. J. Aron was Semgroup’s biggest counterparty, trading both physical oil flowing through pipelines and paper oil, in the form of options and futures.

When crude oil peaked in July, Semgroup ran out of cash to meet margin requirements on options contracts it had with Aron, contracts on which it had paper losses of $350 million. Desperate to survive, Semgroup asked Aron to pony up $430 million it owed on physical oil. Aron said no, declared Semgroup in default on its contracts and demanded immediate payment of losses. Forbes

You can read the gory details at the Forbes website, but clearly something big was going down last spring. I had written a series of pieces on the shenanigans in the oil marts, starting with a nascent CFTC investigation:

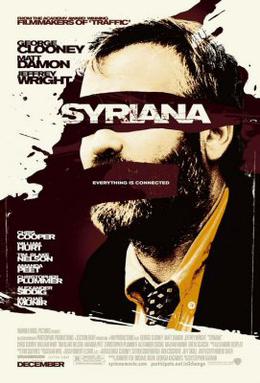

Stay tuned, this one could make Brian Hunter’s escapade look like amateur hour and Syriana merely a window to the real world machinations in the energy markets.

Alas, the investigation ultimately produced only the usual suspects – small time traders who had no powerful connections. The head of the NYMEX made a victory lap on CNBC’s Fast Money July 24th, crowing about the CFTC busting a group of odd-lot energy traders who made a few shekels while simultaneously SemGroup was neutered by powerful interests who had seen their trading book and shot against it, ultimately bleeding consumers of billions of dollars and tipping the economy into an ever deeper death spiral:

July 24th

Of course, while the CFTC busted a small Dutch energy prop trading firm today, accusing several principals of “banging” the market, in a fairly inept fashion, to make $1 million, there are clearly bigger hijinks going on.

And while pointing your finger at Morgan Stanley and Goldman Sachs might not be fair, the futures marts are a zero sum game, and chances are part of SEMGroup’s $3.2 billion loss might have ended up in the hands of the Wall Street titans, who have enough clout to intimidate regulators, and keep them at bay.

The energy markets are the biggest casino’s in the world, and the regulators are clueless, and somewhat powerless, to stop the shenanigans. The CEO of the NYMEX was on Fast Money tonight crowing about the bust, but nailing a couple of Dutch prop traders, who are clearly without any well placed friends, is not that impressive to me. 1440 Wall Street

Too, it seems the Feds were on the verge of something big on June 6th:

The chairman of a Congressional energy panel said Thursday that oil and products markets were being “manipulated” by the biggest trading houses in the futures markets, though he said a probe hasn’t uncovered illegal activity.

Bart Stupak, D-Mich., named Goldman Sachs (GS) and Morgan Stanley (MS) as two of the trading houses. He said the U.S. House Energy Oversight Committee hasn’t subpoenaed the banks and is basing its findings on data from the Commodity Futures Trading Commission.

Stupak said initial results of his committee’s investigation into skyrocketing oil and product prices had found loopholes in current laws were allowing the biggest traders in the futures market to “game the system.” He said the committee would hold a hearing to announce full results of the investigation on June 23.

“As our investigation goes further, we are really starting to unravel quite a web of – I am trying to say collusion, but I wouldn’t quite go that far – but you can certainly see manipulation of the price in places we’ve never seen before,” he said.

Asked if the biggest trading houses were Morgan Stanley and Goldman Sachs, Stupak said: “Yes, it’s them,” again stressing the lack of any evidence of illegal behavior.

“It’s not that they are doing anything criminally illegal…they are taking advantage where no one has ever looked before and when someone does take a look, there may be something illegal.” (DJ, cited in 1440 Wall Street)

But somebody muzzled Stupak – he changed his tune a few hours later and was never heard from again on the subject, as far as I know.

Of course these new allegations could not come at a worse time for Goldman, given that packs of anarchists are roaming the Streets with pitchforks.

But when it rains, it pours, and the shitstorm hanging over 85 Broad continues to intensify.

And if you are looking for someone to blame over the near $5 gas you saw at the pump last summer, you probably have your answer.

___________________________________________________

Did Goldman Goose Oil?

Forbes, by Christopher Helman and Liz Moyer,

Forbes Magazine dated April 13, 2009

May 21st

An Oracle of Oil Predicts $200-a-Barrel Crude

NYT

June 9th

What Mr. Crude Oil Sees Ahead

Barron’s

June 5th

Crude Oil Rips After Regulators Show Their Hand

1440 Wall Street

June 7th

Why Oil Spiked

1440 Wall Street

June 10th

CFTC Forms Interagency Task Force To Probe Commodity, Energy Trading

1440 Wall Street

July 24, 2008

SEMGroup Roils Oil Market But Questions Linger

1440 Wall Street

Aug 6, 2008

CFTC/NYMEX Come Clean and Revise Data on Oil Speculators

1440 Wall Street