More mortgage crisis excitement on the way — the majority of resets have not yet occurred. – Ilene

Mortgage Crisis Over? Please, It’s Just Beginning

Courtesy of Henry Blodget at ClusterStock

Now that all those sub-prime loans have defaulted and folks who couldn’t afford their houses have been evicted, the foreclosure crisis is over, right?

Wrong.

Why?

Because subprime loans aren’t the only loans that began with a couple of years of fantastic teaser rates that made houses seem affordable. And over the next few years, all of those other loans will reset.

Now that interest rates are low, the folks who still have jobs and equity in their houses will refinance. Others, however, will be stuck paying higher rates–or they’ll walk away from their houses.

Fund manager John Hussman of the Hussman Funds explains:

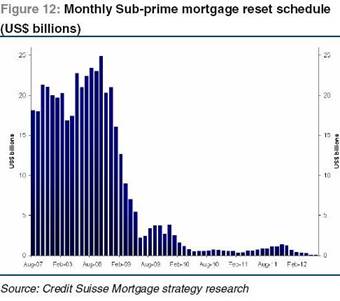

If there is any good news at present, it is that the capital infusions of late-2008 have temporarily stabilized the banking system, and that the U.S. economy is presently enjoying a brief and modest reprieve from the financial crisis. This is largely the result of an ebbing in the rate of sub-prime mortgage resets, which reached their peak in mid-2008, with corresponding mortgage losses and foreclosures a few months later. Since this crisis began, the profile of mortgage resets has been well-correlated with subsequent foreclosures.

Unfortunately, the reset schedule above depicts only sub-prime mortgages. As the recent housing bubble progressed, the profile of mortgage originations changed, so that at the very peak of the housing bubble, new originations took the form of Alt-As (low or no requirement to document income) and Option-ARMs (teaser rates, with no required principal repayments).

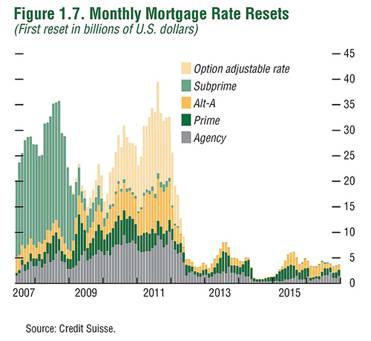

A broader profile of mortgage resets is presented below (though even this chart does not include the full range of adjustable mortgage products).

This reset profile is of great concern, because the majority of resets are still ahead. Moreover, the mortgages to which these resets will apply are primarily those originated late in the housing bubble, at the highest prices, and therefore having the largest probable loss. Though many of these mortgages are tied to LIBOR, and therefore benefit from low LIBOR rates, the interest rates on the mortgages are typically reset to a significant spread above LIBOR, and this spread remains constant as interest rates change. Undoubtedly, some Alt-A and option-ARM foreclosures have already occurred, but the likelihood is that major additional foreclosures and mortgage losses lie ahead. If we fail to address foreclosure abatement during the current window of opportunity (early to mid-2009), there may not be time for legislative efforts to contain the resulting fallout.

See also – additional articles on the housing crisis by Henry Blodget at ClusterStock: