Corey Rosenbloom revisits his comparison between the 1937-38 chart and the 2008-09 chart. – Ilene

Elliott Wave Similarities between 1938 and 2008

Courtesy of Corey Rosenbloom at Afraid to Trade

Earlier, I took a look at “Dow Jones Similarities Between Dow Jones 1937/1938 and Today” and then followed up with “The Resolution of the 1937 Bear Market,” both of which were high-traffic posts. Let’s take a special look now at the Elliott Wave structure as more price bars have developed since that report and the structure is still as eerily similar now as it was then.

Dow Jones 1937 -1938 with 5-Wave Structure:

One could have interpreted the final wave structure such that an “ABC” Wave 4 actually completed at the beginning of 1938 (meaning, replace “A” with a circled “4″) and then one might have an even more similar structure that’s playing out in today’s market – in that many analysts (myself included) were (maybe still are) expecting a final test of the March lows to mark a Five-Wave fractal pattern.

We see that in 1938, those expecting a final push to ‘double bottom’ or test the lows were disappointed, as price managed to retrace to the falling 20 EMA (off of a positive momentum divergence) and then form only half a test of the lows at 100 before marking the ‘bottom.’ We know from the “resolution” post that this was not the actual bottom of the bear market (it occurred in 1942) but this structure preceded a 62% price rally off the lows at circled Wave 5.

Let’s see how Today’s structure resembles that of yesteryear. I gave you a few more weeks to examine on the 1938 chart. If I froze the chart exactly similar to today, I would have done so at the Doji at the 120 level which came up into the falling 20 week EMA in April 1938 (how ironic).

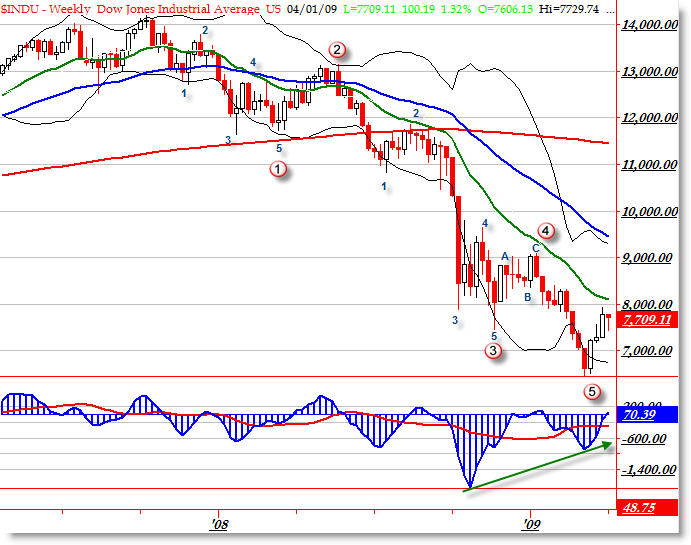

Dow Jones 2007 – 2009 with (possible) 5-Wave Structure:

A major takeaway is to watch very closely for a positive break above the falling 20 week EMA to assure us that any rally has legs. We’re seeing a very same oscillator and moving average structure, combined with the broader Elliott Wave structure.

IF the structures do wind up being more similar (and that is a big ‘if,’) then we could expect a weak downswing that may take us to the 7,000 level, but price would find support there before testing lows, and we could even get a continuation of this swing. There’s no certainty or guarantees in either direction, but sometimes it can be helpful (if only to give reference) to look at what’s happened before to see what has potential odds of happening again.

For now, I continue to be amazed at how similar this Bear Market (price-wise on the Dow Jones) appears to the last major Bear Market. The implication is that 6,500 may mark an intermediate low that could hold for a few years and give us a decent rally… but it might not be the absolute low.