Spencer at Angry Bear examines the March employment report in detail, finding slight reasons for optimism.

EMPLOYMENT REPORT

Courtesy of Spencer at Angry Bear

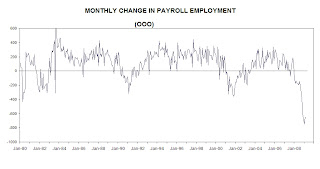

The March employment report continued the trend of the last few months with payroll employment down 694,000, about the same as the last few months. This brought the unemployment rate to 8.5% and job loses of some 5.3 million over the past year.

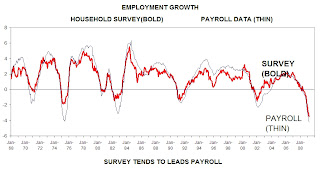

[Click on graphs for sharper images] The one encouraging item was a repeat of last month where the household survey is now showing weaker employment losses than the payroll survey. This is a leading indicator for the economy that I have watched for years. Interestingly, a couple of academics just published an NBER working paper where they discovered the cyclical pattern of the household survey leading the payroll survey at economic bottoms.

The one encouraging item was a repeat of last month where the household survey is now showing weaker employment losses than the payroll survey. This is a leading indicator for the economy that I have watched for years. Interestingly, a couple of academics just published an NBER working paper where they discovered the cyclical pattern of the household survey leading the payroll survey at economic bottoms.

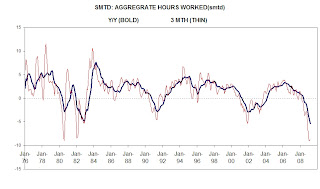

First quarter hours worked fell at an 8.7% annual rate versus a 7.4% annual rate in the fourth quarter. This data implies that the first quarter real GDP plunge could be worse than the fourth quarter despite the point that real PCE will probably grow at a 1% or higher rate. But this difference in real PCE growth should be offset by a massive inventory liquidation.

First quarter hours worked fell at an 8.7% annual rate versus a 7.4% annual rate in the fourth quarter. This data implies that the first quarter real GDP plunge could be worse than the fourth quarter despite the point that real PCE will probably grow at a 1% or higher rate. But this difference in real PCE growth should be offset by a massive inventory liquidation.

The economic cycle shifting from involuntary inventory accumulation to inventory liquidation is a positive economic development that signals we are closer to the end of the recession. Some people are actually starting to think the second quarter real GDP could show positive growth.

But that is a minority view. Inventory liquidation means firms are going from spending money to acquire goods they do not sell to selling goods they have already paid for. This shift does wonders for corporate cash flow and profits and sharply reduces the need to shed employees.

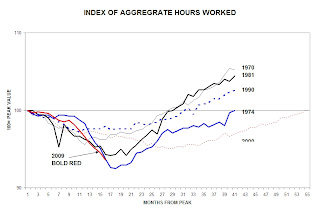

The index of hours worked is now at 93.6 — versus 100.0 at the peak. This is a more severe drop than the 94.2 in the 1981-82 recession and almost as bad as the 92.5 bottom in the 1974 recession.

The index of hours worked is now at 93.6 — versus 100.0 at the peak. This is a more severe drop than the 94.2 in the 1981-82 recession and almost as bad as the 92.5 bottom in the 1974 recession. With the weakness in employment we are finally starting to see the expected cyclical moderation in wage gains. Over the last three months average hourly earnings rose at a 2.2% rate and average weekly earnings only grew at a 1.0% annual rate. This implies that it will be very hard to sustain the first quarter growth in real PCE if oil prices continue to rise and/or significant tax cuts for consumers are not enacted.

With the weakness in employment we are finally starting to see the expected cyclical moderation in wage gains. Over the last three months average hourly earnings rose at a 2.2% rate and average weekly earnings only grew at a 1.0% annual rate. This implies that it will be very hard to sustain the first quarter growth in real PCE if oil prices continue to rise and/or significant tax cuts for consumers are not enacted.

Addendum:

Spencer (answering a question of mine): "The primary reason that consumer spending improved in the first quarter was the plunge in oil prices. Because of that inflation actually fell over the last six months and consumer real income rose. But if oil prices rise, inflation will rebound and real income will fall. With weekly earnings growing at a 1% rate it would take only a slight rebound in oil prices and/or inflation to turn the 1% nominal gain in weekly wages into a real drop in income."