Here’s another disturbingly fascinating article by Tyler Durden at Zero Hedge. – Ilene

Exposing The Utter Hypocrisy Of The FDIC, And How Andy Beal Is Making A Killing Off It

Courtesy of Tyler Durden at Zero Hedge

But first, there has been a lot of speculation about where banks have marked their commercial loan portfolios. Zero Hedge had previously discovered and disclosed interpretative data from Goldman, which concluded that the major banks were still stuck in a fairytale world where these loans were marked in the 90+ ballpark, a far, far cry from where comparable loans would clear in the market. Of course, FDIC’s head Sheila Bair (who many WaMu shareholders lately do not feel too hot about) had some interpretative voodoo of her own, claiming the bid offer disconnect is purely due to a lack of liquidity and access to financing:

"It has been clear for some time that troubled loans and securities have depressed market perceptions of banks and impeded new lending. Difficult market conditions have complicated efforts to sell these troubled assets because potential buyers have not had access to financing. The Legacy Loans Program aligns the interests of the government with private investors to provide financing and market-based pricing, and is a critical step forward in the process of restoring clarity to the markets. While there are inherent challenges to implementing a program of this magnitude quickly, the framework announced today provides the foundation upon which the FDIC will begin to build immediately."

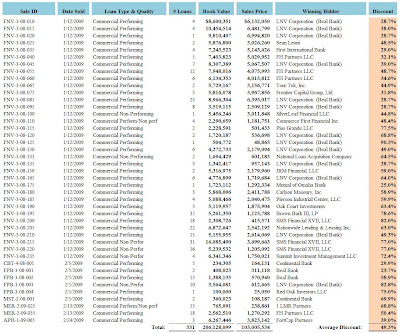

So it came as a big surprise that none other than the FDIC keeps a track of where commercial loans clear in its own internal auctions. In a relatively obscure part of the FDIC’s website, there lies a little gem of disclosure, which exposes all the rhetoric by Sheila Bair and by other members of the administration as hypocrisy on steroids. We bring you: FDIC’s closed loan sales database. Zero Hedge took the liberty of compiling some of the data for the benefit of our readers: we picked a data sort of all closed commercial loan auctions from January 1, 2009 to February 28, 2009, to see just at what level these would close. Of course, we highly recommend our readers recreate these results.

The results: 43 commercial loan auctions, of which 39 were for exclusively performing (so not non-performing, or lower quality auctions, and by implication free cash generating), consisting of 331 total loans, representing $206 million in face value, ended up clearing for a $103 million price, a 49.3% discount, or a 50.7% clearing price! That’s right, the FDIC itself clears performing commercial loans at 50 cents on the dollar on average in its own regulated, orderly auctions. One would assume the chairman of the very agency that conducts these loan auctions would be aware of them and would at least reference or mention these results in her numerous public appearances.

Curiously, the FDIC also discloses the winning bidders. The surprising recurring result: a little known (but deserving much greater attention) company known as Beal Bank (and its LNV Corporation subsidiary). In the first two months of the year alone, Beal Bank, and more specifically its owner Andy Beal, has won $73 million face value of auctions, for a price of $43 million- a clearing price of 59%. Another way of looking at it is that Beal accounts for 35% of all FDIC auctions.

Just who is Andy Beal, aside from a prolific and profitable poker-playing, college-dropout of course? A great question, which Forbes goes into great detail answering this weekend. We paraphrase the key points from Forbes:

Standing outside the glass-domed headquarters of his Plano, Texas, bank in March, D. Andrew Beal presses a cellphone to his ear. He’s discussing a deal to buy mortgage securities. In just a few minutes, the deal’s done: His Beal Bank will buy $15 million of face value for $5 million. A few hours earlier he reviewed details on a $500 million loan his bank is making to a company heading into bankruptcy–the biggest he’s ever done. A few floors above, workers are bent over computer screens preparing bids for chunks of $600 million in assets dumped by two imploded financial firms. In the last 15 months, Beal has purchased $800 million of loans from failed banks, probably more than anyone else.

It is amusing that Beal Bank, which is not large enough to qualify for the FDIC’s zombie bank life-support program known as TLGP, is beating the FDIC at its own game, gobbling up assets (at fair market prices, which is what auction outcomes are by definition). Beal is such a non-mainstream individual that Project Zero will hold a honorary bunk in his favor, (he will have to decide who gets top with Chuck Bowsher) until such time as he decides to stand outside ZH headquarters for 24 hours to gain admission:

It’s hard to imagine Beal fitting in at a bankers’ convention. He walked into the Las Vegas Bellagio in 2001 and challenged the world’s best poker players to games with $2 million pots–the highest stakes ever. Donning large sunglasses and earphones, Beal held his own against the poker stars, once winning $11 million in a single day, although he shrugs that he lost more than he won. At the track he’ll drive one of his nine race cars (costing as much as $100,000 each) at 150 mph. On city streets he cruises in a huge Ford Excursion, the vehicle that has made him feel safe since a drunk driver punctured his lungs in 2000.

However, the main reason why Beal is prophetic beyond his years is the following:

He thinks the government is going to be "disappointed" by its various programs to revive lending. He says Treasury Secretary Timothy Geithner’s new plan to guarantee loans to buyers of toxic assets won’t lead to many sales because the problem isn’t liquidity but price. They are not low enough. Half the country’s banks–4,000 in all–would be bust, he says, if they marked their loans to what the loans would fetch in an auction. He says banks are fooling themselves by refusing to mark busted assets down.

"Banks are on a prayer mission that somehow prices will come back and they won’t have to face reality," Beal says. And that reality, according to Beal, is going to get a lot worse. "Unemployment is going over 10%, commercial real estate hasn’t even begun collapsing and corporate credit defaults are just getting started," he says. His prediction: depression, without bread lines this time, thanks to the government safety net, but with equal cost to society.

It is a fitting conclusion that Beal himself is the winning bidder in FDIC’s commercial loan auctions (which no other major bank with a $ trillion+ balance sheet has any interest in participating in –  why is this if the loans are worth 90 cents as Citi et al have them market internally?), and thus the true market test of what all these toxic legacy loans are really worth. Zero Hedge wholeheartedly agrees with Beal that the CRE situation is headed for a cliff at 120 mph, and that no matter how much hypocritical posturing and rhetoric the administration spouts, or how many more trillions in debt the U.S. incurs to revive the financial zombie on the morgue dissection table, there is nothing at this point that can be done to change the final outcome.

why is this if the loans are worth 90 cents as Citi et al have them market internally?), and thus the true market test of what all these toxic legacy loans are really worth. Zero Hedge wholeheartedly agrees with Beal that the CRE situation is headed for a cliff at 120 mph, and that no matter how much hypocritical posturing and rhetoric the administration spouts, or how many more trillions in debt the U.S. incurs to revive the financial zombie on the morgue dissection table, there is nothing at this point that can be done to change the final outcome.