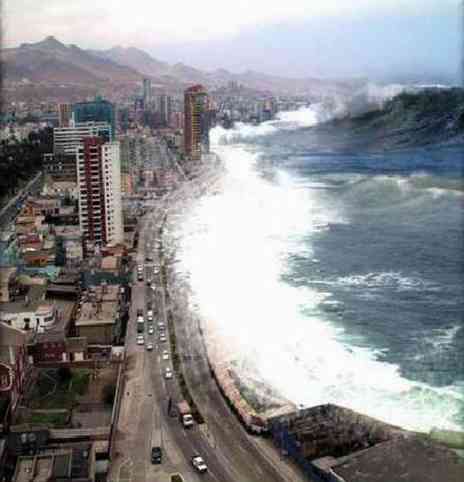

My friend Tim Naegele wrote this excellent article discussing his views for our country’s financial destiny and alluding to a tremendous, more frightening tsunami in violence that could be down the road. – Ilene

Commentary: Euphoria or the Obama Depression?

Courtesy of Timothy D. Naegele | Distributed by McClatchy-Tribune News Service

Former Federal Reserve Board Chairman Alan Greenspan’s "easy money" policies and laissez–faire attitude toward the regulation of banks and other financial institutions – a belief in self-regulation – gave rise to the housing "bubble" and our ensuing economic problems. When the bubble finally burst, a tsunami was released that has been rolling worldwide and hurting millions of people, with no end in sight to the enormous suffering.

Barack Obama is euphorically optimistic, but neither he nor the leaders of other countries can hold back an economic tsunami, just as mankind is helpless to stop the wrath of natural tsunamis in the oceans.

Obama supporter George Soros says: "There’s no sign that we are anywhere near a bottom." Obama’s business guru, Warren Buffett, believes the U.S. economy has "fallen off a cliff." Vernon L. Smith, Nobel Laureate in Economics, and Steven Gjerstad said recently: "The events of the past 10 years have an eerie similarity to the period leading up to the Great Depression." According to the Rasmussen Reports, most Americans – 53 percent, in fact – believe the United States is at least somewhat likely to enter a 1930s–like Depression within the next few years. If so, the repercussions are unfathomable.

Rupert Murdoch said: "We are in the midst of a phase of history in which nations will be redefined and their futures fundamentally altered. Many people will be under extreme pressure and many companies mortally wounded." Legendary former Federal Reserve Chairman Paul Volcker, who now oversees Obama’s economic recovery efforts, said recently: "I don’t remember any time, maybe even in the Great Depression, when things went down quite so fast, quite so uniformly around the world."

While Volcker was referring to the global economy, he could have been talking just as appropriately about Americans’ faith in the Obama administration during the months ahead.

The "New Deal II," or the most sweeping expansion of government in decades that is being put into place by Obama and the Democrats, will only prolong the "Great Depression II," not thwart its progress. Franklin D. Roosevelt’s New Deal programs did not end the Great Depression; the onset of World War II did. Years from now, economic historians may look back at this era and conclude that the world’s central bankers were overwhelmed and Depression–era "safety nets" did not work; and global market forces ultimately determined the depth and duration of the economic meltdown, not the politicians in Washington or anywhere else.

The tsunami that was released when the housing bubble finally burst may not run its course until about 2017–2019; and its effects will be devastating worldwide. There are no legislative solutions or quick fixes to the problems. The carnage between now and 2019 will approximate the Great Depression; and the world is only 10 percent to 15 percent into the meltdown. If anything, the United States will probably fare better than other countries – such as the United Kingdom and Third World countries, including Russia – despite the massive hemorrhaging and de–leveraging process that are under way here.

The tsunami that was released when the housing bubble finally burst may not run its course until about 2017–2019; and its effects will be devastating worldwide. There are no legislative solutions or quick fixes to the problems. The carnage between now and 2019 will approximate the Great Depression; and the world is only 10 percent to 15 percent into the meltdown. If anything, the United States will probably fare better than other countries – such as the United Kingdom and Third World countries, including Russia – despite the massive hemorrhaging and de–leveraging process that are under way here.

Barack Obama – or John McCain, if he had been elected – may be a one-term president because government bailouts and more spending will distort the markets, not solve the problems; and ultimately the buck stops with the president. Both Obama and former President Jimmy Carter are very smart; however, as the Carter era showed, sheer intelligence does not translate into successful presidencies. National security and other fiascos might hasten Obama’s political decline, which may happen to other politicians globally at an ever–accelerating pace.

International terrorism and other very real national security concerns still loom, which might produce flashpoints at any time. We have enemies who seek to destroy us – a fact that is sometimes forgotten as 9/11 recedes in our memories. While it might be attractive for the president and the Democrats to take a "meat ax" to the Defense Department, it would be foolhardy to gut our military precisely when it has been performing magnificently and its continued strength is needed most. America’s economic and military strength go hand in hand. Both are indispensable ingredients of our great nation’s future strength.

One of these factors alone presents daunting challenges for any president. Taken together, they potentially represent a maelstrom, the likes of which most Americans have never envisioned, much less experienced. Newsweek’s Howard Fineman suggests that there "is only one question on this great test of American fate: can (Obama) lead us away from plunging into another Depression?" Unfortunately, in all likelihood, the answer is "no." The economic tsunami will gain strength and finally run its course and take years to do so, stretching well into the next decade.

While U.S. politicians and their counterparts in other countries have been trying to convince their electorates that they have the answers, they are simply holding out false hopes that real solutions are at hand; and Americans are apt to realize this as the elections of 2010 and 2012 approach.

To use Paul Volcker’s words, politicians may not "remember any time, maybe even in the Great Depression, when (so many once–promising political careers) went down quite so fast, quite so uniformly around the world."

America and other nations are in uncharted waters; and their politicians may face backlashes from disillusioned and angry constituents that are unprecedented in modern times. Also, the limits of godless secularism and paying homage to the false gods of materialism may become self–evident.

ABOUT THE WRITER

Timothy D. Naegele, former counsel to the U.S. Senate Banking Committee and chief of staff to Sen. Edward W. Brooke, R-Mass., practices law in Washington and Los Angeles with his firm, Timothy D. Naegele & Associates, P.O. Box 6408, Malibu, Calif. 90264.

This essay is available to McClatchy-Tribune News Service subscribers. McClatchy-Tribune did not subsidize the writing of this column; the opinions are those of the writer and do not necessarily represent the views of McClatchy Newspapers, McClatchy-Tribune or its editors.

© 2009, Distributed by McClatchy-Tribune Information Services