Here’s an excellent review of the economy by Tyler at Zero Hedge. He calls attention to the fading divide between so-called democrats and republicans, and the emergence of a new division between investors and taxpayers – many of us are both. What’s being ignored by those celebrating an end of the banking crisis? For starters, the commercial real estate market. – Ilene

The Imminent Disinformation Schism

Courtesy of Tyler Durden at Zero Hedge

Speaking of facts, Time contributing author Douglas McIntyre, may have considered presenting some to justify his thesis that the "the great banking crisis of 2008 is over." Pointless regurgitation of secondary viewpoints serves no purpose in the mainstream media, especially not in formerly reputable mainstream media such as Time (Zero Hedge’s subscription is running out with no plans for renewal). It is even worse when the MSM represents as "facts" the disinformation by banks, who claim that the downward inflection point has been reached and ignore the full context: a much weaker mark-to-market methodology, the FDIC and SEC aiding and abetting wholesale "pennies on the dollar" blue light specials of bankrupt banks such as Wachovia and Washington Mutual, taxpayer funnels such as AIG being used to pad the top and bottom line, a financial system balance sheet which has over 70% of its assets guaranteed by the Fed and the Treasury, and lastly, a spike in commercial real estate deterioration to unprecedented levels.

Speaking of facts, Time contributing author Douglas McIntyre, may have considered presenting some to justify his thesis that the "the great banking crisis of 2008 is over." Pointless regurgitation of secondary viewpoints serves no purpose in the mainstream media, especially not in formerly reputable mainstream media such as Time (Zero Hedge’s subscription is running out with no plans for renewal). It is even worse when the MSM represents as "facts" the disinformation by banks, who claim that the downward inflection point has been reached and ignore the full context: a much weaker mark-to-market methodology, the FDIC and SEC aiding and abetting wholesale "pennies on the dollar" blue light specials of bankrupt banks such as Wachovia and Washington Mutual, taxpayer funnels such as AIG being used to pad the top and bottom line, a financial system balance sheet which has over 70% of its assets guaranteed by the Fed and the Treasury, and lastly, a spike in commercial real estate deterioration to unprecedented levels.

The cold facts – "When you stare at the abyss, the abyss stares back at you."

Why is everyone so afraid to stare at the proverbial abyss? Readers of Zero Hedge know all too well, about my fascination with the economic fundamentals, and my desire to expose the real abyss in all its deep glory.

I dare anyone: McIntyre, Kudlow, Geithner, Obama, to look at the chart below and tell me we are in a V shaped recession. Yes, ISM may be bottoming (at record low levels which is not indicative of much), and unemployment may soon be bottoming (it has not, yet somehow the market believes it is just a matter of time), however one look at the chart of accelerating commercial real estate delinquencies and what they mean for the multi-trillion commercial real estate market should stop any V-recovery fans dead in their tracks. [click on charts for sharper images]

I will present some more factual glances of the abyss, compliments to the good folk at Realpoint.

Through the February 2009 reporting period, the delinquent unpaid balance for CMBS increased by a substantial $1.2 billion, up to a trailing 12-month high of $11.99 billion. Overall, the delinquent unpaid balance grew for the sixth straight month, up over 244% from one-year ago (only $3.48 billion in February 2008) and now over five times the low point of $2.21 billion in March of 2007.

While a slight decline was noted in the 30-day and 60-day delinquent loan categories, the distressed 90+-day, Foreclosure and REO categories grew for the 15th straight month – up over 216% in the past year. This increase took place despite another $53.9 million in loan workouts and liquidations reported for February 2009 across 20 loans. Ten of these loans at $19.1 million, however, experienced a loss severity near or below 1%, most likely related to workout fees, while the remaining 10 loans at $34.8 million experienced an average loss severity near 46%. As additional pressures are placed on special servicers to maximize returns in today’s market, loss severities are expected to increase while liquidation activity is expected to slow further as fewer transactions occur. This would be the result of reduced or distressed asset pricing, lower availability of funds, and increased extensions of balloon defaults through the end of 2009 and into 2010.

While a slight decline was noted in the 30-day and 60-day delinquent loan categories, the distressed 90+-day, Foreclosure and REO categories grew for the 15th straight month – up over 216% in the past year. This increase took place despite another $53.9 million in loan workouts and liquidations reported for February 2009 across 20 loans. Ten of these loans at $19.1 million, however, experienced a loss severity near or below 1%, most likely related to workout fees, while the remaining 10 loans at $34.8 million experienced an average loss severity near 46%. As additional pressures are placed on special servicers to maximize returns in today’s market, loss severities are expected to increase while liquidation activity is expected to slow further as fewer transactions occur. This would be the result of reduced or distressed asset pricing, lower availability of funds, and increased extensions of balloon defaults through the end of 2009 and into 2010.

The total unpaid balance for all CMBS pools under review by Realpoint was $837.78 billion in February 2009, down from $842.8 billion in January. Both the delinquent unpaid balance and delinquency percentage over the trailing twelve months are shown in the chart above and the one below, clearly trending upward for the timeline.

The resultant delinquency ratio for February 2009 increased to 1.431% from 1.281% one month prior. Such ratios above 1% reflect levels not seen in since April 2005. What is more concerning, however, is that the delinquency percentage through February 2009 is more than three times the 0.399% reported one-year prior in February 2008. The increase in both delinquent unpaid balance and delinquency ratio over this time horizon reflects a slow but steady increase from historic lows through mid-2007.

Assumptions based on three-month historical data:

- Over the past three months, delinquency growth by unpaid balance has averaged roughly $1.65 billion per month, while the outstanding universe of CMBS under review has decreased on average by $3.5 billion per month from pay-down and liquidation activity.

- If such delinquency average were again increased by an additional 25% growth rate, and then carried through the end of 2009, the delinquent unpaid balance would top $32 billion and reflect a delinquency percentage slightly above 3.8% by December 2009.

- In addition to this growth scenario, if one adds the potential default of the $3 billion Peter Cooper Village / Stuyvesant Town loan and the $4.1 billion Extended Stay Hotel loan, the delinquent unpaid balance would top $39 billion and reflect a delinquency percentage near 5% by December 2009.

"V-shaped recovery" indeed. But let’s continue:

Special servicing exposure has also been on the rise, having increased for the 10th straight month to $17.11 billion in February 2009 from $14.38 billion in January 2009 and only $12.78 billion in December 2008. The corresponding percentage of loans in special servicing has also increased to 2.04% of all CMBS by unpaid balance, up from only 0.50% in both February 2007 and 0.67% February 2008. The overall trend of special servicing exposure since January 2005, by both unpaid balance and percentage, is presented in Charts 3 and 4 below.

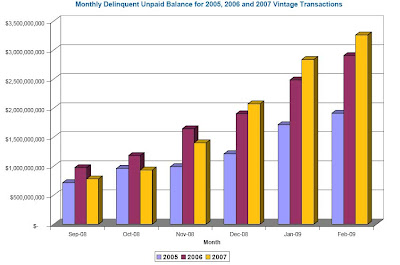

Realpoint’s default risk concerns for the more recent 2005 to 2007 vintage transactions relative to underlying collateral performance and payment ability are more evident on a monthly basis. Both the volume and unpaid balance of CMBS loans transferred to special servicing on a monthly basis continues to raise questions about underlying credit stability in today’s market climate for these deals, as evidenced by attached table. An additional 117 loans at $2.28 billion issued from 2005 through 2007 were transferred to special servicing in February 2009, mostly (but not only) for delinquency. Such figure reflected 71% of the current month’s transfers and 13% of total special servicing exposure in February 2009. Furthermore, over 51% of delinquent unpaid balance through February 2009 came from transactions issued in 2006 and 2007, with over 27% of all delinquency found in 2007 transactions. Extending a review to include the 2005 vintage, an additional 16% of total delinquency is found meaning over 67% of CMBS delinquency comes from the 2005 to 2007 vintage transactions. The chart below shows the increased delinquent unpaid balance relative to these three vintages over the past six months, clearly reflecting the increasing trends highlighted in recent months.

Throughout 2009, it is expected to see high delinquency by unpaid balance for these three vintages due to aggressive lending practices prevalent in such years. Also some loans from the 2008 vintage are expected to show signs of distress and default in cases where pro-forma underwriting assumptions fail to be met at the property level.

Focusing on deals that have seasoned for at least one year, the investigation reveals the following:

- Deals seasoned at least a year have a total unpaid balance of $822.94 billion, with $11.661 billion delinquent – a 1.42% rate (up from 0.5% six months prior).

- When agency CMBS deals are removed from the equation, deals seasoned at least a year have a total unpaid balance of $793.3 billion, with $11.656 billion delinquent – a 1.47% rate (up from 0.52% six months prior).

- Conduit and fusion deals seasoned at least a year have a total unpaid balance of $701.2 billion, with $10.78 billion delinquent – a 1.54% rate (up from 0.54% six months prior).

Other concerns/dynamics within the CMBS deals monitored which may affect the overall delinquency rate in 2009 include:

- Balloon default risk related to upcoming anticipated repayment dates (ARD’s) or term maturity from highly seasoned transactions for both performing and non-performing loans coming due in the next 12 months that may be unable to secure adequate refinancing due to current credit market conditions, lack of financing availability, or further distressed collateral performance.

- Refinance and balloon default risk concerns from floating rate transactions, as many large loans secured by un-stabilized or transitional properties reach their final maturity extensions, or fail to meet debt service or cash flow covenants to exercise such extensions.

- Aggressive pro-forma underwriting on loans with debt service / interest reserve balances declining, more rapidly than originally anticipated, on a monthly basis.

- Further stress on partial-term interest-only loans that begin to amortize during the year that already have in-place DSCRs hovering around breakeven.

- The unpaid balance related to loans underwritten in the past three years with DSCRs between 1.10 and 1.25 is very high, and any decline in performance in today’s market could cause an inability to make debt service requirements.

- A decline in distressed asset sales or liquidations as traditional avenues for securing new financing is becoming less available.

- Additional stress on both the retail and lodging sectors as consumer spending declines and the U.S. economy weakens.

Monthly CMBS Loan Workouts and Liquidations

The rate at which liquidated or problematic CMBS credits are replenished by newly delinquent loans remains a concern, especially regarding further growth to Foreclosure and REO status (evidence of additional loan workouts and liquidations on the horizon for 2009). Through February 2009, newly reported CMBS delinquency continued to outpace monthly liquidations by a very high ratio, raising concerns for further deterioration in the market.

In February 2009, 10 loans for $34.8 million experienced an average loss severity near 46% – a clear reflection of true loss severity in today’s credit climate. Higher levels of loss severity will be the norm in 2009 for those loans that experience a term default where cash flow from operations is not sufficient to support in-place debt obligations.

Since January 2005, over $7.52 billion in CMBS liquidations have been realized, while 44 of the trailing 49 months have reported average loss severities below 40%, including 21 below 30%. While average loss severity increased slightly for the 12 months of 2007 when compared to 2006, monthly loan liquidations by unpaid balance declined significantly in 2007 when compared to 2006 (by 43% year-over-year). Liquidations in 2007 totaled $1.094 billion at an average severity of only 32.8%. Liquidations in 2006 totaled $1.93 billion at an average severity of only 30.2%, while 2005 had $3.097 billion in liquidations at an average severity of 34.2%.

Comparison by property type:

- The highest loss severities in 2006 were found in healthcare (55%) and industrial (34.5%) collateral; multifamily collateral remained highest by balance before liquidation ($606.7 million), but reported the lowest severity (24.5%).

- The highest loss severities in 2007 were found in industrial (50%) and healthcare collateral (44%); multifamily collateral was again highest by balance before liquidation ($356 million), but reported the fourth lowest severity (32.5%).

- The highest loss severities in 2008 were found in mixed-use / other (36%) and multifamily collateral (31%); multifamily collateral was again the highest by balance before liquidation ($576.97 million).

Future Workouts – Delinquency Categories

The total balance of loans in Foreclosure and REO increased for the 16th straight month to $2.696 billion from $2.39 billion in January 2009, despite ongoing liquidation activity. These figures had declined steadily for some time through mid-2007, reflective of expedited loan work outs, but continue to be replenished with new loans due to aggressive special servicing workout plans. The chart below also shows the rapid growth of loans reflecting 30-day delinquency in the later half of 2008, transitioning rapidly into more distressed levels on a monthly basis, thus supporting the use of 30-day defaults as an early indicator of workouts to come in 2009.

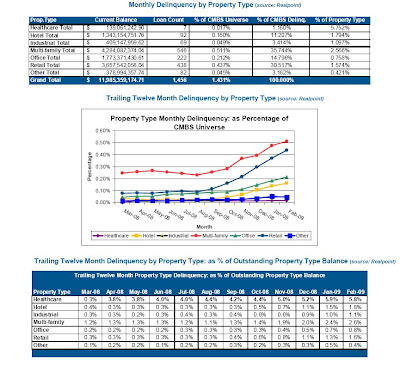

Property Type

- Multifamily loans remained a poor performer in January 2009, with over a 2.5% delinquency rate (up from only 0.9% in January 2008 – over a 177% increase).

- Multifamily loans also are the greatest contributor to overall CMBS delinquency, at 0.51% of the CMBS universe and over 35% of total CMBS delinquency (but down slightly for the second straight month).

- By dollar amount, multifamily loan delinquency is now up by an astounding $3.38 billion since a low point of only $903.3 million in July 2007.

- As shown in Chart 7 below, multifamily, retail, office and hotel collateral loan delinquency as a percentage of the CMBS universe have clearly trended upward since mid-2008.

- Only seven healthcare loans at 0.017% of the CMBS universe are delinquent, but such delinquent unpaid balance reflects 5.8% all healthcare collateral in CMBS.

- As a percentage of total unpaid balance, year-over-year delinquencies for all categories increased by triple digits from February 2008 to February 2009.

- In 2009 retail delinquency will increase substantially as consumer spending suffers from the overall weakness of the U.S. economy. Store closings and retailer bankruptcies will continue throughout the year.

- In addition, the hotel sector will likely experience an increase in delinquency as both business and leisure travel slows further.

Geography

- The top three states ranked by delinquency exposure through January 2009 changed as California surpassed Michigan in third position. This remained the same through February 2009. Together with Texas and Florida, these three states collectively accounted for 30% of CMBS delinquency.

- Previously in November 2008, New York had passed Michigan and moved into third place in the rankings, following the reported delinquency of the Riverton Apartments loan at $225 million (CD07CD4). New York is now in the fifth position when ranked by delinquent unpaid balance.

- The 10 largest states by delinquent unpaid balance reflect 62% of CMBS delinquency, while the 10 largest states by overall CMBS exposure reflect 53% of the CMBS universe.

- The state of Texas remains a major concern at over 11.5% of CMBS delinquency, concentrated within the Houston and Dallas-Fort Worth, MSAs (almost 9% of CMBS delinquency); however, such MSAs reflect a fairly low percentage of total exposure in their respective MSAs (at less than 3.4%).

- Four MSAs topped 4% of CMBS delinquency in February 2009 (up from three a month prior).

- The 10 largest MSAs by delinquent unpaid balance reflect 37% of CMBS delinquency, while the 10 largest MSAs by overall CMBS exposure reflect 34% of the CMBS universe.

…And the facts go on and on and on… yet not one of them is mentioned in McIntyre’s "analysis".

Commercial real estate is nothing more than a proxy for the intersection of the two historically core driving forces in the U.S. economy: real estate values and business conditions. And as the facts above indicate, the deterioration is only starting to pick up.

But what about all the stimulus programs skeptics will ask? The bail out packages? The constant funneling of taxpayer money into every underperforming segment of economy?

The truth is that the more taxpayer money is dumped to try to fill the abyss, it may become marginally shallower, but only at the expense of it getting wider. At some point soon (if not already), the U.S. economy will be unweenable from the trillions and trillions of taxpayer subsidies all the while it becomes more indebted to the both its investors and taxpayers, further exacerbating the abovementioned paradox (presumably not without a motive). As the multi-trillion CRE crash continues to deplete the left side of the financials’ balance sheet with an exponentially growing pace (and I have not even touched on the credit card topic), the banks will be left scratching their heads what accounting rules to bend, which insurance companies to implode and get another AIG-like piggybank, how to break REG-FD more and more creatively with select memo leaks, how to manipulate the market, and how to make the Tsy curve become even more upward sloping with the compliments of the Fed and the Treasury. In the meantime the disinformation rift between the American taxpayers and investors will keep growing until inevitably, one day, it will escalate to the point where empty promises on prime time TV by the administration’s photogenic representatives will not suffice, and real actions that benefit future American generations will be demanded… What happens after I have no idea.