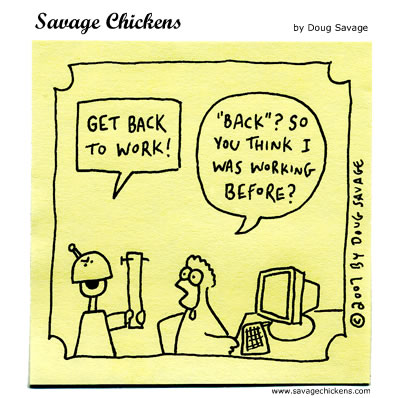

Welcome back!

Welcome back!

It's always hard coming back off a holiday weekend. Not everyone is in the mood to work and not everyone even shows up. Europe isn't showing up this morning as their markets are closed today but there's no Easter Bunny in mainland China, where the Shanghai gained 2.8% and Taiwan gained 1.3%. The Nikkei was down 0.4% on the day but Hong Kong, Thailand (where they are rioting), Australia and New Zealand were all closed for Easter Monday. So, all in all, a very slow morning in the markets so far yet US futures have still managed to sink about a point as of 7:45.

That's fine with us as we went into the weekend bearish, per the plan we had way back on Thursday morning, when I said: "We’ll be shorting into this morning rally because it’s stupid." We half-covered our longer puts with May $79 puts, giving us plenty of room to fall and, had I realized Europe was closed today as well, I may have been a little more bearish because my concern Thursday afternoon was that Asia would fly up on us (like China did) and then Europe would follow and give us an extension of the rally. Having Europe closed is like engaging the parking brake in the morning as any continuation of this "rally" will require a lot of outside capital to start drifting into the US markets.

We presented two sides to the rally this weekend at PSW: Jeremy Siegel had a very interesting article asking "Is The S&P Valued Too Low?" in which he makes some very excellent points that the S&P follows a flawed model when it comes to computing overall p/es for the index. John Mauldin, on the other hand, is being sarcastic when he asks "Is That Recovery We See?" and he backs my long-term inflation premise saying: "There is a limit to continued $2-trillion deficits without the appreciable rise in interest rates that will be needed to attract buyers of Treasury bonds." John gives us a definitive answer to his question and it's – No! Have I mentioned I like gold lately?

Goldman Sachs hit the "no" button too, serving blogger Mike Morgan of www.goldmansachs666.com with a cease and desist letter to get him to pull down articles like "Did Goldman-Sachs Scam System With AIG?", "Did Lloyd Blankfien of GS Lie to Congress?", "Does Goldman Sachs Manipulate the Stock Market?", "Did Goldman Sachs Manipulate World Oil Prices?" and "Does Goldman Sachs Run the World?" This led Barry Rhithotz to preface an article pointing out that our tax dollars are being funnelled to GS through Paulson's TARP set-up with "this post was written in International Waters a few miles off the coast of Grand Turks and Caicos. If Goldman Sachs wants to sue anyone over this, send your process server to the wreck of the B-29 bomber, off the north coast, approximately 80 feet below sea level."

Barry also had the quote of the week where he said in the NYTimes: "Understand the difference between an economy that is improving versus one that 'getting worse more slowly,' which is what we’re experiencing now." although he was given a run for his money by Carl Bass, the CEO of Autodesk, who responded to an analyst who asked whether there were any regions that had proven immune to the global slump by saying: "Well, I think Antarctica has been relatively immune, maybe Greenland as well, although not Iceland – as we all found out." There is a disturbing trend of economic gallows humor you see in fed-up blogs and even some of the MSM, something that tends to happen when people feel overwhelmed by a tragedy.

We have overwhelming and possibly tragic data coming this week, so much so that I'll just copy in the economic calandar from Briefing.com as we'll be referring to it often this week:

| Date | ET | Release | For | Actual | Briefing.com | Consensus | Prior | Revised From |

|---|---|---|---|---|---|---|---|---|

| Apr 14 | 08:30 | Core PPI | Mar | 0.0% | 0.1% | 0.2% | ||

| Apr 14 | 08:30 | PPI | Mar | 0.0% | 0.0% | 0.1% | ||

| Apr 14 | 08:30 | Retail Sales | Mar | 0.5% | 0.3% | -0.1% | ||

| Apr 14 | 08:30 | Retail Sales ex-auto | Mar | 0.2% | 0.1% | 0.7% | ||

| Apr 14 | 10:00 | Business Inventories | Feb | -1.2% | -1.1% | -1.1% | ||

| Apr 15 | 08:30 | Core CPI | Mar | 0.1% | 0.1% | 0.2% | ||

| Apr 15 | 08:30 | CPI | Mar | 0.1% | 0.2% | 0.4% | ||

| Apr 15 | 08:30 | Empire Manufacturing | Apr | -36.0 | -35.0 | -38.2 | ||

| Apr 15 | 09:00 | Net Long-Term TIC Flows | Feb | NA | NA | -$43.0B | ||

| Apr 15 | 09:15 | Capacity Utilization | Mar | 69.7% | 69.7% | 70.9% | ||

| Apr 15 | 09:15 | Industrial Production | Mar | -0.9% | -0.9% | -1.4% | ||

| Apr 15 | 10:30 | Crude Inventories | 04/10 | NA | NA | +1645K | ||

| Apr 15 | 14:00 | Fed's Beige Book | ||||||

| Apr 16 | 08:30 | Building Permits | Mar | 545K | 550K | 547K | ||

| Apr 16 | 08:30 | Housing Starts | Mar | 560K | 550K | 583K | ||

| Apr 16 | 08:30 | Initial Claims | 04/11 | 645K | NA | 654K | ||

| Apr 16 | 10:00 | Philadelphia Fed | Apr | -32.0 | -32.0 | -35.0 | ||

| Apr 17 | 09:55 | Mich Sentiment-Prel | Apr | 59.0 | 58.5 | 57.3 |

As if all this exciting data isn't going to be enough, we also begin to get some earnings crossing the wire. CHINA leads off the interesting names for the week this morning with low expectations of a break-even performance. Tomorrow we will be off to the races right out of the gate with PPI, Retail Sales ahead of the bell along with earnings from CBSH, FAST, GS, JNJ and GWW. That's has the potential to take us up to 8,200 or back down to 7,600 all by itself. Tuesday evening we hear from ADTN, CSX and INTC so that may mark the end of the Nas rally or confirm it.

Wednesday will be wild with CPI and Industrial Production AND the dreaded Beige Book, which we know will suck because we read the Fed minutes. That morning we hear from ABT, SCHW, INFY, BTU, PJC and PGR with CCK, KMP, STX and STLY reporting after the bell. Thursday it's Housing Starts (or lack thereof) and Jobless Claims and the always-depressing Philly Fed along with earnings (or lack thereof) from: BLK, CY, GCS, GCI, GPC, HOG, ITW, RX, JPM, MTG, NOK, NVR, ORB, PH, SHW, SON, LUV, VIP and PPG. In the evening we'll get BIIB, GOOG, IRSG, PBCT, SNDK and WERN and then it's options expiration day with AOS, BBT, C, FHN, GE, MAT, OSTK and PRSP.

Needless to say, we will continue to play it conservatively unless and until we see our 8,200 line broken and held on the Dow. That was my target for AFTER earnings and we still think the early exuberance shown by the markets has been irrational, to say the least. There is a difference between irrational and completely unfounded though – and that is what we hope to discover this week as we begin to get a little clarity (we hope) from the early Q1 reports.

As we expected, the EIA is lowering their long-term oil demand forecast yet again and that should be good for the OIH and oil puts we stuck with into that BS rally last week. One encouraging item this morning is that there will be probe of "lending practices of institutions that received public funds, following a rash of complaints about increases in interest rates and fees." This is what I was complaining about last week and it's nice to know the government is actually paying attention this time. We'll be watching the bank earnings very closely to see what they are doing with our money other than widening the crack spreads they make on loans they already have out, without even writing new ones that are desperately needed.

Tonight we have a Big Chart Review, where we'll see how we've done over the past two weeks and we'll review our levels but, for today, we're simply looking to hold a floor at Dow 7,900, S&P 833, Nasdaq 1,580, NYSE 5,225 and Russell 444 but, below that, there is very little support down to Dow 7,636, S&P 805, Nas 1,525, NYSE 5,075 and Russell 420 so – be careful out there!