Courtesy of Simon Johnson at The Baseline Scenario

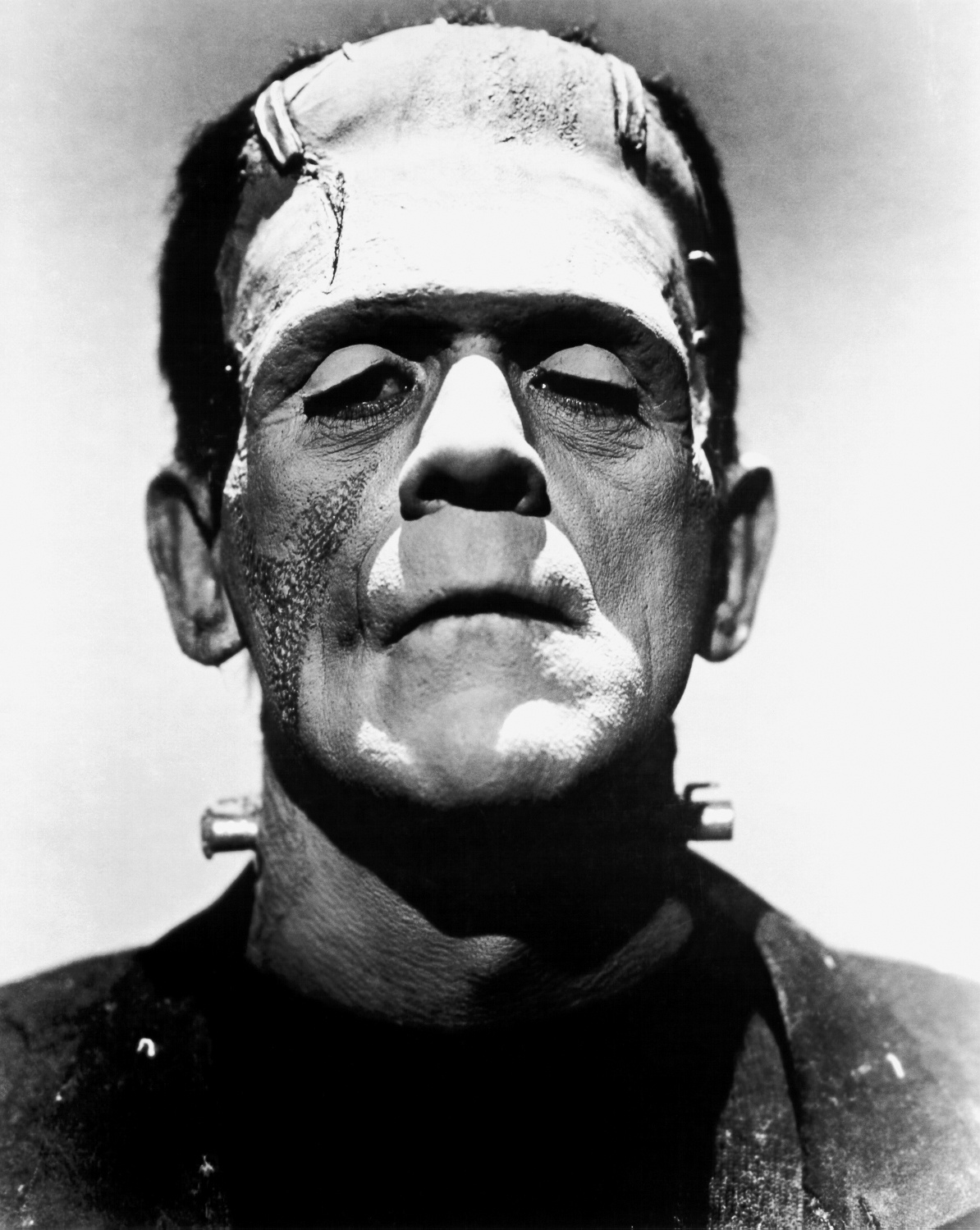

The Bank Run Next Time (Frankenstein’s Monster)

Think about the current and potential future pressure on our largest banks like this. The underlying problems are deep, but the “run” comes from the credit default swap market, and presumably from experienced professional investors – many of whom used to work in the largest banks.

The big banks helped set up these markets. They trained many of the people who are now engaged in speculative attacks on these banks. And the excessive bonuses of yesterday form the capital base for many hedge funds that now lead the attack.

In my Economix column at NYT.com this morning, I explore the ironies and emphasize the dangers. The system may have a tendency to self-destruct, but don’t think that the costs to the rest of us will be anything less than huge.

Bank Runs: Past, Future and Right Now

By Simon Johnson Simon Johnson, a professor of entrepreneurship at M.I.T.’s Sloan School of Management, is the former chief economist at the International Monetary Fund.In the past, bank runs in the United States were literally a pedestrian affair. People would line up in person to withdraw money, and a long line outside a bank meant only one thing: Go check on your own accounts…

Sadly, it turns out we haven’t outgrown runs. Rather, we have learned since mid-2007 that other kinds of runs — let’s call them wholesale or professional investor runs — are not only possible but also increasingly likely in the United States…

Over the last two years we have repeatedly seen versions of this same kind of wholesale run, but now the targets are some of the world’s biggest banks. These banks have obviously made very bad decisions but no one knows exactly how bad, and the betting is about how quickly they will become less creditworthy or actually default. It’s also about how much government financial support will be provided to these banks and on what basis.

The irony is that it’s the financial markets and instruments (particularly credit default swaps) developed by our biggest banks that have helped drive some of them out of business and that now put the remainder on the brink of collapse. These markets are not the underlying cause of the banks’ problems (the back story is here), and questions about the solvency of banks today would remain a brake on economic recovery whether or not markets recognized it…

You might find this irony amusing, particularly if bankers have annoyed you of late. But remember this: The administration has little financial bailout money left and Congress is signaling that further funds to this end will not be forthcoming — in six months, the Treasury has squandered a reputation for safeguarding taxpayer value that was built up over 200 years. Great financial collapses can lead to great depressions.

You might find this irony amusing, particularly if bankers have annoyed you of late. But remember this: The administration has little financial bailout money left and Congress is signaling that further funds to this end will not be forthcoming — in six months, the Treasury has squandered a reputation for safeguarding taxpayer value that was built up over 200 years. Great financial collapses can lead to great depressions.

NY Times article here.