Here’s an interesting post by Mish on a few additional risks to options present during expiration week. – Ilene

S&P 500 (SPY) Max Pain Analysis For April 2009

Courtesy of Mish

Here is an interesting chart of SPY options from Rob Roy at Atlantic Advisors.

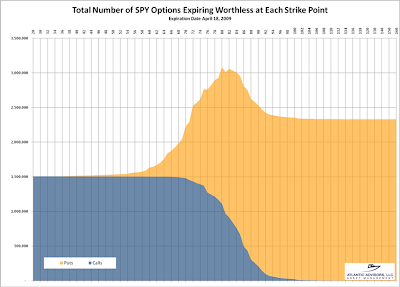

SPY Options Expiring Worthless At Each Strike Point

click on chart for sharper image

Rob writes:

Well, it’s options expiration week again – so time to look at where all of the options bets have been placed. Even with the move dramatically higher in equities, we can see from the chart above that there are about 65% more puts outstanding than there are call options (orange is much greater than blue area). The open interest in SPY options is showing that people are quite cautious about the move higher and are overall wanting to protect these gains.

With the SPY closing Friday at $85.81, the greatest number of options would expire worthless if the SPY were to fall to $80 which would be a drop of 6.77% this week. Nearly as damaging to option holders overall would be a fall to $82 which is only a drop of 4.44%. With 5 days of trading, this is all quite possible.

There are two concepts at play during expiration week which we will watch. The first (and most devious) is the idea that the government likes to intervene in the market during expiration week because the panic that ensues can create the greatest effect on the market. This seems to be a consistent theme to keep in mind, but one that is hard to predict.

Secondly, the concept of pin risk is the effect that the underlying share price will be pulled in the direction of the option strike with the greatest number of contracts outstanding. This is a function of traders having built delta neutral positions and needing to manage the exposure to risk either through unwinding the option position or by adjusting their position in the underlying stock. The potential effects of pin risk grows as you get closer to the moment of expiration, and as the underlying price is close to a strike price that has a lot of option contracts outstanding. Wikipedia has a very nice explanation of Pin Risk.

Expiration week is always interesting, so keep your eyes open.

Rob Roy

PresidentAtlantic Advisors, LLC

In addition to Pin Risk causing gravitation towards the strikes causing the most options to expire worthless (maximum pain), there is also a possibility of a melt-up or melt-down scenario in the event of a strong move away from maximum pain.

For example, PUT owners could decide the market is going higher and start selling their PUTs to get what they can for them (before they expire worthless). The selling of puts would force the hedgers to cover short positions providing a lift to the market. These kinds of things often feed on themselves during option expirations week.

One often hears the claim 90% of options expire worthless. While that may be true, the cemeteries are lined with those selling cheap out of the money options attempting to collect premiums.

For example, a CALL buyer has a known risk. A CALL seller’s risk is theoretically unlimited. Nearly every month some option on some random stock soars from $.10 to $3.00. All it takes to wipe one out is to be overleveraged on the wrong side of such an event.