Never before have such important earnings moved the market so little!

Last night we heard from GOOG who once again pulled a rabbit out of the hat with an 10% increase in revenues as there was a huge surge in searches relating to unemployment, bankruptcy, foreclosures, loans, alcohol and gambling proving that there is always someone who can fiddle while Rome burns. We are thrilled, of course, as we played GOOG to flatline and it looks like we'll get our wish as my trade idea on Google in yesterday's Member Chat was: "May $400 calls for $17.25, selling Apr $400s for $9 and May $370 puts for $15.55, selling Apr $370 puts for $7.15." We'll see how it actually performs but anything between $370 and $400 should be a very nice win on this trade!

As David Fry's chart indicates, GOOG was already driven hard to fill it's October gap and faced significant resistance at $390. Also facing significant resistance at Google is their market share, which was 79.9% in October of 2008 and is 81.39% as of March. Another negative that came out of the CC was that the company is getting lower click conversion rates, possibly indicating that this form of advertising is being ignored more often by the users. In fact, AdSense revenue was down (3%) for the first time ever. As GOOG is still very much a one-trick pony, the analysts on the line pressed management hard about how they could monetize other products and what new revenue streams they would be developing. To Google's credit, people have been worried about this for 2 years yet, despite the recession, the company did post their best quarterly profit ever and they did it the way well-managed companies do – by watching the bottom line.

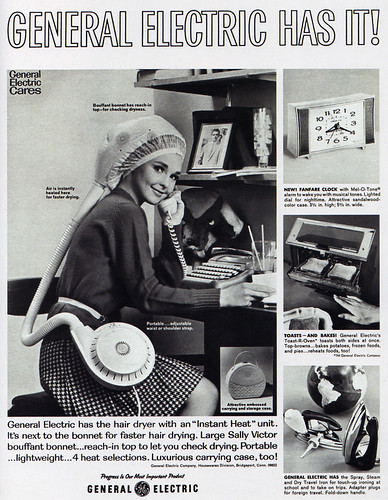

GE handily beat low expectations of .21 per share earning .26 despite revenues being down 9% from last year. "Only" a 36% drop in quarterly profit is good enough for the bulls and GE is up 5% pre-market. Don't get me wrong, I love GE and we've been playing them positive for quite some time but this is the BEST company in the market. GE barely scraping by is no reason to stage a broad market rally! Another best of breed is CitiGroup and they also were "less worse" than expected with losses of just .18 per $4 share for the quarter but analysts had projected a .34 loss so yay, I guess… Investment Banking saved C's quarter with revenue DOUBLING from last year to $24.8Bn, something not every bank can fall back on to save themselves from taking $24Bn in losses on a $21Bn market cap like C did.

GE handily beat low expectations of .21 per share earning .26 despite revenues being down 9% from last year. "Only" a 36% drop in quarterly profit is good enough for the bulls and GE is up 5% pre-market. Don't get me wrong, I love GE and we've been playing them positive for quite some time but this is the BEST company in the market. GE barely scraping by is no reason to stage a broad market rally! Another best of breed is CitiGroup and they also were "less worse" than expected with losses of just .18 per $4 share for the quarter but analysts had projected a .34 loss so yay, I guess… Investment Banking saved C's quarter with revenue DOUBLING from last year to $24.8Bn, something not every bank can fall back on to save themselves from taking $24Bn in losses on a $21Bn market cap like C did.

Of course, as with GS, we wonder how much of that $24Bn windfall came through the AIG money that was doled out to banks last quarter but one can only hope C continues to set record investment banking profits to offset record losses in other divisions. The credit card division, for example, COST them $10Bn with $7.3Bn in loan losses forcing another $2.7Bn in reserves to be set aside. Credit costs at its North American card business almost doubled, rising 91%, in the first quarter as stressed consumers continued to miss payments and default at ever increasing rates. Citi said that the managed net credit loss ratio increased almost 4 percentage points, to 8.88% in the Citi branded virtual portfolio and by more than 5 percentage points, to 12.40% in its retail partners' virtual portfolio. "Continued weakening of leading credit indicators and trends in the macro-economic environment, including rising unemployment, higher bankruptcy filings, and the housing market downturn, drove higher credit costs," the bank said in a press release. "Credit costs also reflected a significant increase in delinquencies, as well as the continued acceleration in the rate at which delinquent customers advanced to write-off," it concluded.

So party on markets! That's right, move along bears – nothing to see here… It has been fun but now it is getting al little scary as we have what I've been calling a "relief bubble" where the market is flying up on news that really isn't very good at all. As an example: C put a buy on HPQ with a target of $51, just $1.85 below the 2007 high! That would make HPQ worth 6 times more than C ($21Bn), maybe they can buy them in a stock swap as it would only dilute them 15%… It's like we’re going to wake up next week and all of the last year or so will have been some bad dream and the Dow will be back at 14,000 and Cramer will tell you to buy POT at $300 because it’s going to $500 and RIMM will have a p/e of 120 and be on somebody’s buy list…. Ah, good times!

So party on markets! That's right, move along bears – nothing to see here… It has been fun but now it is getting al little scary as we have what I've been calling a "relief bubble" where the market is flying up on news that really isn't very good at all. As an example: C put a buy on HPQ with a target of $51, just $1.85 below the 2007 high! That would make HPQ worth 6 times more than C ($21Bn), maybe they can buy them in a stock swap as it would only dilute them 15%… It's like we’re going to wake up next week and all of the last year or so will have been some bad dream and the Dow will be back at 14,000 and Cramer will tell you to buy POT at $300 because it’s going to $500 and RIMM will have a p/e of 120 and be on somebody’s buy list…. Ah, good times!

Good times are already here – US market performance is up 26% since March 9th but that's nothing compared to Russia (up 42%) or India (up 34%) or Hong Kong (up 37%), who just tacked on another 18 points this morning. Sure, they started the day 400 points higher than that but, shhhhh – it's a party! I said yesterday one of the surest things in the market is shorting the Nikkei after lunch and today was no exception with a 100-point dip after a Bento box but a stick save at the end left them up 152 for the day and flat for the week. Japan, South Korea and Taiwan finished the week lower overall but Japan really cracked me up this morning as techs led their rally after Toshiba posted "only" a $2.5Bn loss for the year, which was $300M better than expected. That was our theme for the week of course – things are getting worse more slowly and that's all we needed to hear but we are now pushing the envelope of sustainability. Even LG gained 1% today after leading the downturn yesterday with awful guidance.

Europe was led higher by the banking sector with LYG jumping 14% and I will be making a play on them for a buy/write but we need to see where they end up today. UBS is also looking like a nice play and it seems like buying the stock for $11.90 and selling the June $11 puts and calls for $3.35 should put us in for net $8.55, a 29% profit if called away and, if UBS closes below $11 and more stock is put to us, our average entry will be $9.78, a 16% discount off the current price. We're still going to hedge with FAZ though as this whole "rally" can end very badly. FAZ is a good way to cover a financial pullback but a dangerous stock to play so we like the hedge offered by the July $6 calls at $4.55, selling the May $10 calls for $2. That's a net entry of $2.55 which can go to $4 before your caller is in the money. Using coverage like this enables you to fend off a lot of downside risk on your financial holdings without committing too much to the protection. If you manage to collect another $2 in June, this becomes very cheap protection!

We still haven't made our high-hopes target of 8,200 for the week and we hope to hold 8,200 into the close but there's nothing I can imagine happening in the next 7 hours that will make us go less than 55% bearish into the weekend. We already rolled up our long puts into yesterday's exciting close and, as I'm sure you can tell from the commentary, we are less than impressed by the earnings data so far. Thank goodness the markets were closed while BIDU spiked to $210 yesterday as we may have lost our nerve on our shorts but they are back below $200 now and looking good. FSLR is also progressing well and we'll see how those play out. Now that we have a week of earnings under our belts, we can start picking some fun plays for next week and I'll be writing about that over the weekend so stay tuned.

If it's a real rally, we're going to hold Dow 8,100, Nasdaq 1,650, S&P 855, NYSE 5,400 and Russell 465 – anything less than this on 2 of the 5 levels will put us 60% bearish (uncovered on long puts). Watching our levels kept us bullish yesterday as only the Dow gave us trouble. In fact, I had said to members at 10:53, as we tested the low on the Dow for the day: "If however, only the Dow fails and the others hold, we should take a turn up in the Dow seriously as it’s a silly index and really doesn’t count as much as the others so if it comes back without the others failing, then this was a false sell-off."

Let's hope we can continue to spot the turns that well today – with options expirations, anything can happen so be careful out there.