Courtesy of Corey Rosenbloom at Afraid to Trade

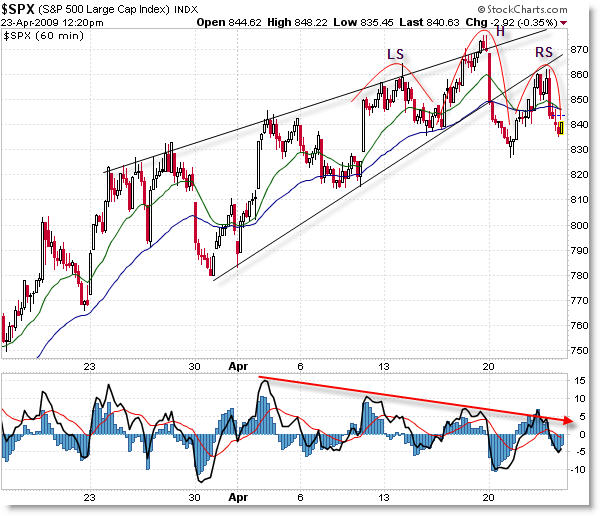

Head and Shoulders Now Forms on SP500 with Rising Wedge Break

That’s a lot to say in one headline! In addition to a (so far) confirmed downside break of the bearish rising wedge on the S&P 500, an ominous Head and Shoulders pattern has now formed on the 60 minute structure. Let’s take a look at this new development.

If there ever was a confluence sell signal, this is it. Does it guarantee price will go down? No, but let’s look at what just happened.

On Monday, we saw a strong momentum move down off the upper trendline of the bearish rising wedge which I had been discussing previously. Not only did we gap down off that level, but we officially broke out of the rising channel at that time. That was an intermediate-term sell signal (to play for a price expansion move down).

Price has risen to re-test the lower trend channel (which offered an even better short-sell signal, as price often re-tests the breakout point before plunging lower) and today we are seeing a continuation of the inflection down off that level (at roughly 860).

That alone is a powerful signal with a low risk (stop either above 870 or 880, depending on your risk tolerance) and high profit target (a test of the 750 level or perhaps as low as the 666 March low, though that would be an aggressive target).

On top of the bearish wedge breakdown, a possible Head and Shoulders (reversal) pattern has formed on the most recent price swings. Look closely to see the left shoulder, head, and right shoulder in pure form. The Right Shoulder formed on the re-test of the rising lower trendline.

The neckline now rests at around 830, and a break of that level would set-up a price projection move down to the 780 level (the projection is taken from the Head to the Neckline – roughly 45 points – and then subtracted from the neckline at 830).

Adding to the fray, we have a lengthy negative momentum divergence that has set-in (also known as the “Three Push” reversal pattern). In addition, a Cradle Sell trade just formed on the hourlies (note the 20 EMA crossing under the 50 EMA).

If bulls (buyers) manage to invalidate these ominous chart patterns – which is a possibility – it would go directly against the odds and historical significance of these patterns.