What a wild ride this is!

What a wild ride this is!

On Tuesday, DB asked: Phil – Is it "I am going with my gut and playing for a 300-point drop tomorrow or Thursday (test results Thurs after close). " OR "we will get a masive relief rally led by the Nikkei, who have to catch up from vacation, followed by Europe making their 40% levels and then we can go off to the races." That was because I had warned the bears, that I expected a huge move up on the announcement BUT I also went bearish into Thursday's close, expecting to flip bullish this afternoon. That was now 150 points ago and, like all who were foolish enough to fight the Fed, GS et al – I got burned on my bearish bets.

Now the question is, how do we play things now? Obviously, it's downright scary to be bearish but now we are up the full 5% from Friday's close and 10% in 2 weeks. It seems incredible that we can do this without a pullback but we're sleeping compared to the Hang Seng, which is up almost 20% in 7 sessions AND ONE OF THEM WAS A HOLIDAY! So if you are an angry US bear, just be glad you are not a Hong Kong bear…

It's not just the acceleration of the release of the stress test results that sent the markets rocketing higher but a massive change of attitude (and a 2.5% drop in the dollar) which is exemplified by GM today, which rose from $1.66 to $1.76 in pre-markets after "earnings" came in at a "only" a $9.78 per share loss. GM was expected to lose $11 per $1.66 share FOR THE QUARTER and the $1Bn market cap company did spend $10.2Bn more than it took in during this 90-day period. Of course it helped a bit that GM was given $30Bn of free money during this period, avoiding all those nasty borrowing costs and I'm sure investors are relieved that they are probably going to be diluted by about 60Bn shares (currently there are 600M shares) so the $9.78 per share loss will "only" be a .0978 per share loss next quarter – what an amazing turnaround!

"Our first quarter results underscore the importance of executing GM's revised Viability Plan, which goes further and faster to lower our break-even point," said Chief Executive Fritz Henderson. "Our Plan is designed to fix the fundamentals of our business by restructuring and deleveraging our balance sheet, enhancing our revenue capability and dramatically reducing costs." What really helped GM, but no one is talking about, is the fact that they made less cars than they did last year. As I pointed out in my March 6th TV appearance, GM loses $20,000 per car they make and my advice to GM at the time was "stop making cars." Well, it looks like they took my advice to heart and managed to save $1.2Bn by making 60,000, less cars than they did in Q1 last year. So GM's plan is to get governrnment aid to deleverage the balance sheet, enhance revenues by selling off divisions and dramatically reducing costs by NOT making costly automobiles. I have to admit it's better than my plan of wrapping GM in a big box, giving it to China's Wen Jiabao as a birthday present and then run away shouting "no backsies."

That may sound juvenile and irresponsible but so is ignoring the fact that oil has creeped back to $58 a barrel, costing US consumers $10Bn a month more than $40, and the markets are essentially celebrating the return of business as usual on Wall Street and we are simply repeating every mistake that destroyed half the savings of the American people as the market overheated and went from 11,000 in July of 2006 to 14,200 in July of 2007 (up 27.5%). Now we've run the Dow from 6,500 on March 9th to 8,500 on May 6th (up 30.8%) yet everyone on TV is suddenly telling you to get in, after telling you to say out for the last 30%. Don't get me wrong, we were BUYBUYBUYing 2,000, 1,000 and even 500 points ago but there is such a thing as pushing your luck. I feel terrible because we took our first break on our Buy List since October and we're missing some very nice gains since April expirations but I still don't feel we're really out of the woods. Today's retail numbers are NOT good (other than WMT of course, up 5%!).

The Hang Seng did not get off to a good start, gapping up to 17,300 but falling 300 points all the way into lunch. That lunch must have been fantastic though as they got most of it back in the afternoon and finished the day up 2.3% at 17,217. Betting the Hang Seng to get pumped up after lunch has been an even surer thing than betting the Dow to get pumped up at 2:30 – buying at the close and selling at the open has been the way to play the Dow lately as overnight sessions have gone "buy only" lately. The Nikkei, as I mentioned, hit the 5% rule but looks ready for more tomorrow and the Shanhai paused flat while the rest of Asia did fairly well on a strong Australian jobs report.

The Hang Seng did not get off to a good start, gapping up to 17,300 but falling 300 points all the way into lunch. That lunch must have been fantastic though as they got most of it back in the afternoon and finished the day up 2.3% at 17,217. Betting the Hang Seng to get pumped up after lunch has been an even surer thing than betting the Dow to get pumped up at 2:30 – buying at the close and selling at the open has been the way to play the Dow lately as overnight sessions have gone "buy only" lately. The Nikkei, as I mentioned, hit the 5% rule but looks ready for more tomorrow and the Shanhai paused flat while the rest of Asia did fairly well on a strong Australian jobs report.

"Even if you believe the rally is overdone and/or premature, it is difficult to go against the trend at the moment," said analysts at Calyon. "Many investors who have sat on the sidelines will eventually have to capitulate, which could either mark the last leg of the rally or provide fuel for much further upside." Those are words of wisdom, if we can break 8,650 and hit our 40% levels (see Big Chart Review), they could quickly become the floor for the next leg of this rally. "We feel this revision marks the end of negative news flows for the banking sector for the time being. While news on capital increases needs monitoring, overall our impression is that share prices will rebound," Nikko Citigroup analyst Hironari Nozaki wrote in a report.

EU markets are up another 2% this morning (8:30) as the ECB cut rates to 1% and the BOE added $76Bn to their bond-buying plan. This quantitative easing by the UK sent the Pound down 1.5% after the announcement but the restrained move by the ECB sent the Euro up 1%. Overall, the dollar is down another point this morning (down 2.75% against the Aussie dollar – a move which I had predicted last month) and gold is flying up to $925 but oil is hopefully topping out at $58. The EU also approved a $24Bn rescue plan for Commerzbank in exchange for 25% of Germany's 2nd largest bank. That will place the bank under EU restrictions, forcing it to divest some 45% of its current balance sheet. It also faces a three-year ban on buying rival financial institutions and can't undercut rivals — such as with higher interest rates on savings deposits — where it has a market share over 5%. I wonder how many US banks would take that deal?

In addition to WMT, TGT also posted a 5% increase in same-store sales and unemployment was "only" 601,000 last week – not as good as the ADP report but a green shoot is a green shoot, no matter how small. Another reason for investors to celebrate is the total lack of action by the SEC to change anything. As David Weidner says in today's WSJ: "The drumbeat for change at the SEC is growing fainter. The House Financial Services Committee is more occupied with credit card rates, Internet gambling and executive compensation than with remaking Wall Street's rules. Once promised radical structural changes, we are instead getting the kind of reform normally enacted by career bureaucrats such as Ms. Schapiro: None."

So everything old is new again and that means it will be time to buy financials, oil companies and consumer stocks until it all falls apart again. We're not creating any jobs but we are creating mountains of new consumer debt as we get them spending again by pumping up the optimism even as we set our 14th consecutive record week of continuing unemployment, now at 6.3M and despite the fact that we know that both GM and Chrysler alone will be laying off about 200,000 more in the next 3 months. Why is that OK? Because it doesn't matter if the people you lend money to go broke and can't pay – the government will bail you out! Oh sorry, not you the bankrupt taxpayer – you're screwed! I mean YOU, the banker and that bailout money comes from the remaining taxpayers who are able to pay so we can keep doing this until we run out of taxpayers so let's enjoy the ride while it lasts.

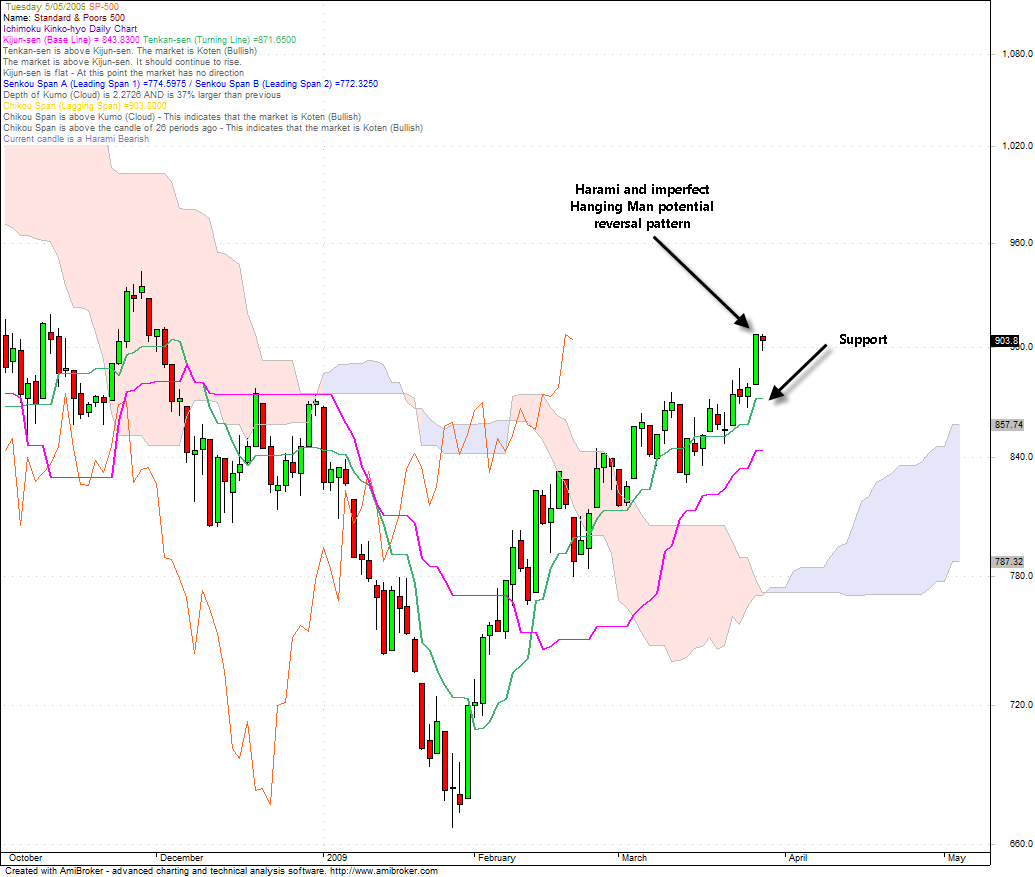

Our plan yesterday was to wait for the gap up open (check) and press our short bets for the pullback but keep in mind that Russell 514 cancels all bearish bets. Our main plan is to cash out our long plays and hope we make something on the short side but we'll have to let that go as we move to cash for the weekend. Next week, if the markets survive, we'll be looking at commodities, financials and (and I can't believe I'm saying this) energy companies as we go with the flow once again.