A lot of mail we get from people interested in our service had the question: "Are option trades as easy to follow as stock trades?"

A lot of mail we get from people interested in our service had the question: "Are option trades as easy to follow as stock trades?"

I think the quick answer to that is yes for straight options and no for spreads but like many things that are worth doing, they are worth learning. I'm going to start a new teaching series here so we can analyze some trades after the fact as practice may make perfect but it also pays to go over our winners as well as our mistakes as finding out where we went right is as important as finding out where we went wrong. Trading has, of late, become much less about the merits of the particular stock and more about the timing of your entries as good stocks and bad stocks can move up and down 5% on any given day.

One of the things we like to do is watch for overbought sectors to short. We had been taking pot-shots at POT all week as it was really running away with itself and on Thursday I discussed with members how the whole sector was getting overbought and, in Friday morning's post I said: "I advocate more shorts into the open if they insist on this ridiculous pre-market pump (down just .25% at 9 am), especially in the over-hyped Agriculture industry, which could not be up for stupider reasons," which neatly summarized my outlook on the sector.

We got exactly the pump action we wanted in the morning and I sent out a 10:34 Alert to Members, sensing that we were topping out on the run in the indexes and I recommended the following plays:

Big disconnect with DBA and AGU, MOS and POT now. It’s a little crazy to do a day trade but the POT $115 puts have .20 in premium at $6.10 and you can sell the $110 puts for $2 if it turns against you. I like the June $90 puts on them for $1.95, looking for $1 and rolling up if it goes the other way at .85 per $5.

AGU July $40 puts are $1.05. MOS $50 puts are a fun day trade for .10 but you need to get 3/4 out at .15 and leave the 1/4 or 1/2 out at .20 and 1/2 out at .30 if you get that lucky but consider the .10 money down the drain most likely. Sept $40 puts are $2.75 and we can sell the June $45 puts, now $1.50, if they fall to $1.25 and then use that to roll up $5.

The POT $115 puts were about as easy a win as you could get as POT fell from $109.20 at the time of the Alert to $106.60 just 90 minutes later. Since the puts carried very little premium, they flew to $8.10 at noon (up 33%) pulled back to $7.40 (up 21%) and then headed up to $9.60 (up 57%). We continued to short the sector through lunch and I called all done with POT at 1:25 and we flipped bullish on the market in general at 2:15 when we played for the infamous "stick save," which we got. Unlike the wild May puts, the June $90 puts went nowhere and finished at $2 (up .05) but, to be fair, they did hit $2.25 before 1pm and $2.30 after I called out of POT so a quick 15% was there to be had. We didn't take Junes for a day-trade though, as I said in the Alert, we intended it as en entry and we are looking to improve the position by rolling it to higher strikes.

AGU was also very cooperative as our entry came with the stock at $49.29 and they topped out at $49.50 a few minutes later (giving us good option entries) and they fell $2 over the course of the day but finished at $48.18 on the bounce. Like the June POT puts, the July AGU puts ran up more than 15% to $1.25 but finished the day at $1.15, up a dime. Again, we aren't day-trading the longer contracts and it's really no different than simply shorting the stock except I risk only $1.05 to do so, tying up much less cash and taking much less risk than a short play.

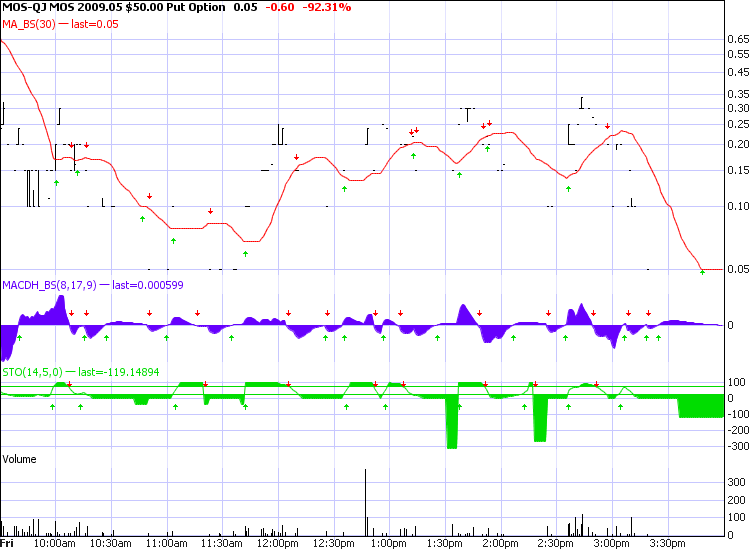

The MOS $50 puts are a good example of how we scale out of a winning trade. At .10, it was pretty much an all or nothing entry as the trade would either work or it wouldn't. This is something I call a "craps roll" trade, which means you shouldn't play more money on the trade than you are willing to put down on a craps table. At $10 per contract, it's easy enough to control but, of course, if your fees are more than a penny per contract, you already need to make a nickel just to make the trade worth the bother.

We had really good timing on MOS as it made it's high of the day at 10:35, and you can see many of our well-trained, patient bidders got in at .05 (in our Strategy Section we discuss the great benefit of low-bidding entries). Whether in at .05 or .10, it was Mission Accomplished just before noon as we hit .15 (up 50%) and then to .20 (100%) and on to .30 (200%) at our exit point in the afternoon. We do these trades for fun but that doesn't mean there's not a method to the madness. If we buy 20 contracts at .10 ($200) and sell 15 at .15 ($225), we lock in a 12% profit and we're letting 5 contracts ride for free. Hitting our .30 target for the trade pays $150 for the last 5 contracts, profiting $175 on a $200 gamble (87%). Now you can see why we call it a craps roll…

The higher-risk road was more rewarding of course, holding out for .20 but, since we went straight from .10 to .20, you can see why there was a flurry of selling at .20 as we hit our target at noon. On a $100 play (10 contracts), that would have put the $100 back in your pocket and left 5 contracts to ride. When those hit their .30 target you get the same $150 for selling the last 5 and that's a very nice 150% profit. Note that we DO NOT do these plays every day, usually we do some day trading during expiration weeks but they are fun and they do take practice and review in order to recognize the opportunities as they come along.

The final Ag trade from that alert was the MOS Sept $40 puts at $2.75, now $2.80. Those are a potential spread so, as I noted above, more complicated than a straight buy of the stock as you have to watch two option positions and keep track of their relationship but learning how to hedge your option plays is the most valuable skill you will ever master in the markets. While we have lots of fun with our day trades, in this market environment we prefer to hedge but that we practice every single day – it's the day-trading we need workshops on!

At 10:52, as I continued to scan the Ag sector for high fliers that were due for a fall, I had a trade idea for MOO saying to Members: "MOO $35 puts just .15 with stock at $35.09 (up .70). Craps roll money only!" That went very well as we were just off the highs of MOO at $35.02 (hey, that's very Dr. Seuss sounding!) and they were kind enough to plunge all the way down to $34.32 at noon. That rocketed the $35 puts to .75 (up 400%) and they finished the day at .52 (up 240%), so that's better than a craps table!

The reason we concentrated on the Ag sector on Friday is we had a unique opportunity, on expiration day, to focus on a group we thought was over-extended and ripe for a fall and, for a change, the markets were cooperating and making a general downtrend that made it difficult for our high-fliers to fight against. As I often say, I'm not a technical trader, I'm a fundamental trader who uses technicals for entries so there is usually an underlying premise to our trades that goes beyond the fact that a couple of sqiggly lines crossed on a chart. Like any good hunters, we followed the herd around and set our sites on some easy targets to pick off. While this may seem like an easy day, a lot of preparation goes into it and trading like this takes a great deal of practice. Fortunately, there are many good paper trading systems out there where you can practice, and that makes your "education" much less expensive than it was for many of us, who learned the hard way.

The reason we concentrated on the Ag sector on Friday is we had a unique opportunity, on expiration day, to focus on a group we thought was over-extended and ripe for a fall and, for a change, the markets were cooperating and making a general downtrend that made it difficult for our high-fliers to fight against. As I often say, I'm not a technical trader, I'm a fundamental trader who uses technicals for entries so there is usually an underlying premise to our trades that goes beyond the fact that a couple of sqiggly lines crossed on a chart. Like any good hunters, we followed the herd around and set our sites on some easy targets to pick off. While this may seem like an easy day, a lot of preparation goes into it and trading like this takes a great deal of practice. Fortunately, there are many good paper trading systems out there where you can practice, and that makes your "education" much less expensive than it was for many of us, who learned the hard way.

Once you understand the logic of options trading, it can be just as comfortable as stock trading but it does take hard work. People do ask me why I don't pick more stocks and I will point out that EVERY pick I make is a stock pick. There are underlying stocks to all these trades. You could straight short the above plays and make 5% here or there on the same day trades but those are the same trades that we made 15-400% on trading options with far less capital at risk – isn't that worth learning more about?

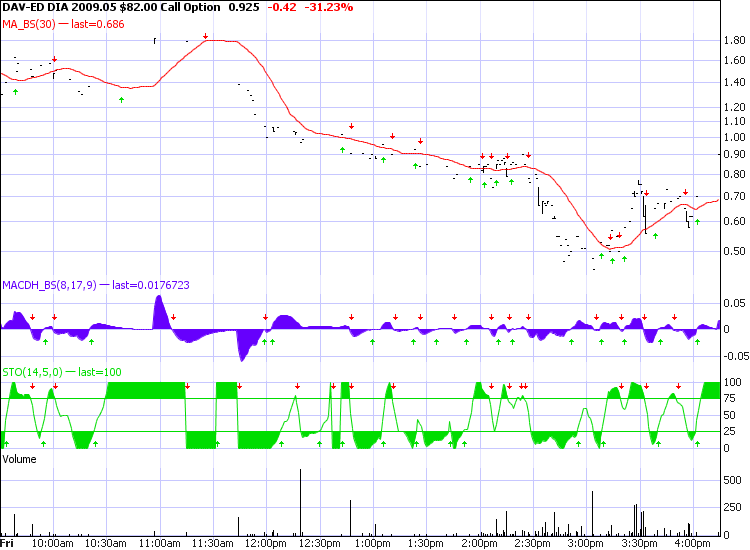

At 11:28, for example, our Ags were moving well but the Dow was holding up so I put up the following trade idea for members: "DIA – The May $84 puts have little premium. In at .55, stop at .45, look for .75+." At the time, DIA was at $83.58 and the ETF fell to $82.93 at noon so a quick .35 could have been made shorting the stock but those puts flew up to $1.10 (up 100%) without a pullback over the same 32 minutes and were s high as $1.70 (up 210%) as the Dow spiked down just after 3pm. Using the option you actually make MORE money than you would had you committed $82.93 to a short sale and a 100 lot contract at .55 cost $55, which is the most you can lose on the trade no matter how high the Dow goes. Options can be a useful tool, not just for leveraging profits but for managing risk but it does require study and practice to use them properly.

We played the DIA once more into the close. At 2:15 my comment to Members was: "Playing for the stick with DIA $82 calls at .82. Stop if we blow 8,270." That trade did not go well as we blew 8,270 just a 17 minutes later at 2:32 but a disciplined stop allowed the trade to be exited at .78 on the trigger (see above chart). Taking the quick loss allowed us to get back in at a lower price. At 2:54, we went back in the same trade at .52 and we were rewarded with a very nice run back to .93 (up 60%) at the close but we were happy to take a small profit off our net (including the original loss) off the table. That is how a good trading discipline can turn a loser into a winner. We lost .06 (always remember to include trading costs) on round one and that made our round two entry net .58. Add another .02 trading cost and we're looking to do just a bit better than .60 and we've saved the trade.

This is, of course, better than doubling down as we're not increasing our risk. Had we rode out the first round from .82 to .52 and doubled down, we'd have an average entry of .67, a 10% higher break-even point than using stops, even accounting for the extra trading costs and, we had less at risk so had we hit our next stop out at .40, we would have lost net .27 x 2 (as we doubled our exposure) vs 1 x .18 using the stops. The theme of our educational posts is "Plan the Trade/Trade the Plan" and working out this kind of math BEFORE you initiate a trade is the key to making the right decisions once you are in the middle of it.

This is, of course, better than doubling down as we're not increasing our risk. Had we rode out the first round from .82 to .52 and doubled down, we'd have an average entry of .67, a 10% higher break-even point than using stops, even accounting for the extra trading costs and, we had less at risk so had we hit our next stop out at .40, we would have lost net .27 x 2 (as we doubled our exposure) vs 1 x .18 using the stops. The theme of our educational posts is "Plan the Trade/Trade the Plan" and working out this kind of math BEFORE you initiate a trade is the key to making the right decisions once you are in the middle of it.

Also keep in mind that we do not advocate buying options very often. We use them for leverage in situation like we had on Friday but, generally, options are things we sell to suckers who are willing to pay us huge premiums because they think they know what a stock is going to do over some period of time. This is why most people have bad experiences with options – the only thing we know for an absolute certainty about options is that the premium you pay will go to zero on expiration day. THAT is an ABSOLUTE fact so, for the most part, we SELL premium and we try not to buy it. You will notice the common denominator to our successful trades on Friday was that they had very low premiums. We were not paying extra to take those risks so being just a little bit right was enough. We were just as right on the June POT puts and the Sept MOS puts but they paid very little. Why? PREMIUMS!

So there's the big trick to understanding options. Unlike a stock, you have a specific clock on your positions that winds down and costs you money every day and that can get very nasty when the market doesn't do what you want. That's why we sell them! You may think GOOG is underpriced at $390 and I may agree with you but the trick in options is do we think it's worth $14.50 for the June $390 calls? If you buy them, then Google has to get to $404.50 by June 19th just for you to get your $14.50 back. If I sell them to you though, if GOOG hits $420 by that date (up less than 10%), I'll be paying you a 100% profit. So I would not sell the GOOG calls but I also wouldn't buy them because, logically, if I by them 12 months in a row, GOOG must gain $174 (44%) over 12 months for me to just break even.

On the other hand, if I own GOOG, or a proxy for GOOG, like the 2011 $270 calls at $145.60 ($25 of premium, 17%), then If I sell $14.50 a month worth of calls for the 18 months I have to sell, I will collect $261 – 80% more than I pay for the long call! Of course, there is a lot that can happen in between and, as I said, option spreads are certainly more complicated than owning stocks but isn't learning to improve your risk/reward ratio by 2-300% worth the effort?