I went away this weekend and didn't do much reading.

Traveling and speaking to actual people every so often is a good thing when you are looking for perspective. As I'm often introduced by friends to new people as "Phil the stock guy," I tend to get into a lot of interesting conversations about people's jobs, the economy, their investments (including their homes), outlook… etc.. It's kind of like being a doctor, where everyone wants to tell your their medical status as soon as they meet you. This is a good thing actually, as I love to get "real" information to offset the mountains of anonymous statistical data that we usually have to wade through.

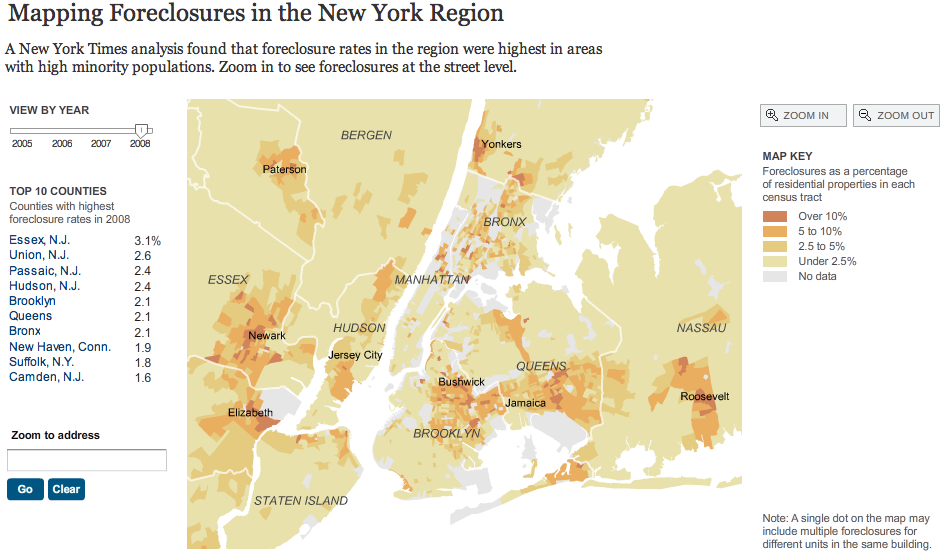

I was down in DC, where most people still have jobs and retired people have insanely generous government pensions so I wouldn't call them typical but there is a lot of optimism that things are really getting better and will continue to do so this year. On the way down there, I was reading a horrific article in the NY Times on the foreclosure rates in our region so I was in a pretty bad mood when I got to our nation's capital but I was very impressed with the "can do" attitude of my political pals, who couldn't hang out on Sunday because they had to work. I haven't seen government employees work on a weekend since just after 9/11 but I will tell you that people in DC are busting their butts to get things done with a motivation I haven't seen since Clinton took office.

Whether it will be "Yes they can" or "No, they are deluded" remains to be seen. Barry Rhitholtz did a nice, negative overview of the NYTimes article so I won't go into it here and the map below is really horrific but an optimist would say that 98% of the people still have their homes and, even if the worst is not over, it's certainly not as bad as the doom and gloom crowd is painting it. In the Great Depression, 25% of the people lost their jobs and, in 1934, nearly 1/2 of all US urban home mortgages were delinquent as US personal income dropped 44% over 5 years. THAT'S A DEPRESSION. The only reason the talking heads on TV can get away with using the "D" word so often is that we, as a nation of viewers, are such poor students of history that we have no idea what a Depression really is so some jackass on Fox gets to scream Depression into the camera as if he's telling a bunch of 5-year olds that the Boogie Man is going to get them and it's just as insulting to the intelligence the "adult" viewers who happen to be watching.

So, despite the plentiful supply of negative newsflow coming from the MSM, I see a lot of smart, hard-working people who are dedicated to solving this crisis who really believe they can get their arms around this situation long before it gets 200% worse and can really be classified as a Depression. In the Great Depression, 75% of the people had jobs so we had to add 20% more jobs to get to 90%. In the Great Media Hype of 2009, 90% of the people have jobs and we need to increase that number by 5% to get to full employment – see the difference? Yes, some real damage was done to our economy and it will take us years to recover and the people who think we're going back to S&P 1,000 this year are off their rocker – but so are the people who think we're heading back to our lows. Let's try and find that middle ground people…

![[Congress supporters]](http://s.wsj.net/public/resources/images/OB-DR696_india2_F_20090517071751.jpg) Asia had a very nice morning led by stunning gains in India as the Bombay Sensex rose 17% following an election that gave Prime Minister Singh's Congress Party a tremendous victory, with the most seats since 1991 when then finance minister Singh introduced free-market reforms the led to India's economy growing 300% over the past 18 years. Singh, 76, may further reduce barriers to foreign investment in insurers and retailers, plans that had been frustrated by communist lawmakers. “Markets are euphoric,” said Rahul Chadha, the Hong Kong- based head of Indian equities at Mirae Asset Global Investment, with $46 billion in global equities. “The focus by federal and state governments on development will lead to a structural re- rating of India.” Trading was halted twice today and closed early so this rally may continue tomorrow!

Asia had a very nice morning led by stunning gains in India as the Bombay Sensex rose 17% following an election that gave Prime Minister Singh's Congress Party a tremendous victory, with the most seats since 1991 when then finance minister Singh introduced free-market reforms the led to India's economy growing 300% over the past 18 years. Singh, 76, may further reduce barriers to foreign investment in insurers and retailers, plans that had been frustrated by communist lawmakers. “Markets are euphoric,” said Rahul Chadha, the Hong Kong- based head of Indian equities at Mirae Asset Global Investment, with $46 billion in global equities. “The focus by federal and state governments on development will lead to a structural re- rating of India.” Trading was halted twice today and closed early so this rally may continue tomorrow!

Soaring Indian markets led to a huge reversal in the Hang Seng, which opened down 400 points and finished the day up 232 points (1.4%). The Shanghai also turned around and added half a point into the close while the Nikkei had suffered too much damage with a 250-point drop in the morning session and failed to recover, closing down 2.44% as the dollar slipped below 95 Yen during their session. Since the Nikkei closed, the dollar moved up 1% to 95.8 which should help tomorrow and will trump Panasonic's truly awful outlook as well as news of a big flu outbreak in Japan. After today's rally, Indian stocks are now trading at 15.6 times earnings, almost double November's p/e of 7.7. China is trading at 26.8 times earnings while the US and Europe are looking like bargains around 13. Keep in mind India has a $1.2Tn economy so it doesn't take much to fuel a massive rally there – we'll have to roll out the Big Chart tonight and see if we can get a real international move to follow up on all this excitement.

The EU is excited too as their Budget Chief, Dalia Grybauskaite won a landslide victory to become Lithuania's first woman President. The significance of this is the acceptance of EU policies by member nations which strengthens perceptions of the Union and shores up the faith in, and value of, the Euro itself – all good things. That will, of course, push the dollar down again today which will give stocks and commodities an undeserved boost this morning but we'll take it. LYG led banking shares higher as Chariman Blank announced he would step downonline.wsj.com/article/SB124256561750327584.html, avoiding what was going to be a messy ouster at the next shareholder meeting. Drug stocks also did very well as flu news renewed interest in that sector.

The EU is excited too as their Budget Chief, Dalia Grybauskaite won a landslide victory to become Lithuania's first woman President. The significance of this is the acceptance of EU policies by member nations which strengthens perceptions of the Union and shores up the faith in, and value of, the Euro itself – all good things. That will, of course, push the dollar down again today which will give stocks and commodities an undeserved boost this morning but we'll take it. LYG led banking shares higher as Chariman Blank announced he would step downonline.wsj.com/article/SB124256561750327584.html, avoiding what was going to be a messy ouster at the next shareholder meeting. Drug stocks also did very well as flu news renewed interest in that sector.

Our Banking sector is off to a flying start this morning as Warren Buffett revealed Berkshire had increased it's stake in WFC (up 4%), USB (up 3%) and J&J (up 10%). Buffett had already said he regretted selling J&J to raise capital las year (which he invested in GE and GS) and has often expressed his confidence in WFC and USB but the fact of the purchases is boosting all three stocks and putting a good spin on their sectors.

We're mainly in cash and were pretty much hoping for a sell-off this week so we could hit our Buy List but that's not looking likely this morning. It's a light data week heading into the holiday weekend and the bond market closes early on Friday, which is traditionally a very light trading day. In our first two holiday weekends of the year, it hasn't been the week before but the Tuesday's we came back (Jan 20th – down 332 and Feb 17th, down 300 points) that have been painful. Friday the 10th of April was a holiday and we did drop 163 by the next Tuesday as well. So we'll have to plan being cautious into the weekend, no matter what happens during the week. Meanwhile, we'll be keeping an eye on our levels and having fun with some shorter-term trades, like we did on Friday with the Ag sector.

No major data today. Tomorrow we have Building Permits and Housing Starts for April, which should be up a touch but pathetic by any measure. Oil inventories are Wednesday morning and crude is back to $59 this morning and we may short them yet again at $59.50 as that's been a fantastic trade for 2 weeks now. Someone called Rent-A-Rebel over the weekend and NIgerians are once again threatening to disrupt oil production which somehow pops oil up 4% even though there is 3 times more oil production off-line from cutbacks this year than Nigeria produces in total so a disruption of Nigera's production would do nothing more than enrich their more stable OPEC "allies." We do get Fed Minutes on Wednesday afternoon and those are always good for at least 150 points one way or the other and Thursday is the usual 600,000 lost jobs along with Leading Economic Indicators and the always sad Philly Fed. Last week's NY Fed was so good though, it's hard to imagine the Philly Fed Report doesn't beat very low expectations.

No major data today. Tomorrow we have Building Permits and Housing Starts for April, which should be up a touch but pathetic by any measure. Oil inventories are Wednesday morning and crude is back to $59 this morning and we may short them yet again at $59.50 as that's been a fantastic trade for 2 weeks now. Someone called Rent-A-Rebel over the weekend and NIgerians are once again threatening to disrupt oil production which somehow pops oil up 4% even though there is 3 times more oil production off-line from cutbacks this year than Nigeria produces in total so a disruption of Nigera's production would do nothing more than enrich their more stable OPEC "allies." We do get Fed Minutes on Wednesday afternoon and those are always good for at least 150 points one way or the other and Thursday is the usual 600,000 lost jobs along with Leading Economic Indicators and the always sad Philly Fed. Last week's NY Fed was so good though, it's hard to imagine the Philly Fed Report doesn't beat very low expectations.

Everyone reporting earnings this morning had a beat. Congrats to ITRN, LOW, PWRD, TNP and VAL for turning in a perfect morning and mega-kudos to LOW and VAL, who also raised guidance. We still have plenty of earnings to plow through this week including APP tonight, DKS, HD, JASO, MDT, SKS, SOLF, VOD, PVH and HPQ tomorrow. Wednesday we hear from ANN, BJ, DE, EV, HOKU, TGT, UNFI, EEP, GYMB, HOTT, INTU, LTD, NTAP and PETM and Thurdsday is BKS, PLCE, GME, HRL, MF, ROST, SKIL, STP, BKR, TTC, ARO, ALKS, ADSK, BRCD, DBRN, FL, GPS, LDK, PSUN, RRGB, CRM and ZUMZ with CBP bringing up the rear on Friday. So lot's of consumer stocks as earnings wind down and nothing that looks like it's likely to derail a rally so it's all about breaking our technicals this week.

We'll be watching our levels with great interest this week but, unless we get a nice sell-off to at least 8,100, I think we're going to be staying mainly in cash until after the holiday, boring but safe, as the market can still go up or down between 8,650 and 7,900 and we would still prefer to do our buying at the low end if possible. We know oil will be pushed as hard as possible into this big summer driving weekend but I think they played their hand too early as higher gas prices in April caused a lot of people to plan to stay home for the Memorial Day weekend. If the weekend demand numbers show weakness, it will be the energy sector that sells in May and goes away until hurricane season as it will take a major natural disaster to make oil "valuable" again. This will probably be an area we focus our short betting on if they run up this week.