Fed days are always great fun.

Fed days are always great fun.

Although it's just the minutes and not a policy decision, often the minutes of the Fed meeting move the market more than the decision itself. Sure a cynic may say that the reason for this is that the minutes are less meaningful and they are just an excuse for manipulators to create whatever market reaction suits their needs but we are no cynics here are we? On the last Fed Minutes Day (April 8th) the market opened up 1%, then fell 1% on a poor oil report at 10:30, then rose 1.5% by 1pm, then dropped 1.5% through the minutes until 3pm when it amazingly recovered and we finished the day up about .75%. Isn't that exciting?!?

It sure was exciting for us as we had grabbed the DIA $78 puts at 1:10 as the market rallied for no particular reason and we caught the dead top of a 150-point drop for a huge win. We'll be looking for opportunities like that today but we're not going to force it – that opportunity came because the markets were up irrationally so it was easy to play. My quick notes (at 2:03) from the last Fed release were: "Credit not easing. Concern over assets they are buying under TALF. Serious downward GDP forecast to -1.3% for 2009 AND 2010 Continuing deflation risk. Economic activity fell sharply and should continue to contract. Uptick in housing starts was a glitch, not a trend. Energy and Ags now being affected by slowdown where they were not before." As I concluded at the time "Not exactly rally fuel."

Nonetheless, the next day we jumped 250 points to 8,083 as "green shoots" were seen in the Fed's language. That was April 9th and we spent the rest of the month struggling below the 8,100 mark but punched over at the end and here we are, up 10% from the last minutes and looking for even greener shoots to break us over our 40% lines. What gave us a boost on April 29th was the FOMC non-decision where the Fed said: "Information received since the Federal Open Market Committee met in March indicates that the economy has continued to contract, though the pace of contraction appears to be somewhat slower." I know – don't you just get goosebumps? Exciting as a statement like that may be to investors (and the markets gained 5% in the week after that release) we can only imagine what amazing things will be revealed in the minutes to fuel the next round of buying.

Nonetheless, the next day we jumped 250 points to 8,083 as "green shoots" were seen in the Fed's language. That was April 9th and we spent the rest of the month struggling below the 8,100 mark but punched over at the end and here we are, up 10% from the last minutes and looking for even greener shoots to break us over our 40% lines. What gave us a boost on April 29th was the FOMC non-decision where the Fed said: "Information received since the Federal Open Market Committee met in March indicates that the economy has continued to contract, though the pace of contraction appears to be somewhat slower." I know – don't you just get goosebumps? Exciting as a statement like that may be to investors (and the markets gained 5% in the week after that release) we can only imagine what amazing things will be revealed in the minutes to fuel the next round of buying.

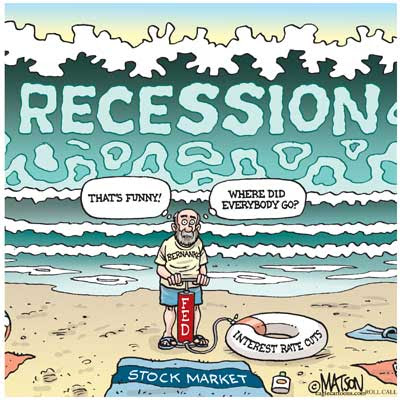

The Fed indicated they would engage in massive quantitative easing (ie. printing money) since they have already cut rates below 0.25% and they aren't quite ready to pay people to borrow money yet (maybe at the next meeting). That decision was excused by the statement: "In light of increasing economic slack here and abroad, the Committee expects that inflation will remain subdued." Aside from our PPI and CPI coming in 50% hotter than forecast, clearly the massive run-up in both commodities and emerging markets would indicate that there is much less economic slack than the Fed believes so what should we do when we have either a Fed that is clearly wrong and pursuing what could be disastrous policies as they misread the markets or markets that are ignoring a gloomy Fed outlook and are off on a disastrously wrong course?

Speaking of disastrously wrong courses: Oil is back over $60 at the start of summer driving season and ahead of next week's OPEC meeting (28th). As usual, today's inventory will show a "surprising" drawdown in gasoline as gas stations top off their tanks ahead of the holiday weekend. This happens every year and analysts are surprised every year so keep in mind that if they can't sell an extra 4Mb of gasoline this weekend, they never will. We've been having a good old time playing the trading range in crude futures but today we're hoping they get it to $61+ so we can short the hell out of it.

There will be a "shocking" draw in petroleum in today's 10:30 report but IT'S A SCAM! As you can see from last week's inventory report, there is now 1 Billion 806 Million barrels of oil in US storage. That is 138M more barrels (8%) more oil than we had last year. This is DESPITE the fact that net imports are down 1M barrels a day. So DESPITE the fact that they are shipping us 7M LESS barrels of oil per week, we have added 3Mb per week to inventories, that is a net drop in consumption of 10Mb PER WEEK! Oil collapsed last summer from $147 (boosted by the misguided Bush stimulus package) in June to $35 in December as demand destruction first showed up in the numbers and we are using far less oil now than we did then. In another act of terrorism against the US consumer, our own refineries are operating at just 83.8% capacity – lower than post Katrina levels when a significant number of refiners were knocked off-line entirely. This is down 3% from last year's low levels and is shorting US consumers 1.6Mb PER DAY of refined product, creating artificial shortages and driving the prices higher – stealing the money from consumers and pulling it out of the economy just when we need it most. WRITE YOUR CONGRESSMAN!

By the way, don't blame the dollar. The dollar was at 72 last summer and is at 82 now. Pathetic still but closer to our high of 89 than the lows and we still higher than we were in December, when oil was $35 a barrel. In the month of December, we used 276M barrels of gasoline, that was UP 4MB from June (extra day) but down just 10Mb from the December 2007. In February, we used just 246M barrels of gasoline per week and that was down 10Mb from Feb '08. In the last 2 weeks, we used 9Mb of gasoline per day so figure 279M for a 31-day month and that's 6Mb less than last year and May is the BIGGEST consumption month of the year. If they do not have a SIGNIFICANT draw today, oil will make a wonderful short but we still have the OPEC meeting ahead so don't expect immediate benefits.

There were no immediate benefits in Japan's GDP report as Q1 was down 4% from the last quarter, on pace to fall 15.2% for the year in the world's second-largest consumer of oil. Japan is getting hit by higher oil prices as well as sagging exports (down 26%) AND their consumers are pulling back as well (down 1.1%). Despite these AWFUL numbers, economists (always accurate) are predicting a turnaround. Why? Because they think other countries are getting better and will pull them out of their slump as demand for exports improves. Hey – that's our plan! With every country expecting every other country to save them with increasing demand (including OPEC) we're lining up a very scary group of dominoes in order to establish a global buying premise.

There were no immediate benefits in Japan's GDP report as Q1 was down 4% from the last quarter, on pace to fall 15.2% for the year in the world's second-largest consumer of oil. Japan is getting hit by higher oil prices as well as sagging exports (down 26%) AND their consumers are pulling back as well (down 1.1%). Despite these AWFUL numbers, economists (always accurate) are predicting a turnaround. Why? Because they think other countries are getting better and will pull them out of their slump as demand for exports improves. Hey – that's our plan! With every country expecting every other country to save them with increasing demand (including OPEC) we're lining up a very scary group of dominoes in order to establish a global buying premise.

The Nikkei gave up half of an early morning pump but managed to finish up 54 points for the day and 100 points off their own May 11th high. Shanghai gave back another 1%, the Hang Seng was relatively flat but also tapered off from a morning pump and India dropped 2% so it will take a very good showing from US equities to get those markets moving again.

Our beloved BDI is up over 2,600 although a lot of that is due to tankers being pulled off line as well as parked for months at a time holding surplus oil. There were two tanker companies in last night's extensive list of dividend plays, TNK and DHT, both of which make nice hedged buy/writes down here. When in doubt about Asia's prospects, we use copper as a tiebreaker and, sadly, copper has been drifting down to 206 from 221 at our May 8th peak (which I noted at the time was due to Chinese stockpiling). Copper faces a technical test as it squeezes between the 200 dma at 207 and the 50 dma at 196, so a break in either direction will be very significant and is likely to indicate the global market's direction for the summer.

Over in Europe, the UK is off .5% and Germany is up .7% along with France so things are better "on the continent." NVS is boosting the Pharma industry with a $1.3Bn purchase of Ebewe. Banks are also moving forward and the auto sector is bouncing back somewhat so it would seem the UK's poor showing is over the resignation of the Speaker of the House of Commons over an ongoing scandal involving expense violations that may claim another dozen or so Members of Parliament before it runs its course. This is the first time a speaker has been removed since Sir John Trevor was given the axe by William of Orange in 1695.

![[scandal in u.k. spurs a historic departure]](http://s.wsj.net/public/resources/images/NA-AX800E_UKPOL_NS_20090519181342.gif)

We'll be watching the OIH today as they make a nice short at $100, October $85 puts are just $5.50 and hopefully we can get $2 or better for the June $85 puts, now $1 on a pullback but as long as we get $1.50 for the June $90 puts (if it goes the wrong way on us) we'll be happy as it only costs $2 for us to roll up to the Oct $90 puts if we have to. That's my favorite oil short ahead of OPEC. On the whole we'd love to see the sector fly higher so we can short the rest but we need that $61 oil first.

The same levels as I pointed out in yesterday's post apply today and maybe we'll repeat last month's move with a high open, down on disappointing energy inventories, back up in anticipation of the Fed minutes and then selling into the minutes as traders look to begin cashing out ahead of the long weekend. We're mainly in cash so not too concerned but we do have our bearish DIA bets which we'll be adding to as the market heads back up to test yesterday's highs.

Be careful out there.