Courtesy of Mish

Consumer Confidence Soars; How Much Is Unwarranted Hope?

Sentiment that the bottom is in is rapidly picking up steam. Please consider Consumer Confidence Jumps by Most in Six Years.

Sentiment that the bottom is in is rapidly picking up steam. Please consider Consumer Confidence Jumps by Most in Six Years.Confidence among U.S. consumers jumped in May by the most in six years, fueling speculation the economy will recover later this year. The Conference Board’s sentiment index surged to 54.9, higher than forecast, according to figures from the New York- based research group today.

“Pent-up demand is increasing each passing day as reflected in these confidence numbers,” said Nariman Behravesh, chief economist at IHS Global Insight in Lexington, Massachusetts. “But there is a funny dynamic going on as people are waiting. The turn will come when there is a sense that we have passed the bottom,” which Behravesh said may happen as early as August.

My Comment: When the economy is losing 500,000 jobs a month and housing is saturated, outside of bargain hunting, demand is shrinking. Indeed, some consumers are looking for bargains on autos, and rental properties, but that demand will subtract form demand in 2010. This is all part of the healing process, but without jobs (and I still see no recovery in jobs), this round of premature bargain hunting will eventually give way.

The 28-point jump in confidence over April and May is the biggest two-month rally since records began in 1967. The measure reached its lowest point ever in February, with a reading of 25.3.

We’re certainly moving in the right direction,” said James O’Sullivan, a senior economist at UBS Securities LLC in Stamford, Connecticut. “We expect to have positive economic growth in the third quarter. The job declines will fade.”

My Comment: Actually we are not moving in the right direction. We are moving in the wrong direction at a decreasing rate.

The confidence report showed optimism over the next six months led the jump. The Conference Board’s expectations measure rose to 72.3, the highest level since December 2007. The gauge of present conditions increased to 28.9 from 25.5.

“As far as consumers are concerned, the worst is now behind us,” Lynn Franco, director of the Conference Board’s consumer research center, said in a statement.

Macy’s, the second-biggest U.S. department store, and Chrysler are trying to revive sales. Chrysler, trying to restructure under bankruptcy, is offering incentives of as much as $6,000.

Some Consumers Excited About Bargains

For consumers with cash, with a job, and no fears of losing a job, saving $6,000 on a new car is quite a chunk of change. But what percentage of the population needs a new car, wants a new car, can afford a new car, has a job, and no fears of losing that job? And pray tell what will happen to demand in 2010 if dealers have to pay $6000 in incentives to clear lots now?

Consumer confidence, or consumer hope?

I am not the only one asking questions. MarketWatch is asking Consumer confidence, or consumer hope?

They call it "consumer confidence," but the numbers released Tuesday by the Conference Board might better be pegged as "consumer hope." There’s a big difference, namely that confidence translates into spending, while hope is just a good feeling.

Consumers clearly believe the worst is behind this economy and the market, when it’s not clear at all to the experts that the U.S. can avoid another leg down — or worse — en route to a broad-based recovery.

Consider that there was a big increase in the percentage of consumers expecting the economy to generate new jobs, despite no evidence that the current economy can actually achieve that.

Consumers ignore possible problems when they are feeling good, but the true measure of consumer confidence ultimately is reflected in consumer spending. Any positive move in confidence now won’t be reflected in those numbers until late summer.

In a MarketWatch interview, Joseph Battipaglia, market strategist at Stifel, Nicolas, said: "The data is mixed as to whether or not consumers are actually going to open their pocketbooks and start spending again."

The problem with the index reflecting more hope than reality is that the numbers could whipsaw based on bad news, and headline risk right now is big. Jobs, inflation, gas prices, the future of the auto industry, the foothold gained by federal policies and much more will have to be aligned right for confidence gains to continue, and to hold long enough that the now-optimistic consumer actually opens his wallet.

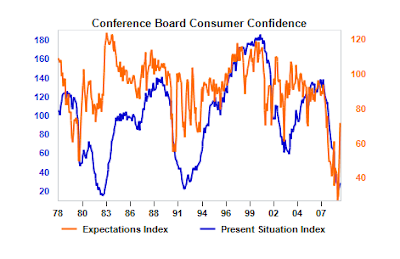

Consumer Conference Board Confidence

The above chart from Bloomberg with thanks to Chris Puplava at Financial Sense.

The expectations index has never in history dropped this far although the present situation index has on two prior occasions. Moreover, the gage of present indicators is still in the gutter at 28.9. I sense that reality will set in when the present situation index fails to rebound along with the hope of growing expectations.