Courtesy of Jesse’s Café Américain

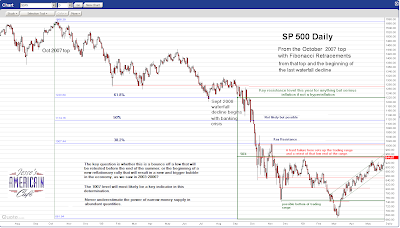

SP Daily Chart: Bubble Bubble Toil and Trouble

Expanding the money supply, commonly called ‘printing,’ cannot result in a genuine economic recovery without significant reform and restructuring, with a net result in an increasing real median wage. We see no indications in that direction yet.

Otherwise, what we will see at best is another false but perhaps impressive nominal recovery in financial assets and equities, with a bigger and more deadly bubble somewhere in the real economy. The last two times the Fed tried this we saw bubbles in tech stocks and the housing market respectively.

What will the next bubble be, besides very painful? Commodities seem a likely candidate.

If the bubble attempt fails, then we will revisit the lows, and experience stagflation. Those who still cling to the deflation prospect are holding on to a narrow thread of true belief indeed. It is possible, but now improbable.

We have some small optimism that the Obama Administration will let go of their cronyism and self-dealing corruption in their decision-making, but not much.

The removal of Larry Summers from the administration team would be the key indicator that would keep that slim hope alive. He is a significant impediment to our national prospects, even moreso than his colleagues Ben Bernanke and Tim Geithner.

Eventually all three will be given their walking papers, it is merely a question of how much damage their bad decisions will make before they leave.

The stench of crony capitalism and corruption is almost as thick as a Chicago style pizza crust in what was supposed to be a reform government.

[click on chart for larger view]